In this post, we will discover why Bitcoiners love Bitcoin. But first, our disclosure:

Disclosure: This post may contain affiliate links, meaning we earn a commission on purchases made through those links at no extra cost to you. As an Amazon Associate, I earn from qualifying purchases.

Disclaimer: The content on this site is for informational and educational purposes only and does not constitute financial, investment, legal, tax, or any other professional advice and should not be used as a substitute for professional advice. For more details, read our full Disclaimer.

What Is A Bitcoiner?

A Bitcoiner is an individual who believes in Bitcoin, seeing it not only as a cryptocurrency but as a revolutionary form of money and a robust store of value.

A Bitcoiner is not just a person who uses Bitcoin but someone who is deeply passionate about it. They believe in its purpose as a counterweight to government money and inflation. Bitcoiners believe in buying and holding onto Bitcoin forever, a practice they refer to as “HODLing,”

The term “HODLing” stands for “hold on for dear life,” a sentiment true Bitcoiners embody. They do not cower in the face of Bitcoin’s volatility. Instead, they see a 50% or 90% drop in Bitcoin’s price as a buying opportunity. This commitment is a testament to their resilience and unwavering belief in Bitcoin’s long-term value.

How to Insult Bitcoiners

Many people think Bitcoin and all other cryptocurrencies, known as altcoins, are the same. They lump them all together in a basket and label it “crypto.” To diehard Bitcoiners, this is an egregious insult.

It may come as a surprise, but many Bitcoiners hold a strong disdain towards other cryptocurrencies. They see no real value in them and question the motives of their developers. It’s Bitcoin or bust, baby!

If you ever want to see a diehard Bitcoiner lose it, mention that you believe the altcoin Ethereum is far superior to Bitcoin. Then, sit back and enjoy the fireworks! Admission to the show is free, but their reaction will be priceless!

Why are Bitcoiners so passionate about Bitcoin? Why does mentioning Ethereum and other altcoins send them into a rage?

It all comes down to the value of money.

Hardcore Bitcoiners judge money on its ability to store value now and into the future. To them, Bitcoin is the ultimate form of money, even surpassing gold.

How can a digital currency that you cannot touch and feel be considered by some to be the ultimate form of money?

To answer this question, we need to start from the beginning. I’m not referring to “The Big Bang” or the universe’s origins. Instead, we must answer the question, “What is money?”

However, before we move on, let’s address the elephant in the room: the common belief that only criminals use Bitcoin and that it should be illegal. No matter your opinion of Bitcoin, we must address this issue before moving on.

The $100 Bill Is the Choice of Criminals, Not Bitcoin

I’m not here to convert anyone into a Bitcoin fanatic. I just want to offer a little perspective against the popular belief that Bitcoin is only for criminals.

Whenever I read the comment section on articles or videos about Bitcoin, I often see people mentioning its criminal use and calling for its outlawing. By that logic, the United States dollar—specifically, the $100 bill—should also be illegal and banned from production and use.

That’s right. Criminals love the United States $100 bill. It is the most popular currency of criminals everywhere.

$100 bills are small, lightweight, and hard to trace, making them convenient for illegal transactions. A criminal can easily fit $1 million in $100 bills into a briefcase or backpack! These bills also allow criminals to operate entirely off the grid, as there is no need for computers or the internet.

On the other hand, Bitcoin requires an internet connection and records transactions on a public ledger that everyone can see. Criminals must manage their public and private keys and hot and cold wallets. These additional steps are not the ideal way for most criminals to transact!

The point is that while some Bitcoin transactions result from criminal activity, far more illicit transactions use the $100 bill.

Then there is FTX.

The Evils of FTX

People love pointing to FTX as an example of Bitcoin’s evils, but far more money has been lost investing in fraudulent companies with no association with Bitcoin.

The estimated losses of FTX were around $8 billion. That is a large sum of money, but it pales in comparison to Bernie Madoff ($65 billion), Enron ($74 billion), and Worldcom ($175 billion). All of which had nothing to do with Bitcoin!

I am not denying that Bitcoin scams exist, and many of the thousands of cryptocurrencies available are crypto scams. But criminals and scammers aren’t just targeting Bitcoin; they go where the money is. It is the same reason so many scammers target investing and real estate.

Now that we have this out of the way, let’s move forward and answer the question, “What is money?” It will help us discover why Bitcoiners are so fanatic about Bitcoin.

What is Money?

Money is ubiquitous in our society and has existed since the earliest human civilizations nearly 5,000 years ago. Without money, we would still be exchanging fish for flour with our neighbors. As human civilization advanced, so did our money, unlocking human potential and freeing us to specialize and innovate.

So, what is money?

It may be surprising, but money is a commodity like oil, gold, corn, or coffee beans. What makes money unique is its role as a medium of exchange and a store of value. It allows us to express prices and values and accumulate wealth while facilitating trade among peoples and nations.

I would argue that money is the single most important human invention. It allowed us to orient ourselves to the future by enabling us to store value for later use. It freed us to innovate and became the mechanism for acquiring property and wealth.

Learn More

If you’re curious about the fascinating history of money, you need to read Jacob Goldstein’s book, “Money: The True Story of a Made-Up Thing.” Goldstein brings money to life in a fun and engaging way. Trust me, this book will change the way you think about money. Don’t miss out on this fantastic read—I can’t recommend it enough!

Soft Money Versus Hard Money

Since money is a commodity, it has soft and hard versions, just like any other commodity. The difference between the two types of commodities comes down to how we acquire them and their durability.

Hard Money

Hard commodities like oil and gold are difficult and more costly to procure as they need to be mined, extracted, and refined.

Due to their durability and scarcity, hard commodities are excellent sources of money, and the money that they back is called “hard money.” For this reason, gold was the ultimate form of money for thousands of years until the 1900s.

Gold is rare and nearly indestructible, allowing it to preserve value. Its ability to store value means gold’s price will likely increase, maintaining its purchasing power over time. In other words, an ounce of gold ten years from now will be worth more than it is today.

Bitcoiners are after hard money, and they believe Bitcoin is the hardest money in existence. That is why Bitcoin is “mined” like other hard commodities and why Bitcoiners hate many other cryptocurrencies. To them, most other cryptocurrencies hold little to no value and serve no purpose.

Soft Money

Soft commodities are easier to produce, more abundant, and less expensive than hard commodities. Unlike hard commodities, which are mined or extracted, soft commodities are grown or produced, making them less durable. Agricultural products, such as corn, wheat, livestock, and rice, are soft commodities.

Since they are easier to produce and prone to damage and decay, soft commodities lose value over time, making them a poor source of money. Imagine using corn as money. Ten years from now, a piece of corn would be worthless, having rotted away many years earlier. Our modern paper currency, fiat money, is also considered soft money, as its value declines over time.

Fiat money is a type of currency not backed by precious metals or tangible assets like gold. Instead, it is issued by the government, which controls money printing, interest rates, and government spending. These factors directly influence the inflation rate. It is inflation that destroys the purchasing power of fiat money.

For example, if you placed a $1 bill under your mattress in 1999, you would find that by 2024, its purchasing power dropped by nearly half, reducing it to about $0.55. In other words, you would need $2 to buy what you could have purchased for $1 twenty-five years ago. In contrast, gold was around $300 per ounce in 1999 and has risen to over $2,700 per ounce by 2024.

The Fall of the Gold Standard and the Rise of National Debt

Until the 1970s, the United States operated under a monetary system known as the “gold standard.” This system links a country’s currency to the amount of gold it possesses. Under the gold standard, the value of paper money is directly tied to gold, which creates a stable form of currency.

In 1971, the United States abandoned the gold standard to control inflation and implement expansionary policies. The primary tool for managing inflation and these policies is interest rates, which influence the expansion or contraction of credit, also known as debt.

Politicians were no longer restrained by gold; they could now engage in deficit spending without limits, as all systematic checks on their spending were removed. The only obstacle is the ballot box, which they further influence through increased spending.

The consequences of shifting from a gold standard to fiat currency and endless government spending are significant.

Pictures Are Worth a Thousand Words

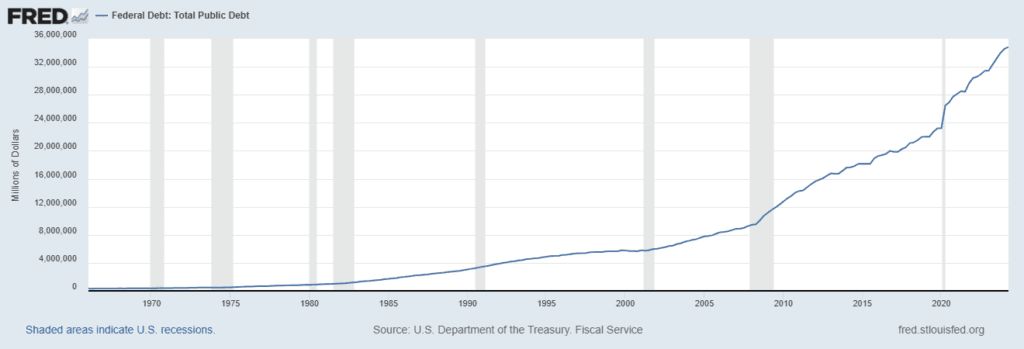

Below are three charts from the Federal Reserve Bank of St. Louis that depict our runaway debt after 1970. The first graph shows the rapid increase in the national debt after the United States abandoned the gold standard in the 1970s.

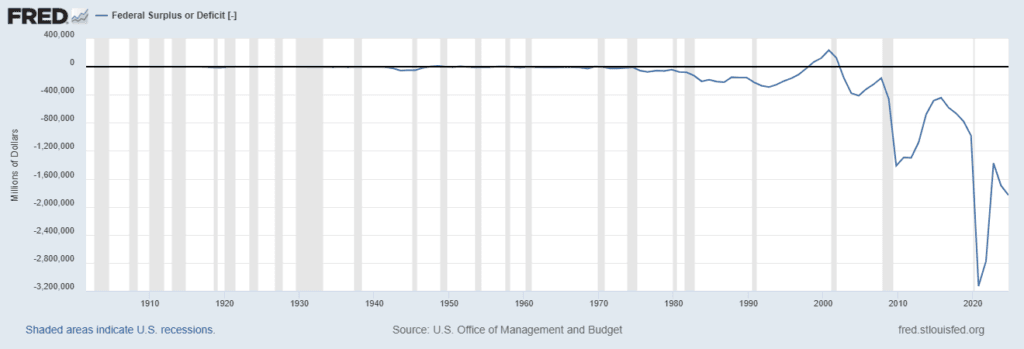

The second graph shows the Federal surplus or deficit from 1901 to 2024. For 70 years, the United States maintained a balance between the two until the gold standard was abandoned. Since then, it has been nothing but deficit spending minus a brief period between 1998 and 2001.

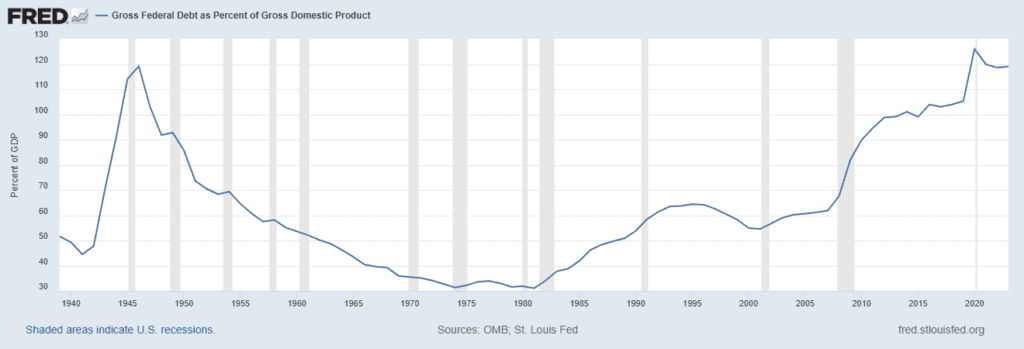

The third chart displays the total public debt as a percentage of gross domestic product (GDP) from 1939 to 2023. There was a massive spike in debt around 1945 due to World War II. However, the debt-to-GDP ratio steadily declined for the 35 years following WWII. This trend reversed after the U.S. abandoned the gold standard. Since 1980, the debt-to-GDP ratio has steadily increased, currently at around 120% and growing.

All of this easy money and debt had to lead somewhere. That somewhere was the Great Recession and the birth of Bitcoin.

The Birth of Bitcoin and Bitcoiners

Combine easy soft money and questionable loan practices with fractional banking, and you have a recipe for disaster.

In fractional reserve banking, banks must only keep a fraction of their deposits available for withdrawal. For example, if a person deposits $10 into their account, the bank can lend out $9, keeping only $1 in reserve. This approach works well when a bank has millions of customers, as it’s unlikely that everyone will want to withdraw their funds simultaneously.

However, fractional banking can lead to catastrophic problems if too many people want to withdraw money at the same time or if too many borrowers can’t pay back their loans. When this occurs, there are not enough reserves to cover withdrawals.

Leading up to the Great Recession, banks handed out mortgages like lollipops, and their cash reserves paled compared to the amount of money they were lending. This led to a never-before-seen housing bubble, and when it popped, the banks and the housing market came crashing down.

Households lost trillions of dollars in net worth, and unemployment skyrocketed. The government used taxpayer dollars to bail out banks “too big to fail,” inflaming taxpayers’ anger. People’s rage turned to Wall Street, leading to the Occupy Wall Street movement.

Bitcoin was launched in 2009 from the ashes of the Great Recession as an alternative to traditional banks and the government monetary policies that contributed to it. It was designed to counter the government’s fiat money policy and those of central and mega banks that brought the world economy to its knees.

Why Do Bitcoiners Love Bitcoin?

The birth of Bitcoin brought about the birth of Bitcoiners. Bitcoiners are passionate about Bitcoin’s purpose and value. They believe it is the answer to out-of-control governments and mega banks that brought about the Great Recession.

To Bitcoin enthusiasts, Bitcoin represents the ultimate form of money, far surpassing any other cryptocurrency or fiat currency. When advocating for Bitcoin, they often highlight six key characteristics: scarcity, stability, decentralization, security, durability, and divisibility. Let’s explore each of these characteristics in more detail.

Scarcity

The United States government can print an unlimited amount of money, whereas Bitcoin has a fixed supply. The total number of Bitcoins is capped at 21 million. However, the actual number in circulation will be much lower, as millions of Bitcoins are gone forever due to lost private keys.

Besides its capped supply, Bitcoin has another ace up its sleeve regarding scarcity: bitcoin halving.

Bitcoin halving takes place every four years and halves the block reward, which reduces the amount of new Bitcoin entering the market by 50%. This process increases Bitcoin’s scarcity, which can lead to a rise in its price. As a result, over time, Bitcoin becomes a more robust store of value and offers protection against inflation.

Stable Supply

In general, when the price of a commodity rises, companies are incentivized to increase production to benefit from the higher prices. This surge in mining and extraction boosts supply, resulting in lower prices. This is not the case with Bitcoin (or gold).

As we know, there will only ever be 21 million Bitcoins. Given Bitcoin’s increasing price, why haven’t they all been mined yet? Bitcoin has a brilliant feature that prevents this from happening: the difficulty adjustment.

The average time required to mine a new Bitcoin block is about 10 minutes. To maintain this 10-minute interval, the mining difficulty is automatically adjusted. The difficulty adjustment occurs roughly every two weeks and is based on how fast Bitcoin miners solve mathematical puzzles and add new blocks.

The difficulty adjustment works with Bitcoin halving to ensure a stable and predictable supply. Bitcoin was designed so that the last Bitcoins will be mined by 2140.

Decentralized

There is no centralized network of servers overseeing the Bitcoin blockchain. Instead, Bitcoin is a decentralized peer-to-peer network that relies on computers, or nodes, to keep it running. A Bitcoin node is any computer connected to the Bitcoin network using its software.

There are different types of Bitcoin nodes: full nodes that store a copy of the entire Bitcoin blockchain and light nodes that act as crypto wallets. However, the most familiar node is the mining node.

Mining nodes validate transactions and create new blocks on the blockchain by solving complex mathematical problems through a process known as “Proof of Work.” Each time a new block is added, the miners are rewarded with Bitcoin, with the reward being halved every 4 years or 210,000 blocks.

Decentralized nodes contribute to making Bitcoin one of the largest computer networks globally. Such mighty decentralized computing power holds a lot of value. To grasp the Bitcoin network’s raw computational power, we can examine its hash rate, which is the number of computations a network can perform per second.

At the time of writing, Bitcoin’s global network hash rate is over 800 quintillion hashes per second (EH/s). This means the Bitcoin global network executes an astonishing 800 quintillion computations every second. For reference, a quintillion comes after a trillion and a quadrillion.

Secure

Bitcoin’s security is like the spark that lights a Bitcoiner’s romantic flame—because nothing says “I love you” like a blockchain that can’t be broken!

Bitcoin’s decentralization, robust computational power, and difficulty adjustment create a complex security framework nearly impossible to breach.

The Bitcoin network’s decentralization means there is no single point of failure. Instead, the system operates across thousands of nodes distributed globally, making it resilient against attacks that target central points of control. Moreover, Bitcoin’s impressive hash rate, coupled with the difficulty adjustment, provides formidable layers of protection.

A high hash rate indicates that more computational resources are being devoted to solving complex cryptographic puzzles necessary for validating transactions. This enhances the security of each block added to the blockchain, making it increasingly challenging and costly for malicious actors to conduct successful attacks or take over the network.

As a result, Bitcoin’s combination of decentralization, hash rate, and difficulty adjustment enables it to maintain a high level of security.

Durable

Physical gold is indestructible and scarce, making it sound money for thousands of years. Even though central banks have transitioned to fiat currencies, they continue to hold substantial amounts of gold, highlighting its enduring role as a store of value. For Bitcoiners, the durability and scarcity of Bitcoin are comparable to that of physical gold, leading them to call Bitcoin “digital gold.”

It is extremely difficult to destroy or take over the Bitcoin network. Gaining control of 51% of the network would require a significant financial investment and the most powerful computer chips, which are in limited supply. Achieving this would be a monumental challenge, even for powerful nations like the United States or China. Even if they could take over the blockchain, would it be worth the money and resources to do so?

The creation of Bitcoin ETFs further increases its durability. The Bitcoin ETFs increase retail investment and impact the bottom lines of giant investment companies like Blackrock and Fidelity. That means there is much more money at stake, and these big investment firms will use their influence to protect the Bitcoin blockchain and their profits.

Maximum Divisibility

An important aspect of money is its ability to be divisible into distinct units. Money must be able to divide into smaller units for efficient exchange and pricing. For instance, the United States dollar can be divided into 100 pennies.

As Bitcoin’s value rises, it’s crucial for it to be divisible into smaller units. Those smaller units are called Satoshis, named after the mysterious creator of Bitcoin, Satoshi Nakamoto. One hundred million Satoshis equals one Bitcoin.

Thus, whereas 100 pennies make up a dollar, 100,000,000 Satoshis make up one Bitcoin. That is maximum divisibility!

The Ultimate Bitcoiner: Michael Saylor

Michael Saylor is the picture-perfect example of “HODLing” and embodies what it means to be a diehard Bitcoiner.

Michael Saylor is the co-founder, former CEO, and current Executive Chairman of MicroStrategy, a business intelligence software firm. He is also one of Bitcoin’s biggest advocates and has intertwined MicroStrategy’s future growth and direction with Bitcoin. Unlike many financial talking heads, Saylor is putting his money where his mouth is.

Under Michael Saylor’s leadership, MicroStrategy shifted its reserve from cash to Bitcoin, becoming the largest corporate holder of Bitcoin. As of November 2024, MicroStrategy owns over 250,000 bitcoins, valued at around $18 billion. The company also plans to raise $42 billion to purchase more Bitcoin. But that’s not all!

As of 2024, Michael Saylor personally owns over 17,000 Bitcoins worth approximately $1 billion. That places him among the top 10 individual holders of Bitcoin in the world. Even more astounding is that he claims he has never sold any Bitcoin and continues to purchase more!

Is his belief in Bitcoin correct? Only time will tell, but there is little doubt that he is the ultimate Bitcoiner.

Learn More About Bitcoin

“The Bitcoin Standard” by Saifedean Ammous is a must-read for anyone interested in Bitcoin. Before reading it, I was a Bitcoin skeptic. The book completely changed my understanding and opinion of Bitcoin, as it did for Michael Saylor, the Chairman of MicroStrategy.

Saylor transformed his multi-billion dollar company to focus on Bitcoin, completely overhauling its business strategy. As a result, MicroStrategy is now the largest corporate holder of Bitcoin, owning over 1% of all Bitcoin in circulation. Any book that can have such a significant impact is worth reading!

Conclusion: What It Means To Be A Bitcoiner

A Bitcoiner is an individual who believes in Bitcoin, seeing it not only as a cryptocurrency but as a revolutionary form of money and a robust store of value.

They argue that Bitcoin’s decentralization allows it to operate independently of central banks and governmental control, granting people greater control over their money. Bitcoiners view decentralization as a crucial defense against the potential greed, mismanagement, and inflationary practices often associated with traditional financial systems.

Bitcoiners also love that the coin’s supply is limited to 21 million Bitcoins, ensuring scarcity and helping preserve its value over time. In addition, Bitcoin’s high level of security protects it from hacking and 51% attacks, while its durability allows it to maintain its value in the long term.

Supporters often believe that Bitcoin represents a financial revolution that can empower individuals, providing an alternative to what they see as flawed and unstable fiat currencies. As the debate continues, we must wait and see if they are right.

In the end, Michael Saylor’s Bitcoin investment could either make him one of the wealthiest people in the world or lead to his spectacular downfall. That is the risk Bitcoiners are willing to take. Is it the right choice? Only time will tell.