In this post, we will cover the topic of a CD Ladder, but first, here is our disclosure.

Disclosure: This post may contain affiliate links, meaning we earn a commission on purchases made through those links at no extra cost to you. As an Amazon Associate, I earn from qualifying purchases.

Disclaimer: The content on this site is for informational and educational purposes only and does not constitute financial, investment, legal, tax, or any other professional advice and should not be used as a substitute for professional advice. For more details, read our full Disclaimer.

What is A CD?

A CD stands for Certificate of Deposit, and it’s a special kind of savings account. What attracts investors to CDs is that they usually offer higher interest rates than regular savings accounts. But there’s one catch – you must agree to keep your money locked in for a specific amount of time. This means you won’t be able to access your funds until the CD matures without incurring fees and penalties. You give up some flexibility and liquidity in exchange for higher interest rates.

The terms for CDs usually range from 3 months to 5 years. However, there are less common CDs with shorter or longer terms, like a one-month or ten-year CD. The flexibility in terms of CDs allows investors to choose an option that aligns with their financial goals, risk tolerance, and liquidity needs. An investor can select a short-term CD if they need their funds in the near future or a long-term CD if they are willing to commit their funds for an extended period of time.

CDs are considered a safe investment because they offer a guaranteed interest rate and protect your initial investment. So, a CD could be a good choice if you’re looking for a low-risk investment option. Also, if you purchase CDs through a bank, they should be FDIC insured up to $250,000. So don’t forget to verify that a CD you are interested in is indeed FDIC insured before making a purchase.

What is a CD Ladder?

A CD ladder is when you divide your savings into multiple certificates of deposits (CDs) with varying terms and interest rates. Each CD is a different rung on the ladder. With this approach, you can enjoy higher rates of return on your savings while also addressing the liquidity issue that comes with CDs. By having CDs that mature at regular intervals, you have the flexibility to reinvest or withdraw your funds as needed.

Typically, you divide your funds evenly between CDs and purchase them simultaneously, selecting terms that allow for reinvestment or withdrawal at regular intervals. This approach keeps things consistent and simplifies the task of tracking maturity dates. However, there’s no one-size-fits-all approach, and you can construct your CD ladder to meet your savings goals. Be careful if you decide on a non-traditional approach to building your CD ladder. If you go non-traditional, it is even more important to carefully track maturity dates and be mindful of liquidity risks.

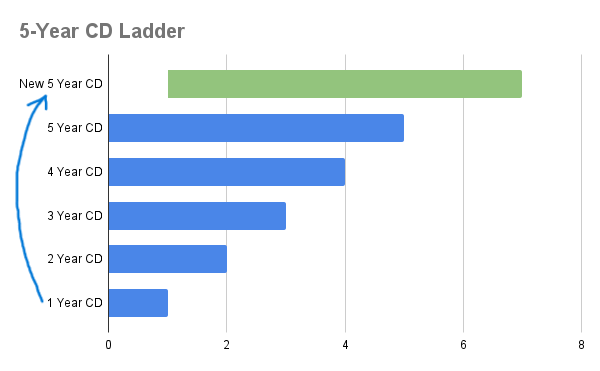

To maintain a CD ladder, you roll the funds from a maturing CD into one that matches your ladder’s longest term. For example, in a 5-year CD ladder, you would purchase a 5-year CD as each CD matures. Similarly, in a 3-year CD ladder, you would purchase a 3-year CD as each CD matures.

Great! Now that we’ve got a handle on CDs and CD ladders let’s look at two approaches that are both timely and timeless. These are the 5-year and 1-year CD Ladders.

Classic Examples of CD Ladders

5-year CD Ladder Example

Let’s say you have $5,000 that you want to invest in CDs. You have a few options: invest all of it in one CD, split it between a couple of CDs, or create a CD ladder. If you decide to go for a five-year CD ladder, you will divide your money equally among five CDs. You construct your five-year CD ladder by purchasing CDs that will mature at one, two, three, four, and five years. It would look something like the table below.

1st CD: $1,000 in a 1-year CD

2nd CD: $1,000 in a 2-year CD

3rd CD: $1,000 in a 3-year CD

4th CD: $1,000 in a 4-year CD

5th CD: $1,000 in a 5-year CD

After your initial CD matures, you can choose to either withdraw the funds or renew it for another 5-year term. If you want to maintain a CD ladder, you use the principal and interest earned from a 1-year CD to purchase a new 5-year CD. You can repeat this process by buying a new 5-year CD each time a CD matures in your CD ladder. By doing this, you will always have a CD maturing annually. However, you also have the option to withdraw funds and opt out of this cycle at any time when a CD matures.

If you wish to avoid locking your funds in long-term CDs but still want to make the most of a CD ladder, there’s an alternative. You can consider constructing a CD ladder using short-term CDs. This brings us to our 1-year CD ladder example.

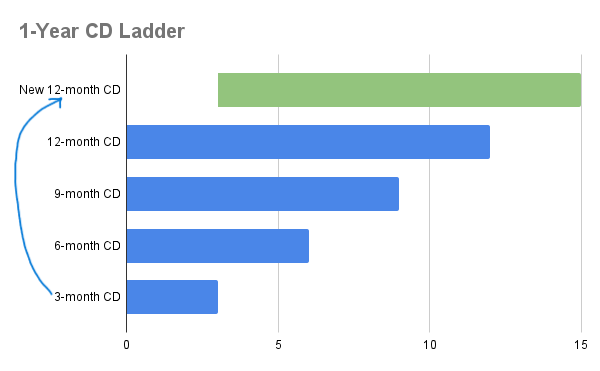

1-Year CD Ladder Example

A one-year CD ladder operates similarly to other CD ladders but utilizes short-term CDs. These are also known as mini CD ladders. This approach allows you to access your funds more quickly, usually every three months. A one-year CD ladder usually has only four rungs, consisting of a 3-month, a 6-month, a 9-month CD, and a 12-month CD. You can withdraw the original principal and interest as each CD matures or roll it over into a new 12-month CD. Here is what a 1-year CD ladder can look like if you want to invest the same $5,000.

1st CD: $1,250 in a 3-month CD

2nd CD: $1,250 in a 6-month CD

3rd CD: $1,250 in a 9-month CD

4th CD: $1,250 in a 12-month CD

If you opt for a short-term CD ladder, you’ll have more flexibility with your funds than with a longer one. A 1-year CD ladder enables you to react promptly to changes in interest rates. For instance, if they go up, you’ll only have to wait three months before transferring some of your funds to higher-earning CDs. If they go down, you can choose to withdraw your cash every three months and invest it in securities that offer a better rate of return. However, keep in mind that you won’t be securing the interest rates for a longer period like you would with a 5-year CD ladder.

Where Do You Buy CDs to Build a CD Ladder?

Many banks offer CDs. If they offer good rates, you can consider working with your bank to set up a CD ladder. Or you can build your CD ladder by purchasing CDs from different institutions, though tracking each CD can make it difficult. Another option is to use low-cost brokerage companies like Fidelity, Vanguard, or Charles Schwab. These low-cost brokers can make it easy to build CD ladders.

For example, Fidelity offers a variety of preset CD ladder strategies that range from 1-year to 5-year options. Fidelity gives you the option to have the money deposited into your account as each CD matures or have it automatically rolled over into a new CD. Additionally, Fidelity provides the flexibility to personalize your CD ladder. You can select CDs from various banks, with differing interest rates and terms starting as short as one month.

Regardless of your route, it is important to remember that there is typically a minimum deposit requirement. You also need to be mindful of FDIC insurance. Make sure your CDs are FDIC insured.

Pros of CD Ladders

One advantage of investing in certificates of deposits is that they usually offer a higher interest rate compared to a savings or money market account. Despite a decreased level of liquidity, you receive a higher return on your investment. By agreeing to keep your money with the bank for a specified period of time, they in turn pay you a higher interest rate to compensate you for your loss of liquidity.

A CD ladder is a useful strategy because it allows you to take advantage of the higher fixed interest rates that CDs offer over a longer time frame while maintaining some flexibility. When a CD matures, you get to decide to either cash it out or keep the CD ladder fully intact by reinvesting the money into a new CD. A CD ladder provides interest rate stability with increased flexibility and liquidity.

Cons Of CD Ladders

While CD Ladders have their advantages, they also have certain drawbacks that should be taken into consideration. For instance, the fixed interest rate locks your money up for a considerable period of time. this may not be a disadvantage if the interest rates are higher. However, It can become problematic for those who create a CD ladder when rates are lower.

Locked into an interest rate for better or worse

Just a short while ago, receiving a 1% return on a 1-year or more CD from an online bank was considered satisfactory. Today, CD rates can exceed 4%. If you had established a 5-year CD ladder in 2021, three of your five CDs would still be locked in at the lower rate, awaiting maturity. Although you could move the maturing CDs into a new CD with higher rates, most of your money in the CD ladder remains locked in at the lower rate.

May Not Keep Pace With Inflation

It is possible that the rate offered by CDs might not meet or exceed the inflation rate. This is something to keep in mind if you plan on investing in CDs or setting up a CD ladder. It’s important to have a clear goal in mind for your money. CDs may be a good option if you’re looking to create a CD ladder for funds that won’t be needed in the near future and would otherwise be held in a savings account. However, exploring other investment opportunities may be more beneficial if your goal is to outpace inflation and build wealth.

Liquidity Risk And Early Withdrawal Fees

In some cases, a lack of access to your funds can pose a challenge. If you encounter an unforeseen circumstance or require the funds for a significant expenditure, withdrawing them can be complicated. You may also incur hefty fees and penalties. You could be subject to penalties equivalent to days or months’ worth of interest. For instance, if you opt to withdraw cash prematurely from a 5-year CD, you may be charged a penalty of 12 months of interest.

Need to Keep Track of CDs and Maturity Dates

With CD ladders, it’s super important to stay organized and keep track of all your CDs and when they mature. If you miss the deadline for withdrawing your cash, you could end up paying early withdrawal fees and penalties. This can be a real headache if you’ve got CDs from a bunch of different banks or credit unions. So, if you choose to build a CD ladder, stay on top of the maturity dates. You want to make sure you can get your hands on your money when you need it most without penalties.

I know I have listed a lot of negatives but Investing in a CD ladder has been a topic lately. This is due to the rise in interest rates. While I don’t want to discourage you from considering a CD ladder, being aware of its drawbacks is crucial.

Alternatives to A CD Ladder

If having access to your savings funds is your top priority, a high-yield savings account can be a suitable alternative to a CD ladder. Although the interest rate may not be as high, you have the freedom to withdraw your money whenever you need it. It’s important to keep in mind that interest rates on high-yield savings accounts will fluctuate regularly. If keeping up with inflation is your main goal with your savings then I Bonds might be a better place to put your money.

I Bonds are a type of investment that is specifically designed to keep up with inflation. The interest rates for these bonds are set twice a year. It’s important to note that you cannot withdraw your funds during the first 12 months. Also, withdrawing your money before the 5-year mark will result in a 3-month interest penalty. But, after the first year, the penalty for early withdrawal is always the last 3 months of interest.

If you’re seeking to achieve growth and are willing to take on some level of risk, investing in the market may be a viable option. However, it’s important to exercise caution and invest in high-quality securities. A wise choice would be a low-cost index fund or ETF that tracks the overall market’s performance. Just don’t get pulled into speculative stocks hoping to get rich quickly.

Should You Invest In CD Ladders?

What did I decide? I am still weighing the decision to establish a CD ladder. If I do, I am leaning toward a 1-year CD ladder if CD rates stay consistent in the coming months. This strategy would enable me to have access to my funds every three months, increasing liquidity. A 1-year CD ladder would allow me to strike a balance between earning higher savings rates while reducing my concerns about liquidity risk. Liquidity risk is one of several reasons to ensure you diversify your accounts.

Personally, CD interest rates would need to get closer to 8% or more before I would consider a CD ladder that is over one year long. I do not want to have my money locked up for a long period of time with access to only a portion of it annually unless those rates are closer to the historical rate of return of the S&P 500.

Everyone’s financial situation is unique, so what may be good for me may not be good for someone else. As with any financial decision, assessing your financial goals and situation is important before committing to a CD ladder. If you’re uncertain, consulting with a financial advisor is recommended.

I hope you found this article on CD ladders informative.

Until the next post, good luck on your money journey!