In this post, we will discuss the rise of Nvidia and the challenges of determining when to sell.

Disclosure: This post may contain affiliate links, meaning we earn a commission on purchases made through those links at no extra cost to you. As an Amazon Associate, I earn from qualifying purchases.

Disclaimer: The content on this site is for informational and educational purposes only and does not constitute financial, investment, legal, tax, or any other professional advice and should not be used as a substitute for professional advice. For more details, read our full Disclaimer.

Nvidia Has Me Freaking Out

I must confess my purchase of Nvidia stock was a pure stroke of luck. I’m not an expert in stock trading, and my stock selections yield mixed results at best. I don’t spend hours analyzing stock charts trying to become the next Warren Buffet. Though I enjoy investing in individual stocks, my primary investment strategy involves low-cost index funds like the S&P 500 index fund.

So, when I stumbled upon Nvidia in 2022, it was dumb luck. Now, I am freaking out as Nvidia’s stock is skyrocketing, reaching new highs almost every day. I do not know what to do. I lived through the dot-com bubble, and I am fearful we are in an Artificial Intelligence (AI) bubble. Will Nvidia crash and burn like Cisco during the dot-com crash, or will it maintain its lead role in chips and become more like Amazon?

I don’t know, and that has me nervous as hell. I bought Nvidia before AI became the talk of the town. Nowhere in my wildest dreams did I believe I was investing in a stock that would become one of the hottest stocks in over 20 years. As such, I have never been in this position before.

What do I do? Do I hold? Do I sell some of my position and lock in big gains? I honestly do not know, and it has me freaking out. Make no mistake, it is a good problem to have, but if Nvidia is overpriced and the bubble bursts, I can be right back where I started, or worse.

This is a living, breathing lesson on stock picking that I have never experienced before. The funny thing is that I am in this situation by doing something I strongly advocate against.

Timing But Not Timing The Market

In early 2022, I did something I do not recommend: timing the market. I was not trying to time the market in the true sense of the approach. Instead, I saw inflation rising, and after twenty-plus years of investing, I knew stocks were ready for a correction. In particular, I felt tech stocks would be hammered by high inflation, creating a buying opportunity (and they did).

This was not a massive restructuring of my portfolio, as I love low-cost index funds for most of my investments. I also believe in investing regularly in good times and bad times and focusing on a buy-and-hold strategy. So, there is no way I am trying to time the market with my S&P 500 index fund.

Instead, I decided it was a good opportunity to lock in some gains and dump some investments I was not so keen on. This would free up cash to buy shares when the inflation panic was in full swing. Why? I love a bargain, and there is no better time to buy than when stocks are down and on sale.

To be clear, after years of investing, I know my limitations, and investing in individual stocks is one of them. I know trying to beat the market is a fool’s errand. This is why I love investing in low-cost index funds that track the broader stock and bond markets.

However, that doesn’t mean I don’t like trying to beat the market or that I do not hold individual stocks. The key is that I do so with only a tiny portion of my portfolio, and I have also established a “play fund” to feed my hunger.

What is a “Play Fund”?

A “play fund” or “play money” is a designated amount of money that allows you to take significant risks without jeopardizing your financial well-being. It is money you can afford to lose. I like having a play fund because it satisfies my urge to beat the market without destroying my financial future.

Some people set aside a certain amount of play money based on a percentage of their portfolio or treat it like a hobby they budget for yearly. The key point is that a play fund or play money helps to safely satisfy one’s appetite for risk-taking without the risk of financial ruin.

Selling My Way to Nvidia

By the start of 2022, my play fund was comprised mainly of tech stocks, having pivoted into them during the COVID-19 pandemic. I was convinced tech stocks would suffer in 2022 due to inflation, so I was determined to sell them and repurchase them later at a discounted rate.

I sold off stocks in companies like Apple, Meta, and Alphabet and money in a NASDAQ index fund. What did I do after selling? Nothing. I was not in a rush to buy, and Nvidia wasn’t registering anywhere on my radar. Besides, I had two stock splits I was eying.

Alphabet (GOOGL) and Amazon (AMZN) announced stock splits that would occur in June and July of 2022. I was not going to pass them up and guessed that inflation would have wreaked most of its damage by then. I was fine waiting. My settled cash was earning around 4%, while I sat,

While sitting back and waiting for the stock splits, I found an article on Nvidia that changed everything.

Again, I do not encourage timing the market. Things can go wrong when you do. I know this, so I kept these stock moves small, below 5% of my portfolio. In other words, over 95% of my investments remained as is.

I can not stress enough that, in my twenty-plus years of investing, I have never stopped my automated investing or altered my buy-and-hold strategy—not during the Great Recession or the COVID-19 pandemic. As Charlie Munger said, “The first rule of compounding is to never interrupt it unnecessarily.”

Why did I buy Nvidia?

Down But Not Out

When I stumbled across Nvidia, it was down in the dumps, and the AI revolution was nowhere in sight. To say 2022 was an awful year for Nvidia is an understatement. It was down over 50% from its high in 2021, and I smelled a bargain.

To put it in perspective, Nvidia peaked at over $300 per share in 2021, and by October 2022, it was trading near $100 per share. That is a massive decline in stock price. Was this decline warranted? Over the next several months, I set out to answer that question.

My research led me to believe that the sell-off was overdone and that buying into Nvidia was an unbelievable opportunity. So, in September 2022, after months of observing Nvidia, I decided to buy. My investment goal with Nvidia was not to get rich quickly. Instead, it was based on my confidence in Nvidia’s long-term potential.

I believed in Nvidia’s long-term potential to the point that I purchased more shares in early 2023 outside of my play fund. However, I want to make it clear that I did not invest huge amounts of my portfolio in Nvidia. I don’t want to mislead anyone about my ability to choose stocks or make it sound more glamorous than it is.

The reality is that stock picking is risky, and I lose more often than I win. So, I prefer to invest most of my money in either a low-cost S&P 500 Index fund or a Total Market index fund when investing in the stock market. These types of funds provide instant diversification among stocks through a single fund. Owning one of these index funds also means gaining exposure to Nvidia, along with hundreds to thousands of other companies.

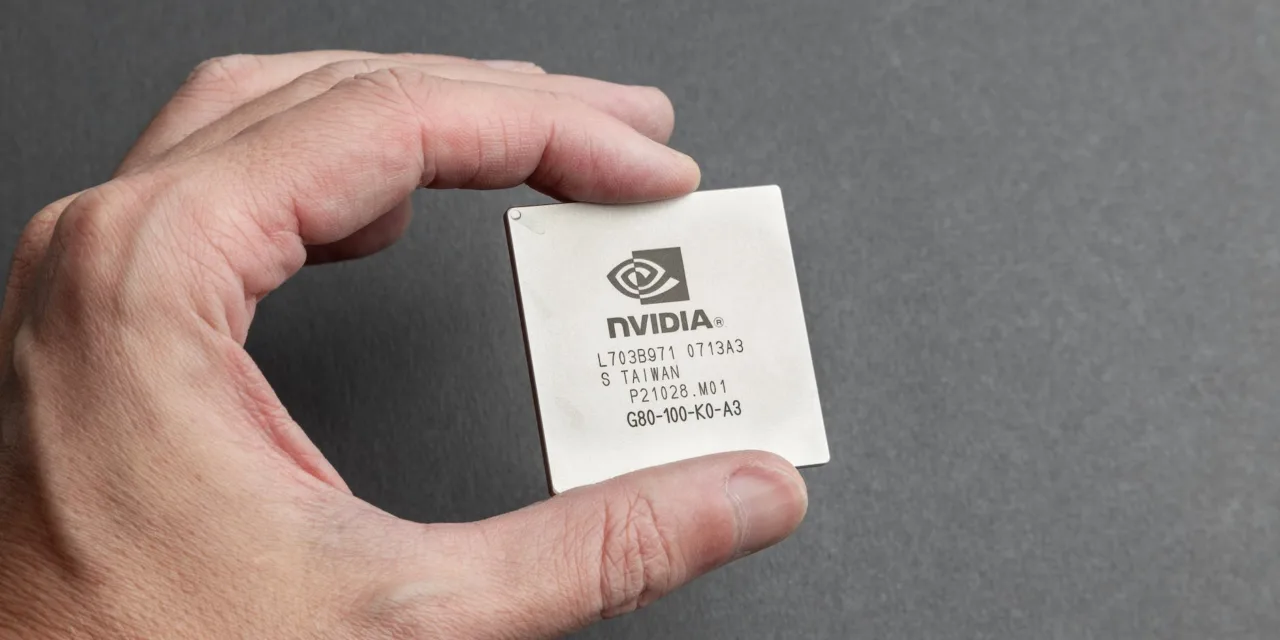

Nvidia: The King of GPUs

You might wonder why I felt so good about investing in Nvidia. The answer is three words: Graphics Processing Units.

Graphics Processing Units or GPUs are specialized electronic circuits designed to process and manage complex graphics and images on your computer. A GPU is optimized specifically for tasks related to graphics processing, such as 3D rendering, video editing, and gaming.

Nvidia is the market leader in graphics processing units. It isn’t even close. Their GPUs are considered the gold standard, and depending on the article you read, Nvidia holds anywhere from 80 to 98% of the market. Nvidia’s massive market share in GPUs means it has a sizeable moat.

In other words, it will take time for the competition to catch up, if ever. Moreover, Nvidia was still turning profits even as its stock price bottomed in 2022. Both of these facts made Nvidia’s stock attractive.

I am also well aware that the semiconductor industry is notoriously cyclical. It is known for its booms and busts. In 2022, the semiconductor sector was in a doozy of a down cycle fueled by high inflation. All this together convinced me it was an excellent time to buy Nvidia.

Then, ChatGPT came roaring onto the scene in late 2022, ushering in the Artificial Intelligence Revolution. This is when things got interesting, and the funny thing is I never saw it coming.

The AI Revolution

To say things got crazy fast when ChatGPT showed up on the scene is an understatement. Since then, everyone and anyone has become cuckoo for artificial intelligence (AI), and Nvidia has found itself at the number one position. More specifically, Nvidia offers the best-in-class tools to help companies achieve their AI goals.

It turns out Nvidia’s powerful GPUs are excellent for generative AI. Without graphics processing units (GPUs), there is no AI. This puts Nvidia and its GPUs at the top of the AI food chain for any company trying to implement AI into their processes. Sure, there is competition from other chip makers like Advanced Micro Dynamics and Intel, but they are playing catchup.

As the competition tries to dethrone Nvidia, companies are tripping over each other, trying to get their hands on Nvidia’s superior GPUs. This is fueling demand like never before and increasing Nvidia’s revenue at a blistering pace. As of February 2024, Nvidia’s year-over-year revenue growth was an impressive 265%, reflecting the company’s remarkable growth.

This revenue growth, along with the artificial intelligence hysteria, has propelled Nvidia to new heights. Nvidia stock returned 239% in 2023 and is up a staggering 64% in the first two months of 2024. At the start of 2024, Nvidia has risen an eye-watering 600% since its lows in October 2022!

All this sounds pretty awesome, and it is, but things are starting to smell a lot like the dot-com bubble. I know because I lived through it. The dot-com bubble took place in my early 20s and shaped how I invest.

This similarity between the Artificial Intelligence (AI) craze and the dot-com bubble is starting to scare the crap out of me.

Are We In An Artificial Intelligence (AI) Bubble?

What is happening with AI is eerily reminiscent of the dot-com bubble. Back then, the internet was the new transformative technology that was going to change our lives, and it did. The internet has revolutionized all aspects of our lives, from communicating and shopping to investing and saving.

The problem with the dot-com bubble came when retail investors became retail speculators, bidding up share prices on any company loosely associated with the Internet. It did not matter if the company was making money or not—what mattered was getting rich quickly.

Usually, when retail investors (speculators) jump on the moving train in hordes, it is when it is about to crash. That is what happened during the dot-com bubble.

Fast forward to today, and I am starting to see the same situation unfolding. It seems any company with any association with artificial intelligence, big or small, is gaining outsized share price. It does not matter if their earnings warrant it or not. Everyone is trying to get rich as quickly as possible, and the fear of missing out is pushing AI into bubble territory.

Is Nvidia’s Stock Too Expensive?

I am getting anxious about Nvidia because I have never been in this situation before. There is no doubt that Nvidia’s earnings have warranted a higher stock price. That’s what happens when you are growing revenues at triple digits. However, there is a lot of speculation driving up its share price as FOMO sets in for many retail investors.

You can see this in Nvidia’s price-to-earnings ratio, or P/E. Nvidia’s P/E is currently high, and before its latest earnings, it was above 100. This means that Nvidia was trading at 100 times its earnings per share.

To put that number in perspective, a good P/E for the broader market is considered to be 15 or below, or 15 times a company’s earnings. A good P/E for a growing tech company like Nvidia would be in the 30-ish range. So, as you can see, Nvidia’s stock is priced at a premium. The good news is that number is coming down.

After reporting revenue growth of 265%, the P/E ratio dropped to 69. Therefore, if Nvidia continues to achieve triple-digit revenue growth over the next year, it is reasonable to expect a further drop in its P/E ratio to the 30s. This is not an unrealistic P/E for a thriving tech company.

Luck and Emotion

Investing is emotional. It can be hard to separate your emotions from the numbers. This becomes much more challenging when you hold one of the hottest stocks in decades. The ride can be exhilarating, leading you to make decisions more on emotion than facts.

Investing also involves some level of luck, primarily when investing in individual stocks. When you hold a hot stock, it can be easy to confuse luck with expertise. I have invested in individual stocks long enough to know I got lucky with Nvidia. It was dumb luck.

This is why it is so important to have a diversified portfolio. Having a diversified investment strategy and sticking to it means that my financial future is not tied to Nvidia’s stock performance or luck. Nvidia can go bankrupt, and it would not significantly impact my finances. I remind myself of this fact when I get anxious about Nvidia.

Putting It All Together: Should I Buy, Hold or Sell?

The rapid gain in Nvidia’s stock price means I am no longer playing with chump change, and my play fund has morphed into a real account. The bottom line is that I cannot ignore the gains and emotions of investing in Nvidia.

So, should I buy, hold, or sell?

After much deliberation, I am going to hold. I bought into Nvidia when it was down, believing in its long-term potential. Its triple-digit revenue growth over the last three quarters shows its critical role in AI and complex computing. Of course, there will be competition nibbling at its earnings, but I cannot see a situation where Nvidia loses its top position in GPUs in the near term.

I know that fear leads to bad investment decisions. The fact is, I bought shares in Nvidia when they were way down. If tomorrow, Nvidia crashes and loses 50% to 60% of its share value, I will still be ahead. Therefore, I can weather the storms that may come with my Nvidia investment and maintain my long-term investment approach.

Instead of freaking out about Nvidia, I need to remind myself that I am taking a calculated risk on Nvidia. I am not trying to become rich overnight on the back of Nvidia. That is not how I invest. I believe in slowly and steadily building wealth using index funds and a buy-and-hold strategy.

Nothing about my position in Nvidia changes my broader approach to investing.

Best of luck on your financial journey. See you next time!