Investing can be simple with KISS (Keep It Simple Stupid). Read on to learn why. But first, our disclosure:

Disclosure: This post may contain affiliate links, meaning we earn a commission on purchases made through those links at no extra cost to you. As an Amazon Associate, I earn from qualifying purchases.

Disclaimer: The content on this site is for informational and educational purposes only and does not constitute financial, investment, legal, tax, or any other professional advice and should not be used as a substitute for professional advice. For more details, read our full Disclaimer.

Overcomplicating With Little Results

Okay, I need to clarify something right at the start. I am not calling you or anyone else stupid. It is quite the opposite. You are a highly intelligent person. That’s what makes humans so unique.

The human mind is a marvel to behold, from the most mundane task of tying our shoes to blasting people into space. No other creature on Earth comes close to our level of ingenuity. However, that intelligence can sometimes get in our way, causing us to overthink and overcomplicate a problem. We all do it.

It can be a struggle not to fall into the rabbit hole of overcomplicating a situation. The internet makes it easy. There is an endless supply of information, and everyone is trying to sell you something.

You can be searching for the best high-yield savings accounts, but soon, you will be inundated with articles on passive income streams. Before you know it, you are researching private REITs or how to buy a rental property. Hours later, you subscribed to some guy’s YouTube channel, claiming you can make $450,000 per month in affiliate marketing while your savings are still languishing in a bank account, earning next to nothing.

On the flip side, some people spend too much time chasing yield and opening and closing savings accounts faster than the Flash. In the end, they wasted a lot of valuable time overcomplicating their savings, all for a minuscule increase in yield.

Enter the Keep It Simple Stupid (KISS) Principle.

KISS Principle of Investing

“Keep It Simple Stupid” (KISS) is a principle that suggests systems and processes work best when kept simple. It reminds us to avoid overthinking and overcomplicating things and to focus on simplicity instead. In short, the simplest solution is often the best solution, and I would argue that nowhere is this more important than when it comes to investing.

Many underperform the market by chasing the latest investing trend or through frequent buying and selling. Worse yet, some never start investing because it’s “too complicated.” I know firsthand what it is like to underperform the market by overcomplicating my investments.

I have invested in the crypto craze and chased yield with mortgage REITs, with awful results. I’ve tried investment strategies like the Dogs of the Dow, but those dogs ate my returns. Of course, I have attempted to pick individual stocks but quickly realized I am not the next Warren Buffet.

All these trials and tribulations confirmed what I knew all along about investing: keep it simple, stupid.

So, don’t fall for the hype around meme stocks on TikTok. Avoid multi-level marketing (MLM) schemes; they’re just pyramid schemes. And don’t even think about using debt to flip a house just because some YouTuber says it’s easy money. It’s not. Above all, don’t try to be a day trader with stocks, as it will cost you big time.

The point is that none of these things are simple, and they are likely to make you broke instead of wealthy. So, when it comes to investing, the best option is to keep it simple.

Investing Made Simple

The simplest way to invest is to own the entire market. You can achieve this by investing in a simple, low-cost index fund or ETF that tracks the S&P 500 or the total stock market. The same principle applies if you allocate a portion of your portfolio to bonds or international stocks. You can choose from many low-cost index funds and ETFs that track the total bond market and international stocks.

What if you do not want to think about portfolio allocation? You can invest in a single target-date index fund, which automatically adjusts its asset allocation based on your target retirement date. Now, that is simple and low-cost!

By investing in low-cost index funds and ETFs that track the broader stock and bond markets, you can avoid the pitfalls of investing in individual securities or complicated trading strategies. Better yet, with low fees and expenses, you keep more of your hard-earned money working for you over the long term. Remember, even a slight percentage difference in fees can add up to a lot of money over time due to the power of compounding.

I have to give a shoutout to John C. Bogle for making all of this possible. He realized that trying to beat the market is a losing game and that simply matching it delivers the best results. Bogle went on to start a company based on this simple yet powerful concept and changed investing forever. For this, he is my hero.

My Hero: John C. Bogle

I know it might seem weird, but my hero is not a star athlete, nor is it Warren Buffet. My hero is a person who revolutionized the way we invest by keeping it simple: John C. Bogle.

John C. Bogle founded The Vanguard Group and is credited with creating the first index fund. By introducing this revolutionary concept, he single-handedly transformed the world of investing. The creation of the index fund led to a significant reduction in costs across the investment industry while making investing much more accessible to the everyday person.

John C. Bogle proved that few professional fund managers can consistently beat the market. In fact, various studies show that over 80 to 90% of actively managed mutual funds underperform the S&P 500 over five years or more. To make matters worse, these funds charge higher fees, further reducing returns.

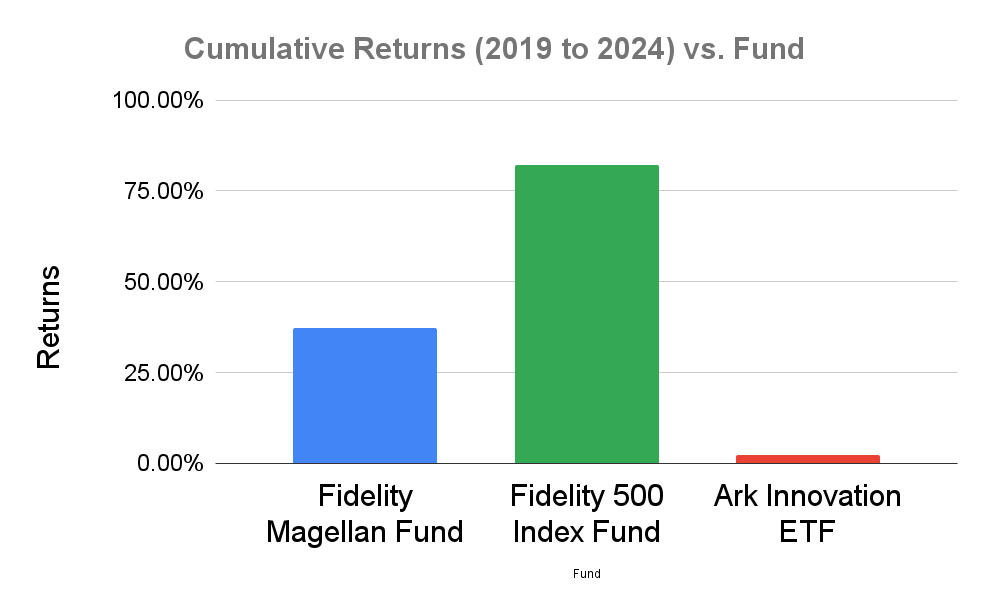

Below is a chart illustrating this point. It consists of three funds: the actively managed Fidelity Magellan Fund (FMAGX), the Fidelity 500 Index Fund (FXAIX), and Cathie Wood’s actively managed Ark Innovation Fund (ARKK).

They say a picture is worth a thousand words, and that is certainly the case in the chart above. Over the past five years, from 2019 to 2024, the Fidelity 500 Index Fund has blown away the storied Fidelity Magellan Fund and trounced Cathie Wood’s glamorous Ark Innovation ETF.

It’s interesting to note that their performance is the inverse of their expense ratios. For example, the Fidelity 500 Index Fund (FXAIX) delivered an impressive 82% return while charging only 0.015% in fees. Meanwhile, the Ark Innovation Fund (ARKK) returned a mere 2% while charging a much higher expense ratio of 0.75%. These figures are summarized in the table below.

| Fund | Returns (2019 to 2024) | Expense Ratio |

|---|---|---|

| Fidelity 500 Index Fund (FXIAX) | 82% | 0.015% |

| Fidelity Magellan Fund (FMAGX) | 37% | 0.42% |

| Ark Innovation ETF (ARKK) | 2% | 0.75% |

Bringing Low Cost To The Masses

Before John C. Bogle and The Vanguard Group, investors were charged ridiculously high fees and expenses for this subpar performance. Bogle’s innovative approach shifted the balance of power towards investors rather than investment firms, which profited immensely from their excessive fees.

Thanks to Bogle, individuals can now invest in index funds that have very low costs. For example, the Vanguard 500 Index Fund (VFIAX) has an expense ratio of only 0.04%, while Fidelity offers a range of funds called Zero funds that have no expenses at all.

Bogle’s index fund concept is a perfect example of the power of the KISS principle. He proved that It is better to own the market than try to beat it. There is nothing fancy about investing in a low-cost S&P 500 index fund, except that it beats 80 to 90% of all actively managed mutual funds over the long term. Simply amazing!

If there were a Nobel prize for investing, John C. Bogle would have been the reigning champion for 50 continuous years.

Common Sense Investing

If you haven’t already, I highly recommend reading Bogle’s book, “The Little Book of Common Sense Investing.” This book is a quick read and an excellent starting point for anyone who wants to learn about investing. It explains how investing in a low-cost S&P 500 index fund or a total market index fund can be a simple yet powerful way to generate wealth. I cannot recommend it enough.

Steps to Keep Investing Simple

Now that we have learned about the KISS principle and John C Bogle, let’s apply it to investing. Here are the top four actions you can take today to simplify your approach to investing. Remember, the key is to keep things simple.

1. Use Discount Brokerage Companies

I think the most important thing you can do is open your investment accounts with a low-cost brokerage company. Forget about the full-service mega banks and investment firms. They are only there to rip you off by charging you excessive fees and expenses. So, if you find yourself at Wells Fargo or Bank of America, don’t walk, but run away as fast as you can!

Your better options are low-cost brokerages like Fidelity, Vanguard, or Charles Schwab. All three will allow you to open accounts and invest with minimum fees and expenses. They are all excellent companies, but I prefer Fidelity. I’m sorry. John C. Bogle may be my hero, but Fidelity is where my heart lies.

Fidelity has no minimums or fees to open accounts and offers many funds with no minimum investment requirements and low to no expenses. On the other hand, Vanguard typically requires an initial investment of $1,000 to $3,000 to start investing in their funds. Vanguard is a great company, but the minimum investment requirements may be too high a barrier for many new investors.

Regardless of your choice, Fidelity, Vanguard, and Schwab are all great low-cost brokerage companies that will put you ahead of the game. The best part is they all make opening an account quick, easy, and simple. You can open an account in less than an hour and then return to binge-watching the latest hit show on Netflix.

2. Invest in Low-Cost Index Funds and ETFs

We have already spent time discussing the benefits of index funds.

To recap, over a five-year period and longer, more than 80% of actively managed mutual funds underperform their index. Worse yet, they charge higher fees and expenses for this subpar performance, further reducing your returns. You could forgo mutual funds and try building an investment portfolio using individual stocks and bonds, but that is super risky.

This is where low-cost index funds and ETFs come into play.

Investing in index funds is a low-cost and diversified way to invest in the stock and bond markets. Index funds track a specific index, such as the S&P 500, whose performance closely reflects that index’s performance. When the index rises, the fund’s value rises, and vice versa.

Index funds provide investors with exposure to a broad range of companies and industries, which helps to reduce the risk of investing in individual stocks. Additionally, index funds typically have lower fees than actively managed funds, which can eat into returns over time.

Like index funds, some low-cost ETFs track the broader stock and bond markets. However, be aware of the ETF’s composition and expense ratio. Though there are many low-cost ETF options, they may not closely track an index or be as cheap as their index fund counterparts. So, do your due diligence before investing in any investment, be it index funds or ETFs.

Overall, low-cost index funds and similar ETFs can be a smart choice for long-term investors who want to invest in the stock and bond markets. However, always remember that investing involves risk, and there is no guarantee that you will not lose money. That goes for index funds, ETFs, and any other investment.

3. Automate Investing

In my experience, the key to successful investing lies in automation. Automating your investments is a powerful strategy. Whether you have a 401K, Roth IRA, or brokerage account, automating your investments will guarantee that you make regular investments and benefit from dollar-cost averaging.

Dollar-cost averaging refers to buying a fixed dollar amount of a particular investment at regular intervals, regardless of the market’s ups and downs. By regularly investing the same amount, investors can reduce their exposure to market volatility by buying fewer shares when the market is up and more when the market is down.

Dollar-cost averaging can be a great way to take advantage of a growing economy over the long run. It allows you to invest consistently over time without having to worry about constantly monitoring the market. Moreover, automating your investments can help you avoid making emotional investment decisions, which can often lead to poor financial outcomes.

Setting up automated investments is simple. If you are already contributing to an employer-sponsored retirement account, like a 401K, you are already doing it. You can also set up automatic investments with your brokerage account or IRA that you opened with a discount broker.

One of the best things about this approach is that it only takes a few clicks to automate your investment accounts. You can easily set up automatic contributions from your checking account to your brokerage or IRA accounts. By doing so, you’ll be budgeting for investing just like any other expense, but instead of paying another company, you’ll be investing in yourself!

4. Buy And Hold

Buying and holding is the secret to becoming a successful investor. Once you automate your investments into low-cost, broad-based index funds and ETFs, there is nothing more to do. It’s as simple as that.

Okay, you may need to rebalance your portfolio each year or adjust your asset allocation as you age, but that is all part of your buy-and-hold strategy. Think of it as a pilot flying a plane. Once you set up your automatic investments, the entire process operates on autopilot. You, as the pilot, only take control of the plane to make periodic adjustments to your contributions and investment allocations, and that’s it!

One word of caution: It will be difficult to fight your urge to sell during a bear market when your investment portfolio declines by 20% or more. Having the discipline to hold steady during the darkest days of the market separates the good investor from the bad.

A Word On 401Ks

Investing mainly through a 401K or other employer-sponsored retirement account may limit your investment options. As a result, you will have less control over your investment expenses and the fees charged by the company administering the employer-sponsored retirement account. Don’t fret.

Many plans offer low-cost index funds, but there is no guarantee that yours will. Do your best to pick the investments that best align with your goals and at the best possible costs. Besides, odds are, your place of work matches a portion of your contributions, offsetting any higher fees and expenses you are paying. Also, don’t forget you are getting tax-deferred growth (or tax-free growth if you invest in a Roth 401K). That will help to offset any expenses that are beyond your control.

Conclusion: Investing With a KISS

Humans are intelligent and capable of great things, but sometimes, our heads get in the way of our success. We can overthink a problem, resulting in a complex solution to a simple problem. We are good at overcomplicating all areas of our lives, including the way we invest.

When it comes to investing, always remember the KISS principle: Keep It Simple, Stupid.

Many people believe that investing is complicated. Full-service investing firms and mega banks reinforce this belief so they can overcharge you for complex investment products that no one understands. Don’t fall for it. Investing is not complicated, and your investments shouldn’t be either.

Study after study has proven that very few professional money managers can beat the market over the long term. Heck, over 80% can’t beat the S&P 500 over five years, let alone 20 or 30 years. If professional money managers cannot beat the market, then odds are you can’t either. So, keep it simple.

The simplest way to invest is through low-cost index funds or ETFs that track the broader markets, like an S&P 500 index fund or a total bond market index fund. Then, set up automatic investments, sit back, and let the power of compounding do the rest.

Of course, you will have good and bad years when investing in index funds and ETFs. It is unavoidable. But at least you know you are getting the market return (good or bad). That is why taking a simple, long-term buy-and-hold approach to investing is so important. Don’t overcomplicate it. Keep it simple.