In this post, we will review the debt snowball, but first, here is our disclosure:

Disclosure: This post may contain affiliate links, meaning we earn a commission on purchases made through those links at no extra cost to you. As an Amazon Associate, I earn from qualifying purchases.

Disclaimer: The content on this site is for informational and educational purposes only and does not constitute financial, investment, legal, tax, or any other professional advice and should not be used as a substitute for professional advice. For more details, read our full Disclaimer.

What Is The Debt Snowball?

The debt snowball is a debt repayment method that involves paying off your debts in order of smallest to largest balances, regardless of their interest rates. The idea is that by focusing on small debts first, you can build momentum and stay motivated to pay off all of your debts (excluding your mortgage).

Think of this approach as a small snowball rolling down a big hill. As the snowball rolls, it gathers more snow and gains momentum. It grows bigger and faster until it becomes a massive boulder of snow that cannot be stopped until it reaches the bottom of the hill – which, in this case, is the end of your debt.

Personal finance guru Dave Ramsey popularized the debt snowball method through his book The Total Money Makeover and on The Ramsey Show.

If you listen to Dave Ramsey, you know he believes that the most important factor in succeeding with money is behavior, not math. That is why the debt snowball method does not prioritize interest rates (math) over small wins (behavior). The goal is to change behavior by creating a sense of accomplishment, leading to long-term financial success.

How Does The Debt Snowball Work?

The debt snowball method is straightforward and simple.

This method is all about prioritizing the repayment of your smallest debt as fast as possible while making minimum payments on larger debts. You throw any extra money you have at it until it is gone.

Once the smallest debt is paid off, the money that was being used to pay it off can be redirected toward paying off the next smallest debt. This process is repeated until all of your debts are gone except your mortgage.

Your mortgage is a unique debt, and there are many pros and cons of paying your mortgage off early. So, for now, we will focus on all other debts besides your mortgage.

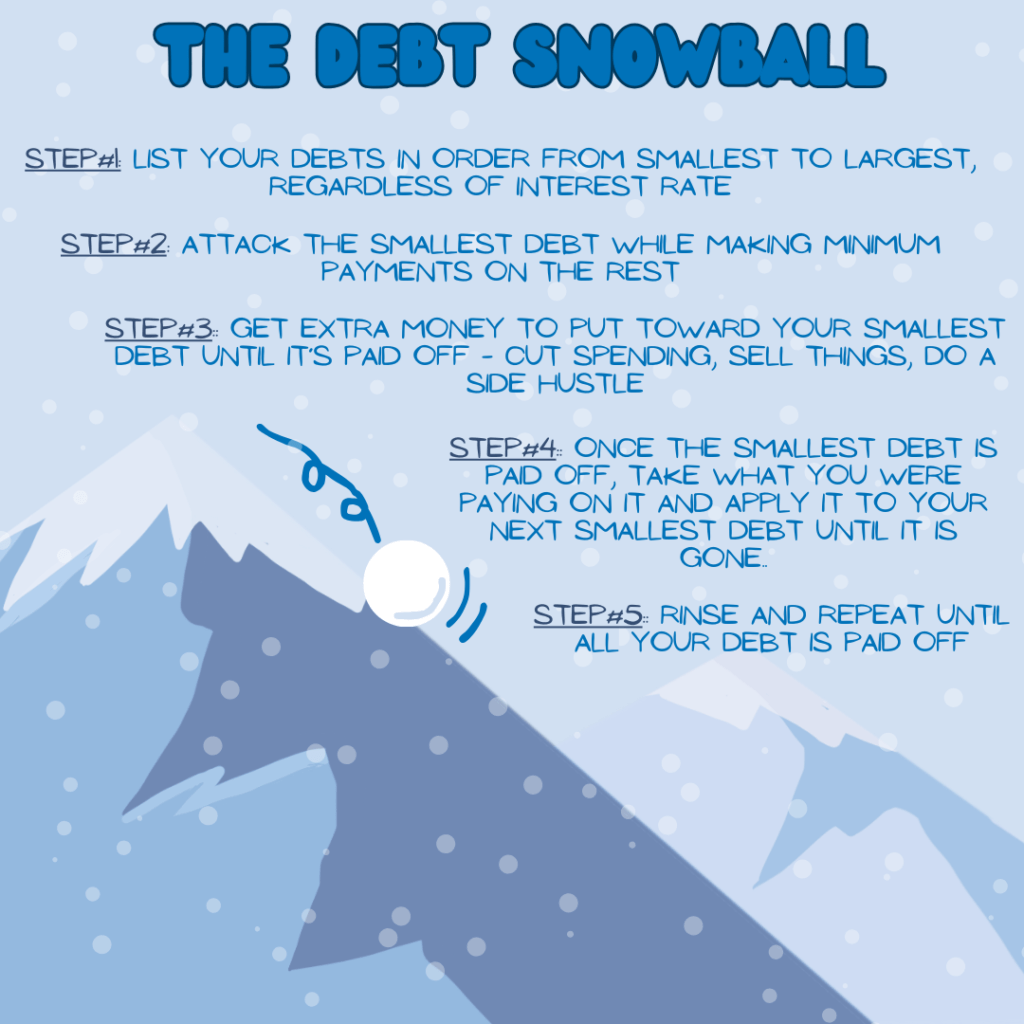

Here are the steps of the debt snowball method:

#1: List your debts in order from smallest to largest balance, regardless of interest rate.

#2: Attack the smallest debt while making minimum payments on the rest. Important: Don’t accumulate additional debt!

#3: Find extra money to put toward your smallest debt until it’s paid off – cut spending, sell things, do a side hustle

#4: After paying off your smallest debt, use that payment towards the next smallest debt until it is paid off.

#5: Rinse and repeat until all your debt is gone.

Debt Snowball Example

Let’s look at an example of the debt snowball in action.

In this scenario, you have a total debt balance of $32,600 distributed across four different debts. The table below displays each debt, along with their minimum payments and interest rates.

| Debt | Total Remaining Balance | Min. Monthly Payment | Interest Rate |

|---|---|---|---|

| Credit Card #1 | $600 | $15 | 18% |

| Credit Card #2 | $2,000 | $60 | 24% |

| Car Loan (Original Loan Amount: $20,000) | $10,000 | $400 | 7% |

| Student Loan (Original Loan Amount: $30,000) | $20,000 | $225 | 6% |

Since you are following the debt snowball method, you start by tackling the first credit card debt of $600. It does not matter that credit card #2 has a higher interest rate. The only thing that matters is eliminating that first debt as fast as you can in order to kick off the debt snowball.

If you pay the minimum balance on the first credit card, it will take five years to pay it off. So, you decide to speed things up, cancel a few subscriptions, and cut back on eating out. These minor cutbacks free up an additional $100 each month to put toward the first credit card, increasing your monthly payments from $15 to $115.

That extra $100 each month yields big results, and you eliminate the first credit card debt in 6 months. With the first debt gone, the debt snowball starts rolling, building size and momentum as it moves down the mountain of debt.

The Snowball Becomes a Boulder

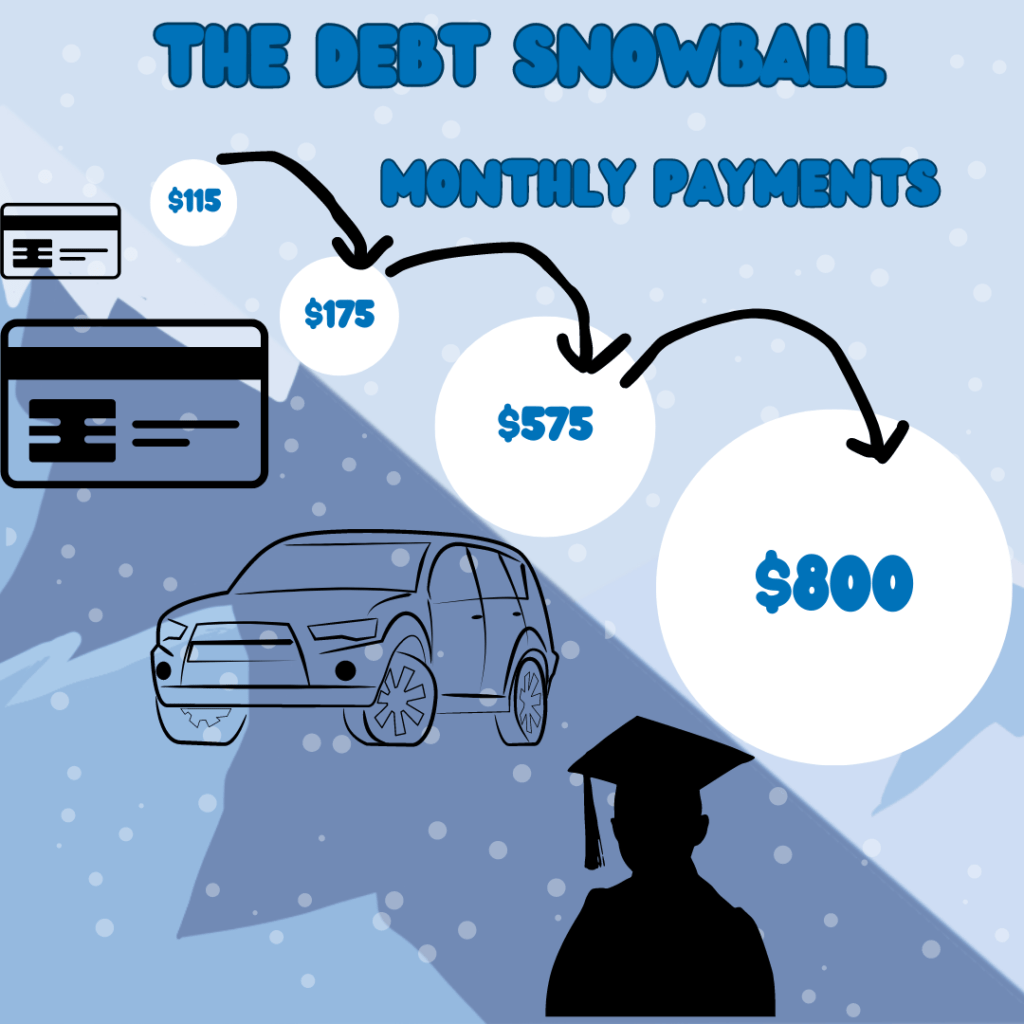

After you pay off the first credit card, you turn your attention to the second one. You take the $115 you were paying towards the first credit card and put it towards the second one. This means that instead of paying the minimum amount of $60 per month, you are now paying $175 each month toward the second credit card.

The debt snowball is now in motion!

After paying off credit card #2, you take the $175 and add it to your monthly car loan payment. This will increase the monthly car loan payment from $400 to $575.

Once you pay off your car loan, you add the $575 to your monthly student loan payment. This will increase the monthly student loan payment from $225 to $800.

Nothing can stop your debt snowball from reaching the bottom!

As you can see, that initial $115 snowball has turned into an $800 giant boulder of snow. This is what the debt snowball method is all about.

Debt Snowball Pros

Simple

The debt snowball follows the golden rule of “Keep It Simple, Stupid” or “KISS.” This rule suggests that you should avoid complex solutions when simple ones will do. When it comes to paying off your debts, there is no simpler method than the debt snowball.

There is nothing complicated about the debt snowball method. Arranging your debts and paying them off from smallest to largest balance is as easy as it gets. That is why it is so effective. No wonder Dave Ramsey’s book The Total Money Makeover is so popular.

I have read other books on getting out of debt that will have your head spinning. Some require all four orders of mathematics: addition, subtraction, multiplication, and division. Some throw in calculus for good measure (Just kidding!).

Although these other methods might save you more money than the debt snowball, the odds are you will grow frustrated and give up before you start. Quitting will cost you far more than the money you might save on interest. There lies the beauty of keeping it simple.

Motivating

The simplicity of the debt snowball method alone will keep you motivated, but the quick wins really put it over the top. By paying off your debts from smallest to largest, you will rack up quick wins that will keep you engaged.

Let’s say you are looking at a list of ten debts and can knock five off your list in the first year. This will feel like a huge victory and motivate you to continue. You will be able to visualize the finish line.

If, on the other hand, you arrange the same ten debts from the largest to the lowest interest rates, your first debt might be one of your largest debts. If that happens, you may become disheartened as you see the same list of outstanding debts month after month as you chip away at your largest debt.

Debt Snowball Cons

Ignores Interest Rates

While the debt snowball approach can be effective by providing a sense of accomplishment and motivation, it comes at a cost. By ignoring the interest rates, the debt snowball method can result in paying more money over the long term. This is especially true if the higher interest-rate debts are not addressed until later on in the process.

It is for this reason that many money professionals advocate for the Debt Avalanche method over the debt snowball. The debt avalanche method focuses on paying off your debts from the highest to lowest interest rates.

Takes Longer

Since you ignore the interest rates, the debt snowball method can take longer to complete.

Why?

Any additional money added due to interest will only prolong the time it takes to pay off the debts.

If you pay off smaller debts with lower interest rates before larger debts with higher interest rates, you will pay more interest in the long run. This will only prolong your repayment and result in you paying more interest charges than necessary.

Alternatives To The Debt Snowball

Debt Avalanche

We discussed the debt avalanche earlier, but here is a more detailed explanation of it:

The Debt avalanche is a debt repayment strategy that prioritizes paying off debts with the highest interest rates first while making minimum payments on all other debts. This approach can help you save money in the long run by reducing the amount of interest you pay over time.

Based on math, the debt avalanche is the best method for paying off your debts. There is no denying it will save you the most money over the long run and shorten your repayment time. However, the debt avalanche requires discipline and perseverance to be effective.

It may not be for you if you tend to give up quickly when you don’t see immediate results. In that case, stick with the debt snowball or try a hybrid of the two.

Hybrid Method

For many people, the best solution might be a hybrid of the debt snowball and debt avalanche methods.

In a hybrid method, you can lump your debts into categories and prioritize paying off high-interest consumer debts first. These are debts like credit cards, payday loans, and buy now, pay later plans. These debts tend to have the highest interest rates but the lowest balances.

Once you pay off your high-interest, low-balance consumer debts, it is time to turn your sites on your larger-balance debts. These are debts like student and car loans or personal and home equity loans (not your mortgage!).

For these debts, you may try the debt avalanche first to save on interest. But, if you feel discouraged and want to give up after some time, then switch over to the debt snowball. Remember, nothing is set in stone.

My Take On Interest Rates

In my opinion, the focus on interest rates by money professionals is a little overdone. I don’t think paying off your debts from the highest to lowest interest rates will result in significant savings in time and money for most people.

The reason is that I believe your small balance debts are probably associated with high-interest debts, like credit cards, payday loans, or short-term loans. On the other hand, larger balances are usually linked with lower-interest debts, such as student or car loans.

So, I bet most people end up paying off their debts pretty darn close from the highest to lowest interest rates using the debt snowball, whether that is its intention or not.

The Debt Snowball: Putting It All Together

The debt snowball is a popular method for paying off debt. It involves focusing on paying off the smallest debts first while making minimum payments on larger debts. Once the smallest debt is paid off, the money being used to pay it off can be redirected toward paying off the next smallest debt. This process is repeated until all debts are paid off.

The debt snowball method has its pros and cons.

On the one hand, it can help people feel a sense of accomplishment by paying off smaller debts quickly, motivating them to keep going. It can also simplify the process by reducing the number of outstanding debts they must keep track of. On the other hand, it may not be the most cost-effective method as it can result in paying more interest over time, especially if the larger debts have higher interest rates.

If you worry about high-interest rates, you might want to consider using the debt avalanche method instead. You can also combine the debt snowball and debt avalanche for a hybrid approach. The most important thing is to find a debt repayment strategy that suits you and that you can commit to following.

Make A Commitment

Regardless of the method you choose, it is crucial to commit to the process of getting out of debt if you want to succeed. No plan or method can guarantee success if you do not change your habits and give up before you start.

Make a promise to yourself. Write it down on a piece of paper and stick it to your fridge. Take all the necessary steps to motivate yourself to get out of debt. You must be strong enough to persevere when things get tough, and trust me, they will.

Remember that your ultimate goal is financial independence, which you can only reach by being debt-free.

You can do this! You can be debt-free!