In this post, we dive into 10 easy money hacks to supercharge your savings. But first, our disclosure:

Disclosure: This post may contain affiliate links, meaning we earn a commission on purchases made through those links at no extra cost to you. As an Amazon Associate, I earn from qualifying purchases.

Disclaimer: The content on this site is for informational and educational purposes only and does not constitute financial, investment, legal, tax, or any other professional advice and should not be used as a substitute for professional advice. For more details, read our full Disclaimer.

In Good Times Or Bad

There is no such thing as a good or bad time to cut costs and save more. It doesn’t matter whether it is during a recession or amid a bull market. Now is the perfect time to eliminate unnecessary expenses and work towards saving more. With extra savings comes more freedom. What you do with these savings is up to you!

Having savings helps secure your future and opens up a world of possibilities. You can put your extra funds into a high-yield savings account or use them to establish a fully funded emergency fund that provides peace of mind. You could use it to eliminate debts or explore investment opportunities that could grow your wealth. If homeownership is your goal, you can use those savings for a down payment on your first home or toward renovating it.

Saving money may seem impossible, but it’s easier than you might think. I’ve gathered seven empowering money-saving hacks that enable you to save more while reducing expenses. So, let’s dive right in, starting with our number one money-saving hack!

Money Hack #1: Dream Big, Act Small

Many people dream big, but they often fail to take the necessary steps to achieve their dreams, feeling overwhelmed by the magnitude of their goals. That is why our number one money hack is to dream big but act small. Remember, Rome was not built in a day, and neither are your savings. It takes time, and above all, action.

The compounding effects of small actions can lead to big results. Think of it like going on a 1,000-mile car ride. You begin by driving one mile, then another, and so on, with each mile building on the previous one until you have driven 1,000 miles. The same principle applies to saving money.

Month after month and year after year, saving one dollar on top of another can lead to significant savings. You don’t have to deprive yourself of all joy; skipping just a few restaurant meals out each month can unlock the potential to save thousands of dollars annually.

For instance, saving just $20 weekly can result in an impressive total of $1,040 at the end of one year. After five years, that amount grows to an inspiring $5,200. You can achieve even more amazing results by adding an extra $5 to $10 to your weekly savings. It may not seem like much, but an extra $5 to $10 per week goes a long way.

By boosting your weekly savings to $30, you’ll achieve $1,560 per year, totaling $7,800 in five years. If you challenge yourself to save $40 a week, you’ll surpass an amazing $2,000 per year or over $10,000 in just five years!

So, don’t let the amount you can save discourage you. Take action, no matter how small, as saving even small amounts of money over time can yield big results.

The 52-Week Money Challenge

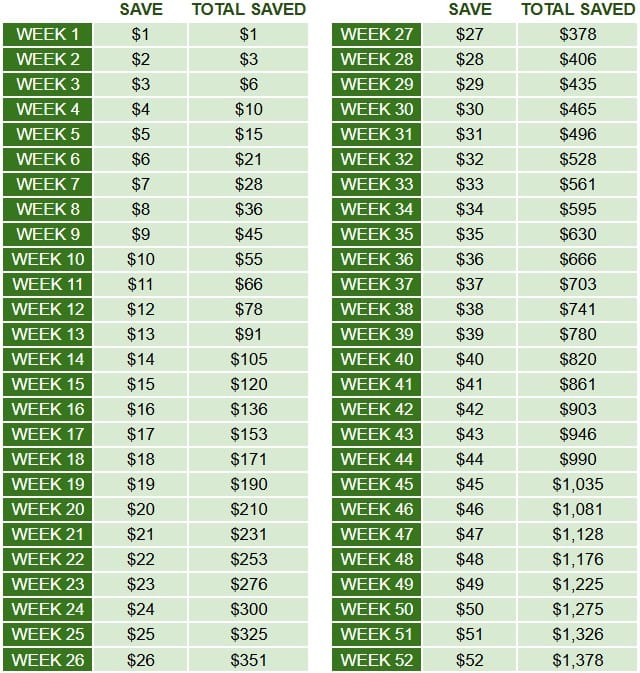

If you want to see the compounding effects of small actions, look no further than the 52-week money challenge.

The 52-week money challenge can help build a consistent savings habit by setting aside an amount that corresponds to the week number. Start by saving $1 in the first week. In the second week, save $2; in the third week, save $3. Continue this pattern until you save $52 in the final week. If you adhere to this plan for all 52 weeks, you will save a total of $1,378!

The best part is that by the time you reach the end, you will have proven that you can save $52 each week, totaling $208 per month, or $2,704 per year.

Money Hack #2: Automate It

Automation is a simple yet powerful money hack that enables you to save money with minimal effort. By creating automatic transfers from your checking account to your savings account, you can grow your savings without having to think about it. This can be accomplished in just a few minutes through your bank’s online portal or mobile app.

To get started, decide on a specific amount you want to save each week or month—be it a few dollars or a significant portion of your paycheck. Next, set up scheduled recurring transfers, perhaps right after your payday, to ensure you ‘pay yourself first’ before spending on other expenses.

Once these automatic transfers are in place, saving money becomes as routine as paying your monthly bills. You’ll find that over time, your savings will gradually accumulate, helping you build financial security for future goals—like an emergency fund, a vacation, or even a down payment on a home—without it feeling like a burden on your budget.

Another benefit of automation is that it helps ensure you pay your bills on time. This reduces the likelihood of incurring late fees and helps you maintain a good credit score. A strong credit score can save you money in the long run by securing lower interest rates on loans, such as a mortgage.

Learn More

David Bach wrote “The Automatic Millionaire,” a New York Times bestseller on the power of people automating their finances. If you’re interested in learning more, I recommend checking out the book.

Money Hack #3: The 24-Hour Rule

The 24-hour rule is straightforward: wait 24 hours before making a purchase. This short waiting period allows you to consider whether you truly need the item and if it fits within your budget. This simple 24-hour cooling-off period helps limit impulse buys, leading to big savings through reduced spending.

It’s your choice when to apply the 24-hour rule. Some individuals might set the threshold at purchases over $50 or $100, while others may prefer a different amount. The main takeaway from this money hack is that taking a full day to consider the necessity of a purchase can help you avoid buyer’s remorse and keep more money in your wallet. However, for some, this may be easier said than done.

The 24-hour rule may seem simple, but for many people, waiting can be the hardest thing to do. It’s easy to give in to temptation, justifying a purchase with thoughts like “just this once” or “it’s only $50.” If you find yourself doing this, don’t worry. Even if this money hack only helps you cut back on unnecessary expenses by 10%, 20%, or 30%, it’s still a reduction in spending.

Remember, small actions can lead to big results. No matter how small the action, every dollar you don’t spend is one more dollar you can save. Over time, the compounding effect of those saved dollars can grow into substantial savings.

Money Hack #4: Don’t Shop By Monthly Payments

If there is one money hack that can save you the most money, this is it: Don’t shop by monthly payments. Let me repeat: DON’T SHOP BY MONTHLY PAYMENTS!

Shopping based on the amount of the monthly payments can lead to significant overspending. The main reason for this is that people often finance the purchase of big-ticket items, such as cars, furniture, or appliances, through a monthly payment plan, which can result in spending far more than intended.

By focusing on total price rather than the amount of the monthly payments, you can save hundreds, if not thousands, of dollars when purchasing big-ticket items. To illustrate this point, let’s look at one of the most expensive purchases a person can make: a car.

Monthly Payments and Car Buying

When shopping for a new car, the first question a salesperson often asks is, “How much are you looking to spend each month?” It’s important not to fall for this tactic. Car dealers use it to encourage people to overspend on a car by extending the loan term.

For example, a $20,000 car loan with a 7% interest rate, financed over 48 months, will have monthly payments of around $500. Similarly, a $30,000 car loan at the same 7% interest rate financed over 72 months will also result in monthly payments of around $500. The difference is that you are spending $10,000 more for a car.

Car dealers also use monthly payments to trick people into thinking that they are getting a great deal. Let’s look at another example using the same $20,000 car loan at 7% interest from the previous example.

You get into the finance department to close the deal and are presented with two options:

- Option 1: 48-month car loan at a 7% interest rate for a monthly car payment of $479

- Option 2: 72-month car loan at a 7% interest rate for a monthly car payment of $341

Which option would you choose?

Many people will choose option 2, thinking it’s the better deal. How can it not be when it is $138 less per month than option 1? However, that would be a mistake. Choosing Option 2 would result in an additional $1,500 in interest over the life of the loan—$4,550 compared to $2,988 in interest for Option 1.

What Should You Do Instead?

Instead of focusing on the monthly payment, prioritize the overall price of the item. Establish a clear budget that you can comfortably afford, and stick to it. If you need to take out a loan for the purchase, opt for the shortest loan term with the best possible interest rate that fits within your budget. Better yet, consider saving up for the item and buying it outright with cash.

Money Hack #5: Get More Than One Quote

A few years ago, when I needed to replace my driveway, I obtained three quotes that ranged from just over $4,000 to nearly $7,000. I encountered a similar situation when I needed a new water heater, blinds, and a sewer line replacement. What I learned from these experiences, aside from the fact that homeownership is expensive, is that obtaining multiple quotes has the potential to save you a lot of money.

A good rule of thumb is to get at least three quotes before making a decision. If that’s not feasible, aim for at least two. While it may not always be easy, the effort is worthwhile. Taking the time to gather multiple quotes enables you to make informed choices that align with your budget and needs.

Comparing offers from different companies can help you save hundreds or even thousands of dollars. Whether you’re looking for insurance, a phone plan, or the best internet offers, comparing options can lead to big savings. If you’re in the market for a new car or home and need a loan, start by comparing different lenders and their loan offerings. Pay close attention not only to the interest rates but also to the loan terms, fees, and any other applicable charges.

Just remember, cheaper is not always better—quality and durability matter. Sometimes, the cheapest quote is the best quote; other times, it’s not. Sometimes, the more expensive quote is the best option based on the quality of the product and craftsmanship, saving you more money over the long run in repairs and replacement costs. The ultimate goal is to secure the best possible price for the best possible item or service that fits your budget and needs.

Money Hack #6: Ask For A Lower Price

You will be surprised by what happens when you take the simple step of asking for a lower price. This money hack doesn’t pertain to haggling at the car dealership or when buying a new home. Instead, this is for recurring charges, such as your internet or phone bill. However, be warned that this involves making an actual phone call. Using the online chat will rarely work.

For instance, when many people first sign up for internet services, they get low-cost introductory rates. Internet providers love doing this to lure in new customers, but after a couple of years, the monthly rate can easily double. While many believe that switching providers is the only way to lower their rates, this process can be time-consuming and may lead to inaction. In reality, a simple phone call to customer service can often resolve the issue.

I use this money hack every couple of years with my internet provider. I call them up and politely state that my internet bill is too high and I am looking to lower my rate. After a little back and forth, my rate is usually cut in half. No, they are not reducing my speed from 250 megabits per second to 25 megabits per second. Instead, I often receive faster internet at a “new” introductory rate for half the price.

I used the same money-saving strategy with my pest control provider. I called their customer service and explained that I could no longer afford their services. Within minutes, they reduced my rates.

By making these two phone calls to my internet provider and the pest control company, I saved almost $1,000 over the next 12 months!

Tips On Getting Lower Rates

When making a phone call, the key is to be polite and respectful. As the saying goes, “You catch more flies with honey than with vinegar.” Avoid becoming combative. Instead, the best approach is to maintain a friendly demeanor.

More often than not, when someone is contacting customer service, they are unhappy and may take their frustrations out on the representative. By starting the conversation in a friendly, non-threatening tone, you can significantly increase your chances of achieving your goal of securing lower prices.

When the rep first answers, calmly explain that you are looking for a lower rate and would like to explore if there are any options available. You do not need to threaten them with your business. The rep can read between the lines. Keep it friendly and remember to use “please” and “thank you.”

If you’re not satisfied with the first offer you receive, politely decline it. Don’t be rude. For example, you might say, “Thank you for the offer, but I was hoping for a lower price. When I first signed up, my rate was $XX.XX, and I was hoping to get something closer to that amount.”

Ultimately, you may need to switch providers if they cannot meet the price and service level you want. However, it is worth the phone call, as it is much easier to keep your current provider than to switch.

Money Hack #7: Do Some Weeding

The “weeds” I’m referring to are subscriptions. Just like weeds drain nutrients from your garden, subscriptions can sap your finances by competing for your most valuable resource: money. At first, you might start with only one or two subscriptions, but before you know it, they can proliferate. You might spend a day or two trying to cancel them, but if you don’t manage them consistently, those subscriptions will quickly resurface and multiply.

It happens to many of us. We sign up for a “free” trial or decide to subscribe to watch a special event, intending to cancel shortly after, but that doesn’t happen. We end up subscribing to multiple similar services when one would suffice. Before we know it, we are spending almost $200 or more a month on subscriptions.

How do we fix this problem? By regularly weeding out our subscriptions. I’m not suggesting that you cancel every subscription service you have, but rather that you eliminate those you’ve forgotten about, don’t use often, or that offer duplicate services. It’s that easy!

Eliminating just a few subscriptions can save you hundreds of dollars per year. That’s additional money you can put toward your savings, paying off debt, or investing.

However, just like weeding your garden, doing this just once isn’t enough, as subscriptions tend to accumulate again over time. Instead, take a few minutes each month to review your credit card and bank statements to identify unwanted or unnecessary subscriptions and cancel them.

Check out our top 5 tips on managing subscriptions for more money-saving ideas.

Conclusion: 7 Easy Money Hacks To Boost Savings and Cut Costs

These seven easy money hacks show that saving money and cutting costs doesn’t have to be challenging. Even if you choose to implement just one or two of these strategies, you could potentially save hundreds, or even thousands, of dollars each year. Don’t underestimate their impact; every little bit adds up!

The power of compounding is amazing. The compounding effects of small actions can lead to big results. However, the power of compounding cannot work unless you take action. Remember, the most important step is to take action, no matter how small, as saving even small amounts of money over time can yield big results.

As Sheryl Sandberg, the former Chief Operating Officer at Meta said, “Getting from point A to point Z can be daunting unless you remember that you don’t have to get from A to Z. You just have to get from A to B. Breaking big dreams into small steps is the way to move forward.”