This post will examine the ongoing debate about Bitcoin price predictions for 2025. First, our disclosure:

Disclosure: This post may contain affiliate links, meaning we earn a commission on purchases made through those links at no extra cost to you. As an Amazon Associate, I earn from qualifying purchases.

Disclaimer: The content on this site is for informational and educational purposes only and does not constitute financial, investment, legal, tax, or any other professional advice and should not be used as a substitute for professional advice. For more details, read our full Disclaimer.

Will 2025 Be the Best Year Ever for Bitcoin?

2024 was a remarkable year for Bitcoin. In January, the first spot Bitcoin ETFs were approved, followed by the election of the first pro-crypto president. The cherry on top came when Bitcoin surpassed $100,000 in December. As 2024 comes to a close, attention is now shifting to what 2025 and beyond may hold for Bitcoin.

Much like Bitcoin’s volatility, opinions and price predictions are all over the map. Some believe Bitcoin will skyrocket into the millions, while others think it will crash to zero. Numerous other predictions lie somewhere in between.

While no one can predict with complete certainty what the future holds for Bitcoin, it’s always fun to speculate! It doesn’t matter if you’re a Bitcoin believer or a skeptic; playing the guessing game on asset prices is a great way to pass the time! So, grab some popcorn and your crystal ball, and let’s dive in and see what the experts say about the price of Bitcoin in 2025 and beyond.

Peter Schiff: Bitcoin Is Worthless

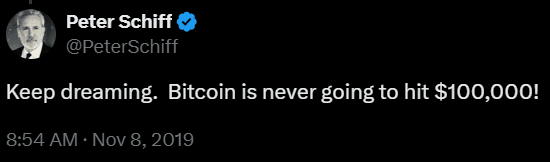

Peter Schiff might be Bitcoin’s most prominent critic. He believes it is worthless and one of the biggest asset bubbles in history. Schiff loves trolling Bitcoiners on X and calling them idiots on TV. However, his problem is that he is becoming a lot like the boy who cried wolf.

Schiff has been calling Bitcoin a bubble since 2013 when its price was around $400 a coin. Over a decade later, he still does, comparing it to the 17th-century tulip mania (which only lasted three years). If that weren’t bad enough, in 2019, he infamously predicted that Bitcoin would never hit $100,000. Five years later, it did just that!

How could he get it so wrong? To find out, you have to follow the money, and Peter Schiff’s money leads to gold.

Peter Schiff founded SchiffGold, a company that buys and sells gold and other precious metals. Gold and Bitcoin are competing assets that serve as hedges against the debasement of the US dollar. As a result, Peter Schiff has a lot to lose if Bitcoin’s price continues to rise.

If Bitcoin continues to grow in value at its blistering pace, it will overtake gold as an asset class. That’s bad news for Peter Schiff and SchiffGold. More money going into Bitcoin means less money going into gold, hitting Peter Schiff right where it hurts: his wallet.

I am not trying to pick on Peter Schiff. Okay, maybe a little bit, but my point is always to do your research and consider the source of information. Often, it is not as altruistic as it seems.

Peter Schiff’s Bitcoin price prediction:

- $0 or close to it. When? He doesn’t say

Michael Saylor: $13 million by 2045

Michael Saylor is the ultimate Bitcoiner. He believes that Bitcoin is better than gold as a store of value and will ultimately overtake it in market capitalization. As you can imagine, Peter Schiff is not a big fan of Michael Saylor and often trolls him in the media. However, that has not stopped Saylor from pushing forward with his Bitcoin plans.

Saylor transformed his struggling software company, MicroStrategy, into a bond-issuing Bitcoin treasury. Under his leadership, MicroStrategy has become the largest corporate holder of Bitcoin, currently owning over 400,000 Bitcoins or 2% of the total supply.

When making his case for Bitcoin, Saylor points to it being the fastest-growing asset over the past decade. He predicts that Bitcoin will continue to grow at an average rate of 29% over the next 21 years, or to $13 million a coin, by 2045. You read that right. Saylor predicts that one Bitcoin will be worth $13 million by 2045!

In the near term, Michael Saylor predicts that Bitcoin will grow at 60% per year before its growth rate starts to decelerate. If Bitcoin maintains a 60% growth rate in the near term, as Saylor predicts, its price could reach approximately $180,000 per coin by the end of 2025.

Gold has a four-thousand-year head start, but this is a new ball game. Given Bitcoin’s price, Saylor is off to an early lead over Schiff in the battle between gold and Bitcoin. However, it’s not all sunshine and unicorns. Like his archrival Peter Schiff, Michael Saylor has a lot of money on the line.

Under Saylor, MicroStrategy is selling shares and issuing convertible bonds to finance his Bitcoin purchases. Duliting shares and using leverage is risky and might backfire if Bitcoin crashes.

Saylor’s Bitcoin prediction:

- 2045: $13 million

Read The Book That Influenced Michael Saylor

“The Bitcoin Standard “by Saifedean Ammous is a must-read for anyone interested in Bitcoin. Michael Saylor credits this book with impacting his decision to pivot MicroStrategy to the Bitcoin standard. Regardless of your opinion on Bitcoin, any book that can have such a significant impact on a multi-billion dollar company is worth reading!

Cathie Wood: $258,500, then $3.8 million

Next, we have another Bitcoin bull: the well-known investor Cathie Wood, founder and CEO of Ark Invest. Wood and her firm invested in Bitcoin long before Michael Saylor got involved. In fact, according to Wood, Ark Invest was the first public asset manager to gain exposure to Bitcoin, starting in 2015.

Wood uses a tiered approach to predict Bitcoin’s price, dividing her projections into bear, base, and bull cases. Her base scenario suggests that Bitcoin could reach a price of $682,000 by 2030. In her bull case, she predicts a price of $1,480,000, while her most optimistic scenario estimates a price of $3,800,000. Conversely, her bear case, representing the worst-case scenario, forecasts Bitcoin at $285,500 by 2030. Notably, even this bear case would reflect a 150% increase compared to prices in late 2024!

Cathie Wood’s projections for Bitcoin 2030:

- Bear case: $285,500

- Base case: $682,000

- Bull case: $1,480,000

- Most Bullish case: $3,800,000

Learn How Your Biases Impact Your Investing

In his book, “The Little Book of Behavioral Investing.” James Montier explores the two systems of thinking he calls the X-system and the C-system. He delves into various topics, such as loss aversion, overconfidence, and the dangers of forecasting, and supports each point with the results of numerous studies. When you are done reading this book, you will no longer be your own worst enemy.

Bernstein: $200,000 in 2025 and $1 million by 2033

Analysts at Berstein, a global asset management firm, predict that Bitcoin will hit $200,000 by the end of 2025 and $1 million by 2033. Their lead of digital assets is calling the $200,000 price target a conservative number. In short, it’s all about supply and demand. The analysts at Berstein forecast that the popularity of spot Bitcoin ETFs coupled with a fixed supply will drive up Bitcoin’s price. Additionally, they predict more people will turn to Bitcoin as a hedge against inflation, further constraining the supply.

Bernstein’s Bitcoin price predictions:

- 2025: $200,000

- 2033: $1 million

Bitwise: Bitcoin $200,000

Bitwise Asset Management is a major player in the crypto space, offering eight different crypto ETFs. Its spot Bitcoin ETF, BITB, is one of the largest Bitcoin ETFs around, so they know a thing or two about Bitcoin. As you might guess, Bitwise is bullish on Bitcoin, predicting its price will reach $200,000 by the end of 2025.

Zooming out to 2029, Bitwise predicts that “Bitcoin will overtake the $18 trillion gold market and trade above $1 million per bitcoin.” That is a bold prediction, but remember, always follow the money.

Bitwise has a lot to gain financially from a surging Bitcoin price. A surging Bitcoin price means more money flowing into its Bitcoin ETF. There is no better way to hype an investment than through bullish price predictions, so it would be wise to take them with a grain of salt.

Bitwise Bitcoin Price Prediction:

- 2025: $200,000

- 2029: $1 million

Tim Draper: $250,000

Tim Draper is a billionaire venture capitalist and one of the largest individual holders of Bitcoin in the world, with 29,656 bitcoins. This amount exceeds the personal holdings of Michael Saylor, who owns 17,732 bitcoins. Interestingly, Tim Draper’s Bitcoin purchases are linked to some of the biggest scandals in Bitcoin history.

Draper lost 40,000 bitcoins in 2011 following the hack and subsequent bankruptcy of the Mt Gox exchange. Then, in 2014, he purchased 29,656 bitcoins auctioned off by the US Marshals Service that were confiscated from the closed Silk Road black market. He got them all for $18.7 million, or $632 per coin! That might go down as the greatest deal of all time. So, what does Tim Draper think about Bitcoin in 2025?

Draper predicts that Bitcoin will hit $250,000 in 2025. However, he made a similar prediction in 2018, stating that Bitcoin would hit $250,000 by 2022. Draper’s 2018 prediction proves that it is nearly impossible to predict asset prices, even for billionaire venture capitalists!

Tim Draper’s Bitcoin prediction:

- 2025: $250,000

Tom Lee: $250,000 in 2025

Tom Lee, co-founder of Fundstrat, a financial research and services firm, predicts that Bitcoin could reach $250,000 by 2025. Like many analysts, Lee emphasizes the importance of supply and demand dynamics as a key factor driving Bitcoin’s price. He argues that the latest halving and shifting political landscape, combined with a fixed supply and increased institutional interest, will cause Bitcoin to surge in price.

Tom Lee’s Bitcoin prediction:

- 2025: $250,000

Dan Morehead: Bitcoin “Has Reached Escape Velocity”

Dan Morehead is well-versed in the cryptocurrency industry. In 2008, he founded Pantera Capital, a billion-dollar asset management firm focused on blockchain technology. Under Morehead’s leadership, Pantera Capital launched the first blockchain hedge and venture funds in the United States, introducing the Pantera Bitcoin Fund and Pantera Venture Fund I. What does Dan Morehead say about Bitcoin?

Dan Morehead and Pantera Capital predict that Bitcoin could reach $740,000 by 2028. When arriving at this number, Morehead explains that only 5% of global wealth is currently invested in blockchain assets, which gives Bitcoin room to grow. As such, Pantera Capital forecasts that Bitcoin will grow at an average annual rate of 88%, achieving a market capitalization of $15 trillion by 2028.

Dan Morehead and Pantera Capital Bitcoin Price Prediction:

- 2025: 88% increase over 2024

- 2028: $740,000

Mark Yusko: A Bear Market Is Coming

Mark Yusko, founder of Morgan Creek Capital, has a cautious outlook on Bitcoin for 2025. While he predicts that Bitcoin will start strong, potentially surging to a peak price of $120,000 to $150,000 by mid-2025, he warns that a bear market may set in during the latter half of the year.

Although Yusko does not specify the severity of this potential bear market, he has indicated that he believes the fair value of Bitcoin is around the six-figure mark. If that is accurate, any price pullback may not be as severe as in previous bear markets, based on Yusko’s projections.

Mark Yusko’s Bitcoin Price Prediction:

- 2025: Peaks at $120,000 to $150,000 before entering a bear market in the latter half of the year

InvestingHaven: Cooling Things Down

InvestingHaven is a financial research company that specializes in forecasting asset prices. When it comes to Bitcoin, they are not as bullish as other people we have seen. InvestingHaven’s Bitcoin 2025 price prediction has it trading in the $75,500 to $155,000 range, with an average forecasted price of $115,200. Looking further out, InvestingHaven expects Bitcoin to hit the $200,000 mark before 2030.

InvestingHaven’s Bitcoin Price Predictions:

- 2025: $75,500 to $155,000, with an average forecast of $115,200

Crash Test Money’s Final Thoughts on Bitcoin’s Price

Following the election of the first pro-crypto administration in history and Bitcoin’s rise above $100,000, Bitcoin maximalists on social media have become even more hyper-focused on the price of Bitcoin. This obsession has extended to Bitcoin price predictions.

Many Bitcoiners on social media are deeply engrossed in Bitcoin’s price. They passionately debate every prediction they come across, often embracing those that align with their belief in Bitcoin’s potential while harshly criticizing those that suggest otherwise. However, it’s important to remember that these predictions are just that-predictions.

No matter the credentials of the person making the prediction, no one can predict the future. When it comes to investing, there is only one guarantee: there are no guarantees. The unexpected will happen. You can do all the research in the world, but it won’t stop the unexpected from happening.

I flew into Boston on 9/10/2001; the following day, the tragic events of 9/11 happened, and air travel and the world came to a grinding halt, taking years to recover. In August 2008, I uprooted my life by moving to a new state and starting a new job. Then, Lehman Brothers collapsed a month later, triggering the Great Recession. I witnessed my investment portfolio lose half its value, and despite surviving several rounds of layoffs, I did not receive a salary increase for many years. On March 10, 2020, I attended a basketball game with families and cheering fans. Within a week, the first global pandemic in 100 years would shut down the world.

So, take all these Bitcoin price predictions with a good dose of skepticism and do your research. No one knows for sure what will happen until it happens. Always remember, even a broken clock is right twice a day.