In this post, we look at a major cost of homeownership and how to prepare for it, but first, our disclosure:

Disclosure: This post may contain affiliate links, meaning we earn a commission on purchases made through those links at no extra cost to you. As an Amazon Associate, I earn from qualifying purchases.

Disclaimer: The content on this site is for informational and educational purposes only and does not constitute financial, investment, legal, tax, or any other professional advice and should not be used as a substitute for professional advice. For more details, read our full Disclaimer.

Homeownership Isn’t Cheap

I was recently listening to The Ramsey Show when a caller asked a question about buying their first home. The caller was interested in purchasing a fixer-upper but was worried about running out of money after closing on the house. They specifically wanted to know if they should take out a $3,000 loan to cover home expenses after the closing.

If someone is about to close on a house, a fixer-upper nonetheless, and $3,000 is going to break them financially, then it may not be the right time to buy. Owning a home can be rewarding, but it is also expensive.

Many first-time homebuyers underestimate just how expensive owning a home is. Oftentimes, they get fixated on building equity and the idea that they are “throwing away” money renting. Yes, you will be building equity, but you will also be spending a boatload of money to maintain the property.

The cost of owning a home is so much more than your mortgage payment, property taxes, insurance, and utility bills. While you may have budgeted for these expenses, there are many more that come in all different shapes and sizes.

There is one particular cost of homeownership that catches nearly everyone off guard. If you ignore it and fail to plan for it, you can find yourself drowning in debt.

I’m talking about repair costs.

Whether you’re a first-time home buyer or a long-time homeowner, understanding and planning for home repairs can save you money and stress.

Homeownership: Where Dreams Meet Reality

There are few experiences as thrilling and terrifying as closing on a house. It’s the moment where dreams meet reality, where a dream home can soon become a nightmare.

Don’t think for a second that a home inspector will catch everything. Remember, they can only report on what they see. Even if the house is in good shape, eventually things break. It’s inevitable. Repairs are going to happen, and when they do, it stinks.

If you think you will save a lot on home repairs by doing it yourself (DIY), think again. Unless you are a contractor or happen to be a plumber, electrician, carpenter, and roofer all rolled into one, then DIYing only gets you so far.

When you have to call in the professionals, it’s gonna cost you money. It won’t be cheap. Here are a few examples from my experience that illustrate this point:

Oh, the Nightmares!

Within the first week of moving into my first home, I discovered that tree roots had infiltrated the sewer line after water backed up into the utility sink while I was running the washing machine. This shocking discovery was soon followed by the oven’s ignitor failing when I tried to bake a pizza. In total, I was facing nearly $6,000 in repairs within that first week of moving in.

Shortly after repairing our sewer, we discovered a leak in our roof, which required us to replace a small flat roof. That repair cost several thousand dollars more, and the issues haven’t stopped since.

The refrigerator’s condenser failed, the water heater broke, and my washing machine broke down mid-cycle. The total repair costs for all three combined exceeded thousands of dollars.

Then there was a storm that caused a tree to fall and smash my newly installed fence. This incident led to an additional thousand dollars in repairs, adding to the thousands of dollars I had already spent replacing the old, dilapidated fence. And that’s not all!

A few years later, another storm came through, tearing off my chimney cap along with several layers of bricks. That storm not only blew away the chimney cap but also my money for repair costs.

Homeownership is freaking expensive!

If you speak to other homeowners, I am sure they would tell similar stories. Whether it’s a new house, an old house, or a gut renovation, things break, and when they do, it can be costly to fix them.

Now that we understand how common and costly home repairs can be, let’s see how we can prepare for them.

How To Prepare for Home Repairs

According to Bankrate’s Hidden Costs of Homeownership Study, in 2025, Americans, on average, spend $8,800 each year maintaining their homes, which includes repair costs. When you include expenses such as utilities, property taxes, home insurance, and internet and cable services, the total annual cost of owning a home can balloon to over $21,000.

However, just because homeownership is expensive doesn’t mean you need to take it lying down. You may not be able to know what will break and when, but you can prepare for it to minimize its financial impact.

Using credit cards, loans, or fancy financing schemes to cover repair costs can result in accumulating more debt at higher interest rates. Having enough savings for repair costs can eliminate the need to take on more debt. It can also help you sleep more easily at night.

Don’t just hope for the best; be proactive and plan.

As a homeowner, there are several methods you can use to prepare for home repair and maintenance costs. Below, we will look at the two common savings methods that you can use. Plus, I have tossed in a third option, as common guidelines don’t work for everyone.

Before we dive into the different savings methods, there are a few important points to consider:

- There is no “one size fits all” approach.

- No two homeowners are the same. How much you save largely depends on your income, current amount of savings, and the age of your house and systems.

- Homeownership and the cost of living have gotten so expensive that many struggle to make ends meet, let alone save for repairs. Don’t be discouraged. Saving something is better than nothing.

- Savings for home repairs complement an emergency fund.

Method #1: The 1% to 2% Rule

A common rule of thumb is to save 1% to 2% of your home’s value each year for repairs and maintenance. For instance, if your home is valued at $400,000, you should aim to save between $4,000 and $8,000 annually.

One significant advantage of this guideline is that the amount you save each year will increase as your home’s value appreciates, allowing it to keep pace with inflation.

For example, let’s imagine your home value increases by 5% next year to $420,000. Saving 1% to 2% would result in saving $4,200 to $8,400 the following year. That’s up from $4,000 and $8,000 from the previous year. However, this approach has its limitations since it depends on the value of your home.

If your home’s value is on the lower end or you are anticipating larger expenses in the coming years, like a new roof, then saving 1-2% of your home’s value may not be enough. Instead, if your budget allows, you may want to bump up your savings rate to 3-4% to give yourself more wiggle room.

For example, if your home is valued at $150,000, setting aside 1-2% of its value would mean saving only $1,500 to $3,000 for repairs. While that’s a great start, it may not be enough, regardless of where you live. Increasing the percentage to 3-4% would raise your savings to between $4,500 and $6,000. Those are a heck of a lot better numbers if you can swing it.

Also, there are years when home values may decline. During those years, it is probably best to maintain your savings rate from the previous year, instead of reducing it. Just because your home value decreases does not mean the repair costs will.

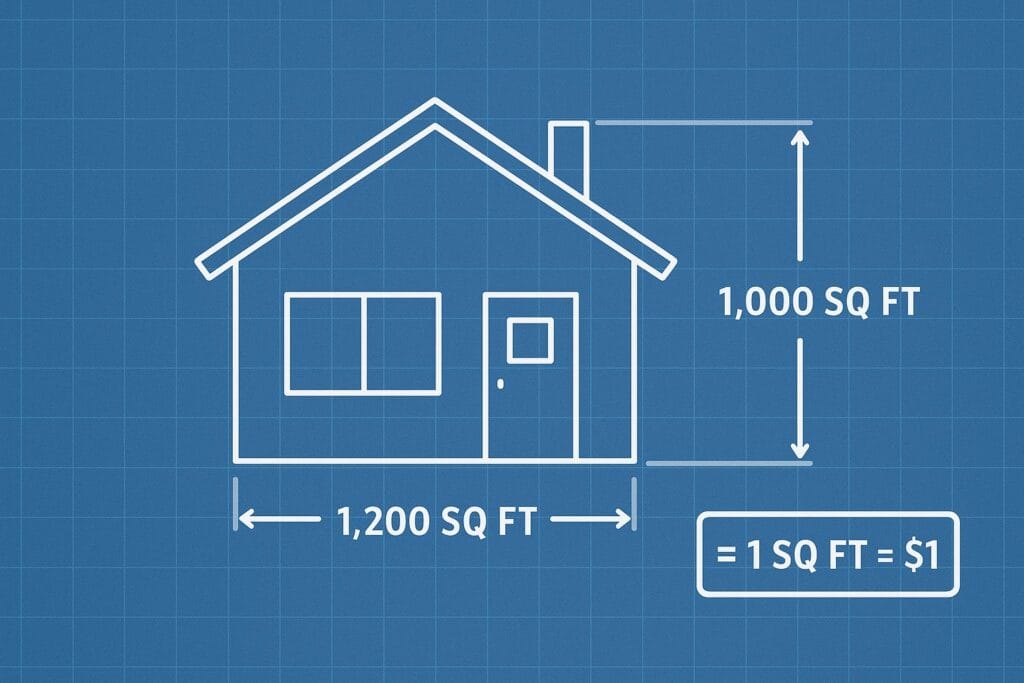

Method #2: The Square Foot Rule

With the Square Foot Rule, the goal is to save $1 per square foot of your home. For example, if you live in a 2,000-square-foot home, which is near the national average, that would equate to $2,000 per year.

One benefit is that it allows homeowners to set aside a manageable amount of money for a small repair fund, making saving less overwhelming. However, the downside is that this method may leave a homeowner short of funds for larger repairs.

Remember, Bankrate found that, on average, people spend nearly $9,000 annually on maintenance and repair costs. Given that figure, this savings method can leave most homeowners short on cash when they need it most.

Saving $2,000 per year for repair costs for a 2,000-square-foot house is not a lot of money. If your home is smaller, this method will leave you with even less money for repairs. Even if you live in a 4,000-square-foot McMansion, this method can leave you scrambling to pay for a repair.

So, if you are going to use this method, then consider picking another dollar amount. Instead of saving $1 per square foot, maybe save $2 or $3 per square foot.

Method #3: Choose Your Adventure

There are countless ways to save for home repairs. You can set aside a percentage of your household income, such as 5%. Alternatively, you might keep a running average of your annual repair costs and aim to save that amount each year.

For those who prefer a more ambitious approach and have the means to do so, consider establishing a specific savings goal, such as $10,000, and then contribute a smaller amount once that target has been met.

In the end, it’s important to pick a savings plan that you can stick to and that is within your budget.

No matter where you’re starting from, building a home repair fund can be challenging—but every little bit counts! Something is better than nothing, and more is better than less.

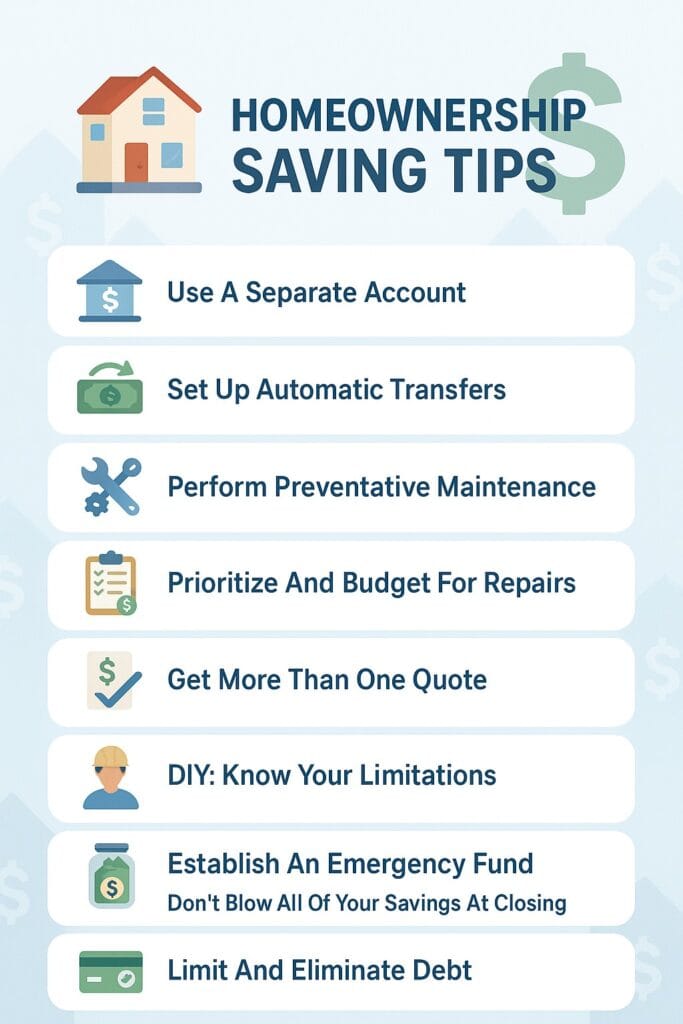

Homeownership Tips To Maximize Savings

Saving for home repairs can feel overwhelming. Homeownership is expensive, but it doesn’t mean it is not worthwhile. Here are some tips to help you save.

Use A Separate Account

Open a high-yield savings or money market account specifically for home repairs. Dedicating a separate savings account to home repairs helps avoid mixing funds and ensures your money is liquid and available when needed.

Set Up Automatic Transfers

Set up automatic transfers from your checking account to your dedicated home repair savings account. By automating your savings, you can ensure you have cash readily available for home repairs and avoid the temptation to spend those funds on something else.

Consider setting up the automatic transfer to occur after each paycheck or every month.

Perform Preventative Maintenance

As the saying goes, “Prevention is the best medicine.” What is true for your health is also true for your home.

Service your HVAC in the spring and fall. Have your furnace inspected and cleaned annually. Clean your gutters regularly. Reseal your driveway. Fix minor repairs promptly before they become major repairs.

While preventative maintenance will cost you money, it will ultimately save you money by extending the life of your systems, helping to prevent or delay larger repairs.

Prioritize and Budget For Repairs

Don’t be the homeowner who spends all of their funds repainting walls simply because they don’t like the color, while their thirty-year-old roof is falling apart.

The key to successful homeownership is learning how to prioritize and budget for home repairs. Not all repairs are emergencies, and not all minor repairs will turn into major repairs.

Begin by sitting down to create a list of all the necessary repairs that need attention. After identifying the repairs, prioritize them based on urgency. Next, research online to estimate the costs for these repairs or obtain quotes from professionals. Finally, develop a savings plan that outlines the total amount required to address your top priorities, along with target dates for completing each repair.

By prioritizing and planning, you can allow yourself time to save for specific repairs while maintaining adequate funds for other home repair costs.

Get More Than One Quote

It is shocking the range of prices different contractors provide for the same scope of work. Whether it was to replace my fence, driveway, or garage roof, the range of prices was in the thousands of dollars. That is why it is so essential as a homeowner to get multiple quotes. Don’t settle for the first quote that comes your way without seeing others.

The trick is to look beyond the numbers and the sales pitch to find a reputable contractor that offers high-quality service at a competitive price. Cheaper is not always better, and comparing quotes can be challenging. They are not always apple-to-apple comparisons. Sometimes the extras are frivolous upcharges, and other times they are game changers.

For instance, when I replaced my old, dilapidated fence, one contractor’s quote stated that it would be my responsibility to ensure the fence line was clear of obstacles like bushes and tree stumps. However, the contractor I ultimately chose took care of the problem by grinding down all the old tree stumps and trimming back any bushes that were in the way. It may have cost more, but it was worth it.

On the other hand, when I replaced my driveway, I chose the cheapest quote I received. Replacing a driveway is a pretty standard process. The lowest quote came from a well-known residential and commercial asphalt company that offered a multi-year warranty.

DIY: Know Your Limitations

DIY can be a double-edged sword. It has the power to save money, but also the power to turn a minor repair into a costly mistake. The key to saving money with DIYing is to know your limitations. Watching a YouTube video is helpful, but it does not make you a professional.

Unless you are a licensed professional, like a plumber or electrician, some repairs are better left to the professionals. In fact, performing some repairs yourself can be illegal, let alone a safety hazard to yourself and your family.

Fixing a leaking faucet or a running toilet is one thing. But replacing a sink or toilet? That’s a whole different ballgame! Do it wrong, and you can be looking at higher repair costs than if you had just hired a professional in the first place.

Bottom line: When it comes to DIY, know your limitations, or it just might cost you more than you bargained for.

Establish An Emergency Fund

Homeownership can seem out of reach for many people. Saving up for a down payment on a home, along with saving for home repairs, can seem like an impossible task. It takes discipline, determination, and years of saving. Adding the idea of also building a fully funded emergency fund can seem like a twisted joke, but it is so vital to your financial well-being.

Ideally, it is best to have an emergency fund established before buying a house. If a repair costs more than what you have saved, you can tap into the emergency fund to cover the expense, which helps you avoid taking on high-interest debt from loans or credit cards.

Don’t Blow All of Your Savings At Closing

Many people stretch their finances to purchase a new home. They scrimp and save for a down payment, but by the time they close on the property, they often drain most, if not all, of their savings. The lack of savings leaves them without a financial buffer for unexpected repairs or expenses.

Once again, it’s crucial to establish an emergency fund beforehand and keep it separate from your down payment. If you haven’t set up an emergency fund and don’t plan to do so before buying a home, try to avoid draining all of your savings for closing costs. Make sure to leave some money behind so you have cash available in case an urgent repair arises after closing.

It stunk to drop $6,000 on a new sewer line shortly after closing on my house. But it stunk a whole lot less because I had cash on hand to pay for the repair.

Limit and Eliminate Debt

Before searching for a new home, try to eliminate as much debt as possible, especially high-interest debt. High-interest debts are those with interest rates approaching 10% or more. A classic example of high-interest debt is credit card balances.

The more high-interest debt you can slash before searching for a new home, the more you can put toward establishing both an emergency fund and a down payment.

Once you buy a house, resist the urge to buy all new furniture using store financing or buy now, pay later schemes. If you use credit cards, pay them off in full each month. Don’t blow your entire budget on a new car that will take you 72 months to pay off.

Life can be unpredictable, and sometimes debt may be unavoidable. The important thing is to take control of it now rather than wait until later. Homeownership is a lot less stressful when you’re not struggling to pay for it.

A Preapproval Is Not How Much You Should Spend

If I had to guess, the mortgage preapproval has busted more home-buying budgets than any other expense. Many homebuyers see the preapproved number and mistakenly assume they can comfortably afford a home at that price tag. That is not the case.

Instead, a preapproval for a mortgage is the maximum amount a lender is willing to lend you. It is not how much you should spend on a home.

A better way to think about a preapproval is that it is the maximum amount of risk the lender wants to take on the homebuyer. It is the sweet spot where the lender can maximize profits while minimizing the risk of non-payment.

Never forget that lenders make money from the interest they charge on loans. The bigger the loan, the more money they make.

For many, buying a home at the preapproved amount will strain their finances, making it hard to handle any necessary repairs. If a homebuyer’s budget is stretched too thin, it can result in taking on more debt to handle repair costs.

Conclusion: Homeownership — Don’t Let Repair Costs Surprise You

Homeownership means embracing both the joys and the responsibilities that come with it—and budgeting for repairs is one of the smartest moves you can make as a homeowner. Whether you follow the 1% rule, build a dedicated repair fund, or perform preventative maintenance, the key is to be proactive.

Adequate savings not only protect your investment but also give you peace of mind when the unexpected happens. A little financial planning today can save you from big headaches—and even bigger bills—tomorrow.

Bottom line: Home repairs aren’t “if,” they’re “when.” Save now, and you’ll be ready for whatever your house throws at you.