In this post, we will learn all about stablecoins and why they matter, but first our discolsure:

Disclosure: This post may contain affiliate links, meaning we earn a commission on purchases made through those links at no extra cost to you. As an Amazon Associate, I earn from qualifying purchases.

Disclaimer: The content on this site is for informational and educational purposes only and does not constitute financial, investment, legal, tax, or any other professional advice and should not be used as a substitute for professional advice. For more details, read our full Disclaimer.

What’s Up With Stablecoins?

If you’ve heard the term “stablecoin” and assumed it was just another buzzword in the crypto world, think again. Stablecoins are rapidly emerging as a powerful force in the financial world. They play a crucial role in the blockchain ecosystem, facilitating quick, global transactions, providing a safe haven for savings in unstable economies, and bridging the gap between traditional and decentralized finance.

Stablecoins have become so popular that the United States Senate passed the GENIUS stablecoin bill. This bill establishes a regulatory framework for stablecoins, enabling banks, fintech companies, and retailers to issue and integrate stablecoin-based payments.

But what exactly are stablecoins, how do they work, and why are they useful?

Let’s break it down.

What Are Stablecoins?

A stablecoin is a type of cryptocurrency designed to maintain a stable value. It is usually linked to a major currency, such as the U.S. dollar (USD) or the euro, but it can also be pegged to other assets, like gold.

Stablecoins are designed to maintain a one-to-one (1:1) value with the currency or asset to which they are pegged. Many stablecoins achieve this by backing their coins with the corresponding currency or asset held in reserve.

For example, a stablecoin pegged to the U.S. dollar will hold the equivalent of cash and treasury bills in reserve. If not, it can lead to major problems, which we will discuss later.

Stablecoins offer the stability of fiat currencies, such as the US dollar, without the wild fluctuations of other cryptocurrencies. Essentially, they are more like placing your funds in a savings account rather than investing in the stock market. I like to think of stablecoins as the money market account of cryptocurrencies (but they are not FDIC-insured).

However, not all stablecoins are created equal; some are much riskier than others. Let’s look at the various types of stablecoins and see how they work.

How Do Stablecoins Work?

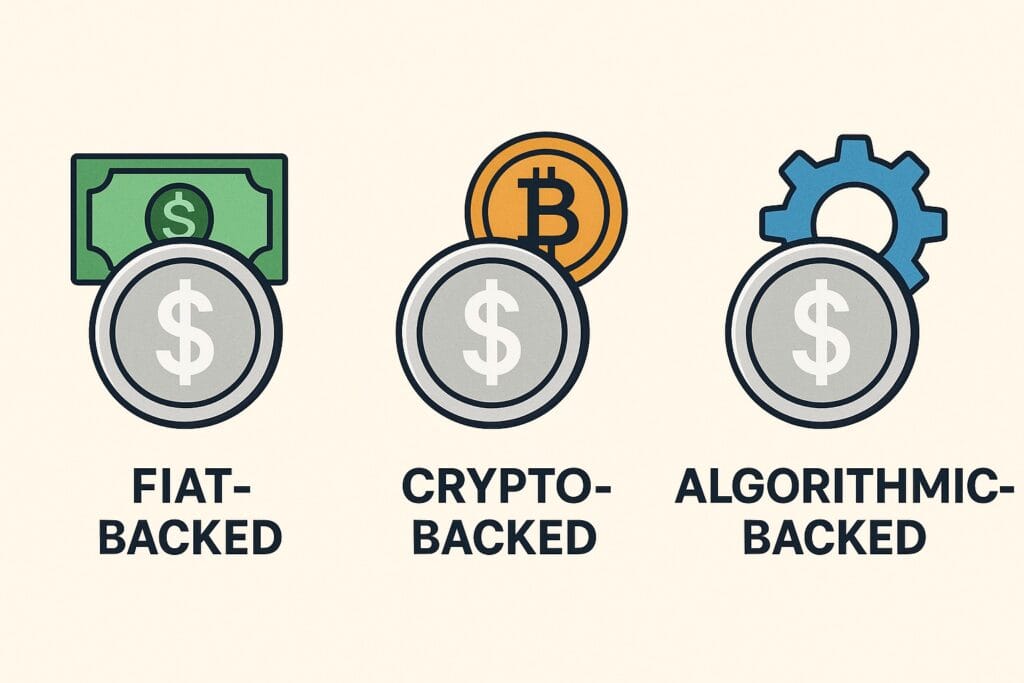

There are three main types of stablecoins, depending on how they are backed:

1. Fiat-Backed Stablecoins

Backed 1:1 by actual fiat currency held in reserves

Examples: USDT (Tether), USDC (Issued by Circle), BUSD (Issued by Binance)

- For instance, for every 1 USDC issued, $1 is held in a bank account or treasury, aiming to maintain a value of $1 USD.

- They are the least risky of the three main types of stablecoins, but can collapse and become worthless if not properly collateralized.

- They are what most people think about when they hear the word “stablecoins.”

- These are the most popular and widely used stablecoins.

How popular are these coins? Very popular! As of this writing, USDT (Tether) and USDC have a combined market capitalization of over $180 billion and growing. Their treasury holdings exceed those of many countries, with USDT (Tether) being one of the largest holders of U.S. Treasuries globally.

2. Crypto-Backed Stablecoins

Backed by other cryptocurrencies and often over-collateralized to manage volatility

Example: DAI

- DAI operates on the Ethereum blockchain and uses smart contracts to maintain a value of $1 USD.

- Unlike fiat-backed stablecoins such as USDC, which are backed 1:1 by actual fiat currency held in reserve, DAI is backed by cryptocurrency collateral that can exceed 150%.

- For example, deposit $150 worth of Ether (ETH)* to borrow (mint) $100 in DAI.

- DAI uses a basket of cryptocurrencies to maintain its 1:1 peg with the US Dollar, including Ether (ETH) and the fiat-backed stablecoin USDC.

We have ventured much further out on the risk curve with crypto-backed stablecoins. These instruments are complex, and generally, the more complex something becomes, the greater the risk.

If the price of the collateral, such as ETH, drops rapidly, it can lead to liquidations. Plus, there is always the possibility of bugs or vulnerabilities in the smart contracts.

* Ether (ETH) is the native token of the Ethereum blockchain, and the terms Ethereum and Ether are often used interchangeably.

3. Algorithmic-Backed Stablecoins

Stabilized by using algorithms and smart contracts, and usually pegged to fiat currencies like the U.S. dollar.

Example: AMPL, UST (collapsed)

- No actual reserves, relies on algorithms and smart contracts to keep prices stable

- The algorithm increases supply if the price rises above its pegged value, and decreases supply if it falls below it.

- Much riskier and experimental

Algorithmic-backed stablecoins place us at the highest end of the risk curve when it comes to stablecoins, as demonstrated by the collapse of TerraUSD (UST).

UST was launched in 2020, but by 2022, it had collapsed, resulting in the loss of billions in market capitalization. Its depegging and subsequent death spiral occurred within a matter of weeks in May 2022.

What Are The Benefits of Stablecoins?

Let’s break down the real-life benefits of stablecoins:

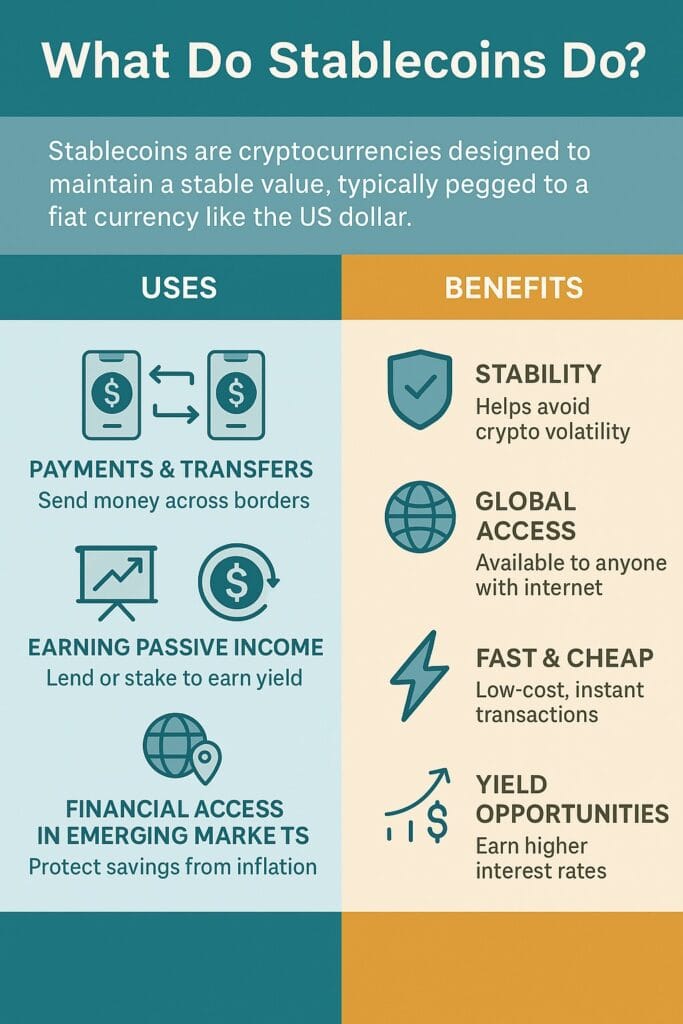

Global Access and Inflation Protection

If you reside in a country with an unstable economy or high inflation, you can use stablecoins like USDT (Tether) to save in dollars and protect your savings from losing value. All you need is internet access.

By converting your savings into stablecoins, like USDT, you can effectively hold your funds in a more stable asset, protecting them from the devaluation that can occur in local currencies during economic uncertainty. This strategy allows you to preserve your purchasing power and minimize the risks of hyperinflation and currency fluctuations.

Available 24/7/365 Without Traditional Banks

Say goodbye to rigid banking hours. Stablecoins are available 24/7, 365 days a year. No bank required. Anyone with a smartphone and an internet connection can access global finance.

You can send money using stablecoins to anyone worldwide from the comfort of your home, even while bankers are fast asleep in their beds. It doesn’t matter if it’s the weekend or a national holiday; you can make transactions 24/7, all year round.

Send Money Abroad Fast and At Low Cost

Traditional international money transfers can cost from 5% to 10% of the transaction amount, and the process can take anywhere from a few days to over a week for the recipient to access the funds.

In contrast, stablecoin transfers are nearly instantaneous, often completing within seconds or minutes. Additionally, the fees associated with these transfers can range from only a few cents to a few dollars, making it a cost-effective solution for sending money across borders.

Once the recipient receives the stablecoins, they can either keep them as is or convert them into their local currency. If they choose to convert, there will be fees; however, it’s generally cheaper than traditional methods.

Earn Passive Income

There are many centralized and decentralized platforms that offer opportunities to earn interest on your stablecoins. Platforms like Coinbase and Nexo offer savings accounts with competitive annual percentage yields (APYs). For instance, Coinbase allows users to earn interest on their USDC stablecoin, while other platforms offer a broader range of stablecoins with varying rates.

In addition to traditional savings products, some platforms enable users to stake their stablecoins, potentially yielding even higher returns. Staking involves locking up your assets to support network operations in return for rewards.

However, approach these opportunities with caution. Returns from these platforms come with inherent risks. Factors such as market volatility, platform security, and regulatory considerations can impact your earnings and even the safety of your investment. Therefore, if you decide to pursue passive income through stablecoins, it is crucial to thoroughly research and understand the associated risks.

Spend Online or in Stores

There are a growing number of ways, such as apps and crypto debit cards, that allow you to use stablecoins like cash. You can use them to buy groceries, pay bills, or shop online. Additionally, retailers such as Amazon and Walmart, along with banks like JPMorgan Chase, are exploring the issuance of their own stablecoins.

Are Stablecoins Safe?

The short answer: Maybe. Maybe not. It largely depends on the stablecoin. Let’s break down their risks:

Not Government Backed

Stablecoins may function like a savings account, but they do not have the same level of government insurance. There is no FDIC insurance protecting your stablecoin holdings. If the stablecoin you own fails, you risk losing your money, as there is no one to safeguard your investment. So, buy and hold at your own risk!

Centralization and Counterparty Risk

Counterparty risk is the chance of losing money when the other person or company you’re making a financial deal with doesn’t keep their promises. Unlike Bitcoin, which is trustless, stablecoins require some level of trust between the issuer and the holder. Counterparty risk is a major concern with stablecoins.

If a company like Tether or Circle fails to effectively manage or secure its reserves, it could lose value and potentially collapse. This means that users must place significant trust in the companies issuing stablecoins to act responsibly.

Lack of Reserves and Transparency

Lack of transparency can be a major issue. If you plan to use a stablecoin, you want assurance that there is sufficient collateral backing its coins. You want to ensure it has the reserves it claims to have. If they do not maintain adequate reserves, you could face serious issues down the road.

Surprisingly, some stablecoins do not undergo regular, third-party audits of their reserves. For those that do, the audits may still not meet industry standards.

For example, as of this writing, Tether (USDT), the largest stablecoin, has not yet undergone a complete independent financial audit by a major accounting firm. In contrast, Circle, the company responsible for USDC, regularly undergoes audits by Deloitte, a firm among the “Big Four” of auditing companies.

Depegging Risk

Depegging refers to the situation where a stablecoin fails to maintain its fixed value in relation to its underlying asset, such as dropping below the target price of $1. In the money market world, this is referred to as “Breaking the buck.”

Stablecoins can depeg for various reasons, including a lack of liquidity, market volatility, or a decline in user confidence.

Remember, people hold stablecoins to provide a reliable and stable value. Therefore, it’s a big issue if a stablecoin fails to maintain its peg, as this can lead to a complete collapse and loss of funds.

The collapse can occur quickly once the peg is broken. As seen with TerraUSD (UST), it took just a few weeks for it to collapse after it depegged from the dollar.

Regulatory Risk

Cryptocurrencies are a relatively new and controversial asset class. As governments around the world begin to understand and respond to their growing market impact, we can anticipate a wave of new regulations aimed at overseeing their use. While some governments are likely to adopt a welcoming stance towards stablecoins, others may take a more cautious approach, implementing restrictions or outright bans.

Technology and Security Risk

There is always a risk that technology may fail or that vulnerabilities in the stablecoin protocol could be exploited by hackers. This can result in the loss of funds, limited access to assets, or blockchain malfunctions.

How to Get Started With Stablecoins

If stablecoins interest you, getting started with them is fairly straightforward. However, it largely depends on your experience with cryptocurrency exchanges and wallets. For those with more experience, the process will be easier. But if you are new to cryptocurrencies and stablecoins, you may find it more challenging.

Here’s the basics to getting started with stablecoins:

1. Choose a Stablecoin

The first step is to choose a stablecoin. You will need to research and find one that meets your needs and aligns with your goals. Some popular and widely used options are:

- USDC (Issued by Circle) – Transparent and regulated

- USDT (Tether) – Highly liquid, but less transparent

- DAI – Decentralized, backed by crypto assets

These are only a few examples, and many others exist. Ultimately, which stablecoin you choose largely depends on your needs, goals, and risk tolerance.

2. Set Up a Wallet

You will need a crypto wallet to store and use stablecoins. Options include:

- Centralized wallets: These are wallets managed by a third party that holds your private keys. They operate more like a traditional bank account where you enter a username and password. Examples include Coinbase, Binance, and Kraken.

- Non-custodial wallets, also known as decentralized wallets, are similar to keeping cash in your pocket, and you have sole possession of your private keys. Examples include MetaMask and Trust Wallet.

When selecting a cryptocurrency wallet, your choice will largely depend on your priorities and level of experience. Do you prioritize convenience over control, or do you prioritize control over convenience? Are you crypto savvy or just starting out? These factors can significantly influence your decision.

Both options have pros and cons, and choosing the right crypto wallet for you may be the most challenging decision when it comes to owning stablecoins. You may even decide to use both types of wallets. Therefore, dedicate ample time to researching each option to choose one that is right for you. Ultimately, the choice is yours.

3. Buy Stablecoins

Similar to crypto wallets, you have both centralized and decentralized options for buying stablecoins.

- Directly on exchanges like Coinbase, Kraken, and Binance

- P2P (peer-to-peer) platforms or decentralized exchanges

Selecting the right cryptocurrency exchange, much like choosing a crypto wallet, primarily depends on your priorities and experience. For instance, are you looking for yield or only to transact?

Therefore, take the time to research your options. If you’re unsure where to start, consider trying out a few different exchanges with a small amount of money to gain hands-on experience. This approach can help you identify the best exchange or combination of exchanges that aligns with your goals.

Stablecoin Tip:

Often, the best way to learn is through doing. However, this is not the time to go big or go home. If you’re considering investing in stablecoins, start small and experiment until you’re comfortable with the process.

For example, you could use a well-known exchange like Coinbase or Kraken. Then, begin by purchasing a small amount of a stablecoin, such as USDC, and attempt to transfer it to a self-custody wallet. Next, try to send it or use it to buy something.

The key takeaway is to take your time when it comes to stablecoins. Start small with an amount of money you can afford to lose and play around to see how things work. Rushing in without a full understanding of stablecoins can lead to costly mistakes.

Final Thoughts on Stablecoins

Stablecoins offer something truly unique: the stability of fiat currency combined with the speed, transparency, and accessibility of blockchain technology at low transaction costs, making them accessible to people worldwide. As a result, stablecoins are gaining popularity, and they are no longer just for crypto enthusiasts. However, not all stablecoins are the same.

If you are considering holding stablecoins, it’s essential to conduct thorough research, just as you would with any other financial product.

Look for transparent, well-backed stablecoins issued by trusted entities. Understand how your money is stored, what risks are involved, and how to use digital wallets securely.

Stablecoins may not be as flashy as Bitcoin or as well-known as traditional banking tools, but they’re quietly revolutionizing how people all over the world think about money. So, whether you are just curious, dipping your toe in, or ready to dive deeper, learning how stablecoins work can be a smart move. What you choose to do with this knowledge is entirely up to you.