In this post, we will take a detailed look at Cathie Wood and her major ETF, ARK Innovation.

Disclosure: This post may contain affiliate links, meaning we earn a commission on purchases made through those links at no extra cost to you. As an Amazon Associate, I earn from qualifying purchases.

Disclaimer: The content on this site is for informational and educational purposes only and does not constitute financial, investment, legal, tax, or any other professional advice and should not be used as a substitute for professional advice. For more details, read our full Disclaimer.

Cathie Wood: A Star Is Born!

If you nerd out on financial news, it’s hard to miss stories about Cathie Wood and her flagship ETF, Ark Innovation (ARKK). She is plastered all across CNBC, Yahoo Finance, and anywhere financial news can be found. As a result of all of this coverage, you might believe she is the queen of England or the next Taylor Swift.

Why is there so much hype around Cathie Wood and her firm, Ark Invest?

It is because she brings a flare of excitement and controversy to investing, adding some spice to what many consider boring. Right or wrong, I love it. I find her investment choices intriguing and fall for clickbait every time. How can you not? She takes huge risks with billions of dollars in assets.

Don’t worry if you’re not familiar with Cathie Wood or Ark Invest. By the end of this post, you will be, and we’ll pick up some valuable investing lessons along the way. But beware: once you see it, you can’t unsee it.

It’s like buying a new car and suddenly seeing it everywhere, even though you never noticed it before. That’s exactly what happens when you read about Cathie Wood and Ark Invest for the first time. Once you read your first article, you’ll start noticing Cathie Wood everywhere you look.

Don’t say I didn’t warn you!

Who is Cathie Wood and Ark Invest?

So, who is Cathie Wood, and what is Ark Invest anyway? Here is the boilerplate answer:

Cathie Wood is the founder of Ark Invest, an investment firm that specializes in actively managed exchange-traded funds (ETFs). Ark Invest is known for its focus on disruptive innovation and cutting-edge technologies, such as robotics, artificial intelligence, and genomics.

Phew! That is a lot of big words, and you might be thinking: “Sounds fancy, but big deal. There are plenty of technology-centric ETFs. What makes Cathie Wood and Ark Invest so special?”

The difference is that Ark Invest, headed by Cathie Wood, takes massive risks on lesser-known, unproven tech companies. Because of this, Ark Invest and Cathie Wood have gained a reputation for making big, bold predictions and investments. Put another way, it is the polar opposite of Warren Buffet and Berkshire Hathaway.

Warren Buffet is known for investing in big, “boring,” blue-chip companies, and he shunned tech stocks for years. When Warren Buffet finally decided to invest in tech, he chose one of the biggest and largest companies in the world: Apple. You are not going to find Apple among Ark Innovation ETF’s holdings, and that’s what makes Cathie Wood exciting and controversial.

To witness her investment strategy in action, let’s examine Ark Invest’s flagship ETF, Ark Innovation (ARKK).

Ark Innovation ETF (ARKK)

The current titans of technology are collectively called the “Magnificent Seven.” This group includes Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla, all of which are among the largest companies in the world. However, the Ark Innovation ETF (ARKK) only includes two: Tesla and Meta, and Meta barely registers at only 1% of the portfolio. Talk about going against the grain!

Apart from Tesla and Meta, Ark Innovation is composed of smaller, more volatile companies. Some of these companies are so small they are almost penny stocks, like Ginko Bioworks, which is trading near $1 per share as of February 2024. That is one risky investment.

To be fair, there are plenty of other names you will recognize, like Roku, Shopify, and Robinhood. However, the fund is littered with lesser-known names like Crisper Therapeutics, UiPath, PagerDuty, and Unity Software, to name a few. Furthermore, its top holding is part of the most risky sector ever created: cryptocurrencies.

Ark Innovation has made a bold investment in Coinbase, the largest cryptocurrency exchange in the United States. The decision to make Coinbase the main holding in its flagship ETF is a gutsy move, as investing in the world of cryptocurrency is considered one of the riskiest investments one can make. I know firsthand as I invested in Coinbase and lost over 80%.

When you take huge risks like Ark Invest, you either win big or lose big. There’s no middle ground. When you lose big, people love piling on top of you. But when you win big, you become a rock star in the investment world.

That’s what happened with Cathie Wood and the Ark Innovation ETF for a brief period during the COVID-19 pandemic.

The Rise and Fall of ARKK

The Meteoric Rise

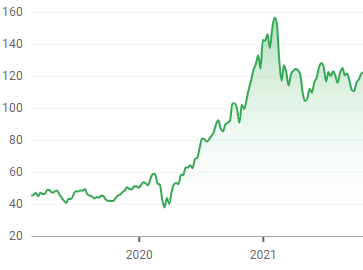

Take a look at the chart below, and you will understand the hype surrounding Cathie Wood and her Ark Innovation ETF (ARKK). You can see how ARKK skyrocketed from less than $40 per share at the start of 2020 to almost $160 per share a year later—a 300% increase! When you deliver those types of returns, you become a rock star in the investment world.

As ARKK’s stock went up, people started pouring billions of dollars into it, making it the largest actively managed ETF with almost $30 billion dollar in assets. Everyone was talking about Cathie Wood, proclaiming her genius. Cathie Wood was all over the news, saying that her Ark Innovation ETF would bring in 20% and then 30% returns annually over the next five years.

However, Ark Innovation had a major issue—it was built to perform well in only one economic situation. All the stars in the sky had to align, and for two years during the COVID-19 pandemic, they did just that.

During the pandemic, inflation was low, bitcoin was near $60,000, and people were locked in their homes, turning to technology to fill the void. That sent tech stocks soaring at levels not seen since the dot-com era.

The problem is if your returns are dependent on a once-in-a-generation pandemic, they disappear as soon as the pandemic is over. That is exactly what happened with Ark Innovation ETF.

The Steep Fall of ARKK

In late 2021, after the pandemic and lockdowns were ending, people were eager to spend. Having spent almost two years in isolation, people were ready to make up for lost time and had the financial means to do so.

It is amazing to see what happens when people are restricted from spending money while the government continues to print it. The combination of demand, easy money, and government stimulus unleashed the worst inflation in over 40 years. It was the perfect storm, except this time, Cathie Wood and Ark Innovation were on the losing end.

Tech stocks and bitcoin all came crashing down as inflation took off. That was bad news for Cathie Wood and her Ark Innovation ETF. She had bet big on cryptocurrency and tech companies like Zoom Technologies. Both were great bets when inflation was low and when the only way to see someone was on your computer. But they are horrible bets when inflation is high, and people are able to venture out again.

The chart below shows how fast Ark Innovation fell. Within two years of reaching its all-time high of almost $160 per share, it was trading at only $30 per share. That is an 80% loss from its peak in 2021 to its low in 2023.

The other observation from the stock chart below is just how reliant Ark Innovation was on the pandemic. Its stock chart looks like a giant mountain range between 2020 and 2022. Outside of that two-year window, it becomes evident that Cathie Wood’s Ark Innovation ETF has been mediocre at best.

Lessons From The Collapse of Ark Innovation and Cathie Wood

The rise and fall of the Ark Innovation ETF provides important lessons on investing and risk management. It reminds us not to mistake speculating for investing. Below are some of the key takeaways, with the most important lesson saved for last.

Speculating Is Not Investing

Cathie Wood draws a lot of headlines and makes big, bold predictions. Claims like Roku will be up 700% by 2026 and that Bitcoin can reach $1.5 million by 2030 fan the flames of speculation. My personal favorite is her prediction in 2023 that Zoom will reach $1,500 per share by 2026. That is a 2,000% increase.

All these lofty numbers can have you chomping at the bit to buy now before it is too late. The fear of missing out can lead you to take huge risks with your money, blurring the line between investing and speculating. Before you know it, your well-thought-out investment strategy is thrown to the side for the chance to strike it rich on the next hot thing.

This is not investing. This is speculating.

Remember, big, bold stock predictions generate headlines and get you on TV, and they accomplish it all for free. That helps Cathie Wood and Ark Invest more than ever, as they have seen major outflows of money when Ark Innovation fell after the pandemic.

So, always take these predictions with a grain of salt. Cathie Wood has Ark Invest’s interest at heart, not yours. This goes for every other investment company. Never forget that.

No One Can Predict The Future

Ark Invest, headed by Cathie Wood, manages billions of dollars in net assets and spends unseen amounts of money on research. However, they still cannot predict the future. Here are a few of Cathie Wood’s worst predictions, and they are epic.

Cathie Wood Prediction: Oil Prices Will Plummet

Back in July 2020, Cathie Wood tweeted that the price per barrel had reached a secular peak and would collapse to $12 per barrel due to electric vehicle demand. At that time, oil was trading around $40 per barrel. Meanwhile, Cathie Wood was everywhere, proclaiming her ARKK ETF would return 20% to 30% per year. Guess what happened?

Over the next few years, oil prices soared, reaching $120 per barrel by June 2022, while the share price of her Ark Innovation ETF tanked by 80%. Since then, oil prices have come down a bit but are still trading between $70 and $90 per barrel. That is a far cry from the $12 per barrel that Cathie Wood predicted.

As for electric vehicles, their sales are still growing but have begun to cool. Despite all the hype, the electric vehicle share of the US market was less than 9% by the end of 2023. As such, it is going to be a long time before electric vehicles disrupt oil demand to the point that oil trades at $12 per drum.

How could Cathie Wood have been so wrong? It’s simple. She was dead wrong with her boldest prediction, and it cost her big time. Her investments were predicated on deflation, not inflation.

Cathie Wood Prediction: Deflation, Not Inflation

I have been following Cathie Wood for some time now. She has been pushing the deflation narrative since at least 2021. This, by far, must be her worst prediction ever, considering how devasting inflation has been for Ark Invest.

In 2021, while Cathie Wood was talking about deflation, inflation was starting its destructive warpath, reaching a 40-year high by 2022. The problem for Cathie Wood is that Inflation is the bane of a tech stock’s existence, more so when they are smaller companies. The result was that Ark Invest and its flagship ETF, Ark Innovation, were decimated.

How bad has this prediction turned out for Ark Invest and Cathie Wood?

Ark Innovation (ARKK) went from a high of nearly $160/share in 2021 to a low of just over $30 per share by the end of 2022. The outflows were just as drastic, going from $30 billion in total assets under management to below $9 billion by 2024.

This has not stopped Cathie Wood from beating the deflation drum. Why would she stop now?

The damage is done, and eventually, she is going to be right. There will always be economic downturns, causing demand to wane. The lack of demand will cause prices to fall, and the Fed will cut rates to spur growth.

It does not matter if deflation happens next year or ten years from now; it will happen. When it does, you can bet the news media will be ready to proclaim Cathie Wood’s genius while ignoring all the years she was wrong leading up to it.

So, be careful when choosing your investments based on someone’s predictions. Even if a broken clock is right twice a day, it is wrong the rest of the time.

The Ultimate Lesson: Slow and Steady Wins the Race

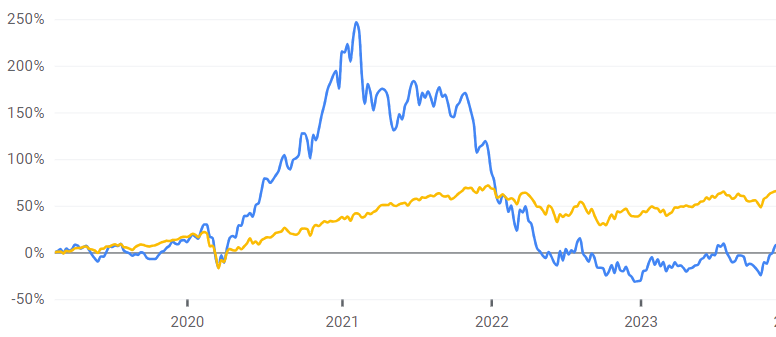

The ultimate lesson is that slow and steady wins the race. Take a look at the chart below. The blue line represents the Ark Innovation ETF, and the yellow line represents the S&P 500 over a five-year period beginning in 2019.

Notice how the S&P 500 moves forward in a steady and consistent manner. It may not be as glamorous as Ark Innovation, but it delivers impressive results. Over a five-year period, the S&P 500 outperformed the Ark Innovation ETF by a substantial margin, with gains of 80% compared to just 12% for ARKK.

This speaks volumes to the timeless wisdom of Warren Buffet and John C. Bogle, who have advocated for most people to buy and hold the S&P 500. Their advice might be simple and “boring,” but an S&P 500 index fund gives you instant diversification across 500 of the largest publicly traded companies in the United States. Alternatively, a total market index fund can provide exposure to thousands of additional companies.

Over time, that level of diversification helps to reduce the risk and volatility associated with investing in stocks while enabling you to take advantage of the growing economy.

It is important to remember that past returns do not guarantee future returns, and the S&P 500 will have down years; every investment will. However, investing in low-cost index funds that track the broader markets helps lower your overall risk compared to picking individual stocks.

This is not to say you should never take risks with your money, but if you do, it is best to gamble only with money you can afford to lose. The last thing you want to do is wipe out your life’s savings, making a big bet on a risky investment.

Putting It All Together

Cathie Wood is a famous investor for good reason. Her company, Ark Invest, takes big, bold risks on businesses and assets that they believe will be the next big innovators in the economy. By following Cathie Wood and Ark Invest, you can gain valuable knowledge about investing and managing risks.

It is the perfect case study on why it is so important to manage risk in your own portfolio and to avoid getting caught up in overzealous predictions. Ark Invest also highlights the fact that there’s a thin line between investing and speculating, and it’s easy to confuse the two. In the end, it is all about knowing your investment goals.

Cathie Wood’s flagship Ark Innovation ETF aims to identify the next major technology disruptor. It is the fund’s primary goal and the reason why people invest in it. However, that does not mean it should be your main objective when it comes to your core investments, such as your retirement accounts. Therefore, it is essential to know your investment goals and to be deliberate when taking financial risks.

See you in the next post. Until then, good luck on your money journey.