In the post, we will review Dave Ramsey’s homebuying advice, but first, our disclosure:

Disclosure: This post may contain affiliate links, meaning we earn a commission on purchases made through those links at no extra cost to you. As an Amazon Associate, I earn from qualifying purchases.

Disclaimer: The content on this site is for informational and educational purposes only and does not constitute financial, investment, legal, tax, or any other professional advice and should not be used as a substitute for professional advice. For more details, read our full Disclaimer.

Who is Dave Ramsey?

Dave Ramsey is a popular radio show host and author who has written numerous best-selling books on personal finance, including “The Total Money Makeover.” With millions of books sold and a podcast with over 1 billion downloads on Apple, Dave Ramsey’s influence on personal finance cannot be overstated.

Dave Ramsey is most famous for his baby-step plan for helping people get out of debt. The plan involves saving $1,000, then paying off debt and saving for the future. The core principle of Dave Ramsey’s approach is to live a debt-free life. As such, he advocates for avoiding credit cards and paying off all debts, except for a mortgage, before saving for retirement.

Dave Ramsey’s approach does not come without controversy. His stance on living a debt-free life by avoiding credit cards and prioritizing debt repayment over retirement savings has sparked intense debate. This controversy extends to his homebuying rules, which we will see shortly.

“The Total Money Makeover”

Love him or loathe him, Dave Ramsey’s influence on personal finance is undeniable. If you want to learn more about his baby steps, I encourage you to check out “The Total Money Makeover.”

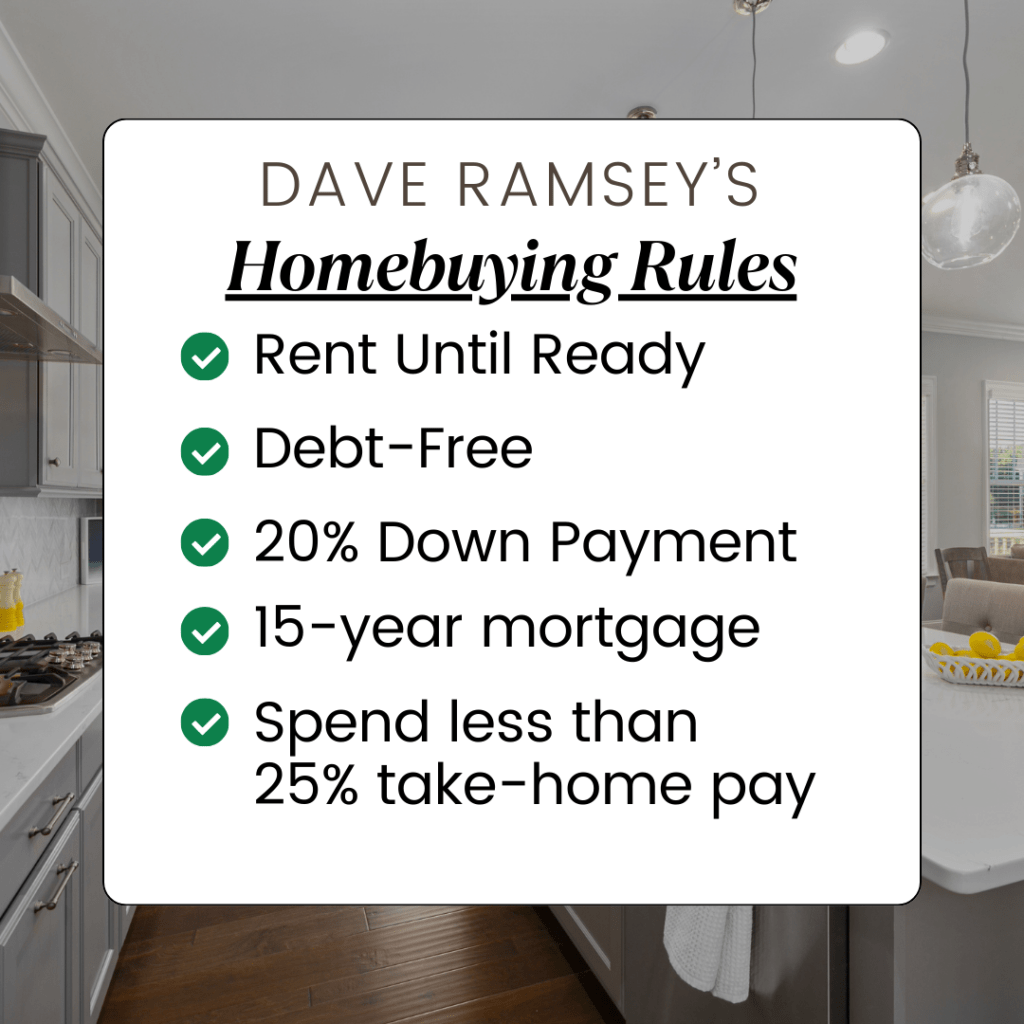

Dave Ramsey’s Homebuying Rules

Dave Ramsey knows a lot about real estate. While real estate helped him gain wealth earlier in his life, the leverage he used to purchase homes led to his bankruptcy.

In real estate, ‘leverage’ refers to borrowing money to increase an investment’s potential return. As Dave experienced, while leverage can be a powerful tool, it can lead to disaster if not appropriately managed. This life lesson set Dave Ramsey on a mission to educate people about the dangers of debt, leading to “The Total Money Makeover” and the baby steps.

Like his baby steps, Dave Ramsey views his homebuying rules in absolute terms. It’s all or nothing. However, he does allow for some flexibility, like when it comes to renting or down payments. Much like his baby steps, Dave’s homebuying rules have passionate supporters and strong critics.

Now, let’s get into the nitty-gritty of Dave Ramsey’s homebuying rules. I’ve numbered them to make it easier for you to follow along. Remember, these are just guidelines. You should always make decisions based on your unique financial situation and goals.

For more details, check out Dave Ramsey’s home-buying tips on his website.

Homebuying Rule #1: Renting is Okay

Many might think that Dave Ramsey will advise against renting by saying it’s like throwing money away, but that’s not true. Instead, Dave Ramsey takes a balanced approach to the renting versus buying debate. Although he believes buying is in most people’s best interest, he does not discourage renting. Like much of his advice, it all comes down to debt.

Buying and owning a home is expensive. Dave Ramsey suggests that individuals in debt who have limited savings should avoid purchasing a home. In other words, you must have your financial house in order before buying one. Ultimately, Dave Ramsey believes purchasing a home can be an intelligent decision if you can afford it.

As Dave Ramsey points out, one of the long-term benefits of homeownership is the ability to lock in your mortgage payment with a fixed-rate mortgage along with building equity. Unlike renting, there will come a time when you pay off the mortgage, and the payments will stop.

Eliminating the fixed cost of housing is a huge advantage when planning for retirement. While it doesn’t eliminate all housing expenses, like property taxes, insurance, and upkeep, you will still be spending far less on housing once your mortgage is paid off.

It’s important to note that these benefits can be lost if you borrow against your home. Remember that word “leverage” we spoke about earlier? When you borrow against your home, you are leveraging your home’s equity. If you fall behind on your payments, your home can be taken from you through foreclosure. So, be careful!

Crash Test Money’s Verdict

I can vouch for his stance on renting. Often, the allure of homeownership can overshadow the financial benefits of renting. In my case, renting allowed me the freedom to live where I wanted and save a significant amount of money. When I decided to buy a home, I was in a strong financial position, living debt-free and having a substantial down payment.

Homebuying Rule #2: Be Debt-Free and Have An Emergency Fund

Dave Ramsey’s debt-free rule on homebuying is straightforward: get your financial house in order first. This means being debt-free and having an emergency fund. The rationale behind this is simple: homeownership comes with significant financial responsibilities. Being debt-free and having savings can provide a safety net in case of unexpected expenses.

When Dave Ramsey advises being debt-free, he refers to all debts you may have except for an existing mortgage. And when he suggests having an emergency fund, he means having a fully funded emergency fund that covers 3 to 6 months of living expenses on top of a down payment.

Dave Ramsey’s recommendations are based on the fact that owning a home is expensive—and I mean wicked expensive. The best way to prepare is to build a solid financial foundation. Building a solid financial foundation requires discipline and sacrifice, but it’s worth it.

Crash Test Money’s Verdict

Being someone who owns a home, I agree with Dave Ramsey’s advice. Trust me when I say closing on your home is only the start of your expenses. When you sign the closing documents, you agree to allow Murphy’s Law into your life. What can go wrong will go wrong when you own a home. It is like the expense of owning a car but on steroids.

I was fortunate to have no debts and a fully funded emergency fund before closing on my home. That financial cushion saved me when we discovered our sewer line needed replacing in the first week of moving in.

Depending on your situation, being debt-free may seem like an impossible task. But remember that the closer you are to being debt-free, the better the loan you will receive.

When applying for a loan, banks consider your debt-to-income ratio. This ratio is important because it determines the amount of money the bank is willing to lend you and the interest rate on your mortgage. Keeping your debts low decreases your debt-to-income ratio and increases your chances of getting the best mortgage.

So, if you carry debt and want to buy a home, work hard to reduce your outstanding debts as much as possible. There is nothing wrong with renting or living with your parents until you are ready to buy. Regardless of your choice, if owning a home is your goal, developing an actionable plan with specific timelines is crucial to avoid drifting aimlessly at sea.

Homebuying Rule #3: Save A 20% Down Payment

Dave Ramsey says the best way to buy a house is with a 100% down payment but concedes that it is difficult. Understanding that most people need to take out a mortgage, Dave Ramsey recommends having a down payment of 20% or more, or 5-10% if you are a first-time home buyer.

Dave Ramsey clarifies that the down payment is in addition to and separate from your emergency fund. Your emergency fund is for emergencies, not a down payment on a house. Besides, you will need those emergency funds once you own a home.

Crash Test Money’s Verdict

Saving a 20% down payment when purchasing a home is smart. A 20% down payment helps you avoid Private Mortgage Insurance (PMI) and provides substantial home equity from the start. As a result, it demonstrates to lenders that you are a dependable borrower and less likely to face foreclosure.

I also like that Dave Ramsey makes an exception for first-time home buyers, allowing for a 5-10% down payment. Dave makes this exception, assuming you are debt-free and have an emergency fund.

I cannot stress enough that owning a home is expensive. It can either be a wealth builder or a wealth destroyer. Whether you put 5% or 20% down, the key is to get your debts under control and have some money set aside for emergencies before buying.

Homebuying Rule #4: Never Take Out More Than A 15-year Fixed Mortgage

Dave Ramsey is adamant that people should only take out a 15-year fixed-rate mortgage or less. He opposes the 30-year fixed mortgage, arguing that someone will pay too much interest and that no one should voluntarily hold debt for 30 years.

What if you want the flexibility of lower payments with a 30-year fixed mortgage in case all hell breaks loose with your finances? According to Dave Ramsey, don’t even think about it. It seems logical, but Dave is opposed to that and pushes back on any caller who suggests otherwise.

Crash Test Money’s Verdict

On the surface, Dave Ramsey’s advice makes sense. He is not wrong that 30 years is a long time to pay off a debt, but it is much more complicated than that. Someone must consider mortgage rates, home prices in their area, down payments, and opportunity costs.

To make matters worse, soaring house prices and mortgage rates since the COVID-19 pandemic have pushed homeownership out of reach for many people. Asking people to restrict their purchasing power with a 15-year fixed mortgage exacerbates the issue. It is a simple math problem.

In 2024, mortgage rates are hovering near 7% in the United States, and the median home price is above $400,000. To afford a $400,000 home on a 15-year fixed mortgage, a household must earn at least $140,000 per year, given a 20% down payment and no other debts.

All factors being equal, choosing a 30-year fixed mortgage would lower the income threshold to $100,000 for the same $400,000 house. Yes, the homeowner will pay more interest over the life of the 30-year loan. However, they can pay extra toward the principal to pay off the mortgage faster and save on interest.

The bottom line is that the 15-year mortgage rule may have worked 20 years ago, but it seems unrealistic today outside of a few exceptions. It might make sense for second-time homebuyers, high earners, and people in cheap housing markets. Outside of those situations, it isn’t easy to see how it will work for most people, especially those living in expensive metro areas.

Homebuying Rule #5: Never Spend More Than 25% Of Take Home Pay

Most financial experts advise that your mortgage payment should not exceed 25% of your gross income. However, Dave Ramsey recommends never spending more than 25% of your take-home pay on your mortgage. Your take-home pay, or net pay, is what you have left after taxes.

The goal of either strategy is to prevent individuals from becoming house-poor. The term “house-poor” refers to someone who spends a significant portion of their income on housing expenses. “House-poor” means that they are spending so much on their house that they can barely make ends meet or may not be able to do so at all.

Both approaches will go a long way in preventing such a scenario, but Dave’s goes further. However, will someone ever be able to buy a house following the 25% net income rule, not to mention Dave’s 15-year mortgage rule?

Crash Test Money’s Verdict

It may appear insignificant whether you use gross or net income when applying the 25% rule. However, the difference is substantial. Taxes and other deductions can reach 30% of your income, increasing your salary requirements. Let’s return to an earlier example but add Dave Ramsey’s 25% rule on take-home pay.

Earlier, we saw how the gross income (pre-tax) requirements to purchase a $400,000 house increase as you move from a 30-year fixed-rate mortgage to a 15-year fixed-rate mortgage. The person who opted for the 30-year mortgage at 7% with 20% down needs a gross income of $100,000 to purchase the home. The person who opted for the 15-year mortgage would need a gross salary of $140,000. That is a 40% difference in salary to purchase the same home!

The income requirement gets much higher if you follow Dave Ramsey’s 25% rule on top of his 15-year fixed mortgage rate rule. Remember, most financial experts recommend keeping your mortgage to 25% of your gross pay, but Dave says to use your take-home pay instead. That means the person following Dave Ramsey’s advice and using a 15-year mortgage would need a gross salary of around $180,000, so their take-home pay is $140,000.

The result is that your gross income would need to be 80% higher if you follow Dave Ramsey’s 15-year fixed mortgage and 25% rule to afford the same house. That is a tough sell for most people in today’s housing market.

Putting it All Together

Dave Ramsey’s approach to personal finance and homebuying may not be for everyone, but there’s no denying his influence in the space. His homebuying rules, such as being debt-free and having an emergency fund, can be helpful for those looking to establish a solid financial foundation before buying. By eliminating debt and establishing an emergency fund, homebuyers can be ready for unexpected expenses.

Although some of Dave Ramsey’s homebuying rules may be helpful, other rules may not be practical for many homebuyers. For instance, adhering to a 15-year fixed-rate mortgage may save money on interest, but it may not be feasible for everyone, as it requires higher monthly payments. Similarly, limiting oneself to 25% of one’s take-home pay instead of the gross pay may make many homes unaffordable.

Whether you agree or disagree with Dave Ramsey’s advice, it is crucial to do your research. You want to make informed decisions about homeownership that fit your unique situation. A good place to start is by following sound financial principles, such as living below your means and saving up for a down payment. By adhering to these financial practices, you can set yourself up for success in the homebuying process.