In this post, we will review Opendoor and meme stocks, but first, our disclosure:

Disclosure: This post may contain affiliate links, meaning we earn a commission on purchases made through those links at no extra cost to you. As an Amazon Associate, I earn from qualifying purchases.

Disclaimer: The content on this site is for informational and educational purposes only and does not constitute financial, investment, legal, tax, or any other professional advice and should not be used as a substitute for professional advice. For more details, read our full Disclaimer.

Key Information to Know About Opendoor:

- Opendoor Technologies is a real estate company that utilizes AI and software to provide instant offers to home sellers through a process known as “iBuying” or “Instant Buying.”

- As a leader in iBuying, Opendoor makes “instant” cash offers on homes and seeks to flip them quickly for a profit.

- Opendoor has struggled with its “iBuying” business model and has been losing money since going public in 2020, driving down its stock price.

- Opendoor’s challenges and potential have caught the attention of EMJ Capital’s hedge fund manager Eric Jackson, who believes the stock price could increase over 100 times under the right leadership.

- Eric Jackson is famous for calling Carvana before its stock rebounded nearly 7,000%. As such, his call for Opendoor to reach $82 per share has attracted the attention of the retail investor community.

- The rush of retail investors into Opendoor has led many to label it a meme stock, similar to Gamestop (GME). However, Eric Jackson argues it is a “cult” stock that more closely resembles Palantir and Tesla in their early years.

- Investing in meme and cult stocks involves significant risks, including the potential for total loss. Invest at your own risk.

Opendoor: Let The Battle Begin?

On the surface, Opendoor Technologies (NASDAQ: OPEN) is a bold real estate tech company aiming to disrupt the way homes are bought and sold. But beneath the surface, its stock trades more on internet buzz than fundamentals.

Opendoor highlights the battle between meme stocks and cult stocks. It has become the main attraction in the online reality show known as social media, thanks to EMJ Capital hedge fund manager Eric Jackson.

Eric Jackson is famous for calling Carvana’s turnaround before its stock skyrocketed. Now, he is turning his attention to Opendoor, believing that its stock price could potentially rise over one hundredfold in the next few years to $82 per share.

Eric Jackson views Opendoor as more than just a passing meme stock; he considers it a cult stock with lasting potential, provided the right conditions are met. He highlights its innovative, artificial intelligence-driven approach to homebuying as a game changer in the industry, often calling it the future Amazon of real estate.

Is Opendoor a cult stock driven by innovation whose time is yet to come, or just a passing trend like other meme stocks that have come before it? In this post, we will attempt to answer this question. Along the way, we will address the challenges Opendoor faces in its quest to revolutionize how people buy and sell homes.

Regardless of what we discover, one thing is certain: investing in meme and cult stocks carries a high level of risk. If you are interested in investing in Opendoor, please do your research and invest at your own risk.

What Is A Meme Stock?

A “meme stock” is typically a beaten-down stock that suddenly gains popularity among retail investors on social media platforms like Reddit and Twitter. The surge in interest leads to a significant increase in its stock price. In most cases, the company’s financial health does not support the rapid rise of the stock, ultimately leading to a crash in the meme stock’s price.

Another way to understand a meme stock is to think of it as a stock that goes viral. It sees a huge spike in attention, enjoying its brief fame before fading back into obscurity. Typically, this results in a classic pump-and-dump scenario, where a group of individuals hype up a stock and then sell off, leaving other investors with losses.

Taking Advantage Of Short Positions

For many meme stock investors, the focus is less about the company’s potential and more about trying to exploit the system to make a quick profit. This is why investing in meme stocks can be extremely risky. Meme stocks can surge quickly and then plummet just as fast. If you’re late to the game, you might end up facing significant losses.

Retail investor groups on social media often find companies where hedge funds have large short positions. Hedge funds take short positions when they believe a stock price will drop.

Retail investors try to create a short squeeze with the meme stock by pumping up the price. The rapidly rising stock price prompts hedge funds that have shorted the stock to repurchase shares, covering their losses and forcing the stock price even higher.

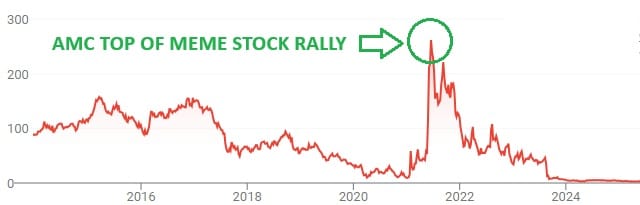

Well-known examples of meme stocks include GameStop and AMC. Both experienced rapid increases in their stock prices due to social media, only to crash back down to earth.

AMC: The Ultimate Meme Stock

AMC is a picture-perfect example of a meme stock. It owns and operates movie theaters, which have been struggling against online streaming services. The stock gained popularity among retail investors not because of impressive earnings—those were actually quite poor—but because it was priced low and had a high level of short interest.

Below is a chart of AMC’s stock price from 2013 to 2025. It begins with a prolonged downward trend from 2013 to 2021, followed by an epic meme stock rally in 2021. However, the rally is short-lived and is quickly followed by a massive crash. This pattern is why meme stock rallies are often referred to as pump-and-dump schemes.

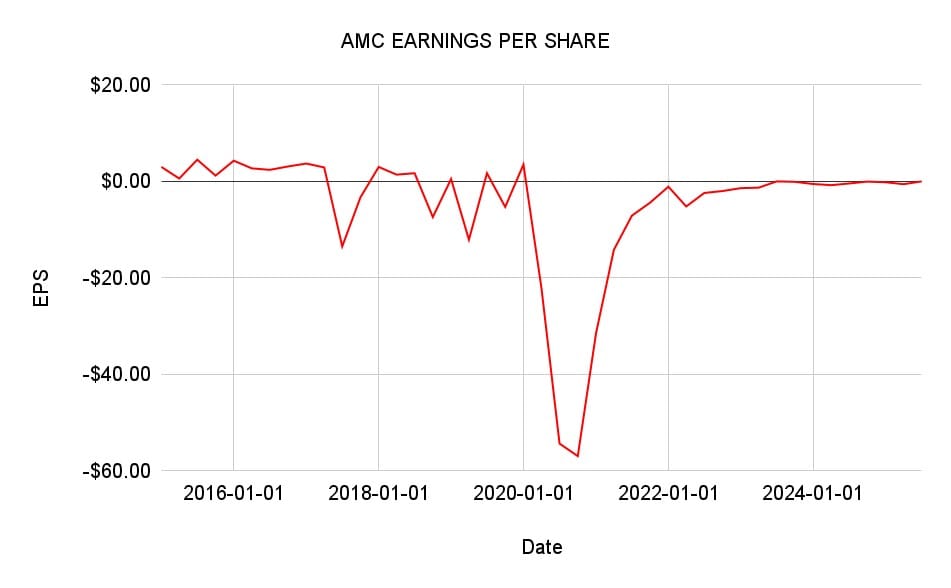

The issue is that AMC’s earnings never supported such a significant stock rally, in which the company’s share price went from around $10 to over $200 per share in a matter of months. While AMC’s stock price was rallying, its earnings were tanking, as illustrated in the chart below. What wasn’t tanking was retail interest, driving the stock up and squeezing the shorts.

Now that we understand what a meme stock looks like, let’s take a closer look at Opendoor and examine why many consider it a meme stock.

What Is Opendoor?

Opendoor Technologies (NASDAQ: OPEN) is a real estate company that leverages artificial intelligence and an online platform to offer instant cash offers to home sellers. Once it acquires a property, the company performs minor repairs before selling it. This innovative approach to homebuying is known as “iBuying” or “Instant Buying,” and Opendoor is widely recognized as a leader in the iBuying industry.

How Opendoor iBuying Works

A potential home seller visiting Opendoor’s website can enter their home address to receive a cash offer. After entering their address, they’ll answer questions about their home and their timeframe for selling. Opendoor will inquire about the property’s square footage and condition through a simple point-and-click interface.

Once all the questions have been answered, Opendoor will provide the seller with an estimated offer. They will finalize this offer after the seller submits videos of the property or conducts a live walkthrough.

Based on the condition of the house, Opendoor will then adjust the final offer, which they refer to as a “Condition Adjustment.” The seller will also have to pay a commission fee and closing costs. There is no getting around those!

Why Would Someone Use Opendoor?

A seller using Opendoor might not receive the highest price for their home compared to using a real estate agent. Conversely, a homebuyer might not secure the best deal. So why would someone choose Opendoor?

Selling a home takes time and effort. First, a seller needs to find a real estate agent and prepare their home for showings. This often means staging the home and hosting open houses. Sellers also have to manage the demands of homebuyers and hope that buyers can secure a mortgage. Using Opendoor can help avoid many of these pain points.

Conversely, Opendoor allows potential buyers to tour homes at their convenience and unlock doors with their phones. They also claim that homebuyers can avoid bidding wars while saving thousands on the listing price.

While these claims sound great, the reality is that Opendoor has struggled to grow revenue and turn a profit. The lack of profits and recent retail interest lead us to ask: Is Opendoor a meme stock?

Is Opendoor A Meme Stock?

Opendoor checks a lot of the boxes of a meme stock, including:

- Surge in retail investor Interest and growing social media hype: Opendoor has seen a surge in retail interest from people on social media who call themselves the “Open Army.” The movement is spearheaded by Eric Jackson, who is famous for calling Carvana’s turnaround.

- Spike in stock price over a short period: The increase in retail interest caused Opendoor’s stock to rise from just over $0.50 per share to nearly $6 per share between July and August 2025, before it gave back some of those gains.

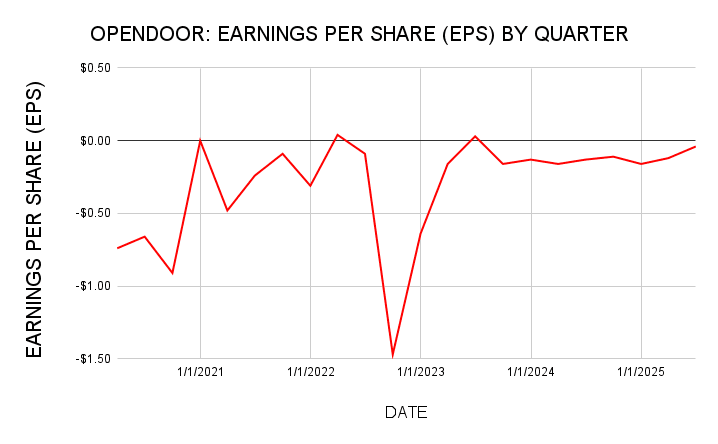

- Negative Earnings: Opendoor’s spike in price comes despite poor earnings. As of Q2 2025, Opendoor has reported negative earnings per share in almost every quarter since its initial public offering in 2020.

- High trading volume: As of September 2025, Opendoor’s trading volume is among the highest in the market.

- High short interest: Short positions make up almost 25% of the outstanding shares as of September 2025

Based on these metrics, it appears that Opendoor is a meme stock. However, the Open Army, led by Eric Jackson, would say otherwise. Instead, they argue it is a “cult stock.”

What Is A Cult Stock?

A cult stock refers to a stock that has a dedicated and passionate following among investors. The enthusiasm surrounding cult stocks can persist for years, unlike the more volatile and short-lived rise and fall of meme stocks.

Those who invest in a cult stock often hold a long-term belief in the company’s mission and success. Although the company may not yet have strong fundamentals, investors have a strong conviction that it will in the future. In many cases, investors in a cult stock may be investing more in the leader than in the company itself.

Some great examples of cult stocks and their leaders include Apple under Steve Jobs and Tesla under Elon Musk. A more recent example is Palantir, under the leadership of Alex Karp. Compare these companies with the meme stocks GameStop and AMC, and you get a good idea of the difference between a cult stock and a meme stock.

Apple, Tesla, and Palantir are innovative companies that invested considerable time and money before becoming profitable. GameStop and AMC are brick-and-mortar stores that have seen their revenues decline in the face of newer, disruptive technologies.

Is Opendoor A Cult Stock?

EMJ Capital’s Eric Jackson and the Open Army certainly consider OpenDoor a cult stock. They highlight several reasons for their case for cult stock status, including:

- Cult-like following: Opendoor has a dedicated following, known as the “Open Army,” worldwide. These retail investors genuinely believe in the company’s mission and want it to succeed.

- Activist Retail Investors: The “Open Army” is using its collective power to elicit change, starting at the CEO level.

- Disrupter/Innovator: Opendoor is challenging the status quo in buying and selling houses with its AI-driven iBuying model.

- Large Addressable Market: The real estate market is valued in the trillions of dollars. Capturing even a small percentage of this market can generate substantial revenue and profits.

- Reducing losses: Opendoor’s earnings remain negative, but the company has been reducing its losses since late 2022. If it can maintain this trend over the next few quarters, then it may finally transition into the profit category.

Eric Jackson believes that with the right leadership, Opendoor can increase its stock value a hundredfold over the next few years. He envisions Opendoor becoming the Amazon of the homebuying industry; however, there are numerous challenges that could slow its progress or halt it altogether

Challenges Facing Opendoor

Eric Jackson and the retail “Open Army” may consider Opendoor a cult stock, but the company has a lot of work to do if it hopes to become the next Amazon of the homebuying industry. Merely reducing its losses is not good enough. Opendoor needs to find a path toward long-term profitability and growth. The journey will be challenging, as Opendoor faces numerous obstacles. Let’s break them down now.

Lack Of Leadership

Eric Jackson and the Open Army launched a pressure campaign on X to oust CEO Carrie Wheeler.

Wheeler became CEO in 2022 during a time when interest and mortgage rates were rising. Under her leadership, the company was able to mitigate some of its losses, but its stock price continued to decline until Eric Jackson’s online campaign gained traction. After ousting Wheeler, the Open Army turned its attention to the board of directors.

Eric Jackson and retail investors are pushing for one of Opendoor’s founders, Keith Rabois, to return to the board or even take on the role of CEO. Who becomes the next CEO is crucial for the company’s turnaround. If they make the wrong decision, any momentum Opendoor’s stock has gained could vanish.

Jack of All Housing Markets

Trying to buy, repair, and sell homes in all fifty states is no easy task. AI and data-driven software are going to have their limitations. You will not have intimate knowledge of every housing market or know the best contractors to work with. This can result in purchasing and selling homes at incorrect price points, ultimately leading to losses on home sales.

High Debt Burden

The real estate industry isn’t cheap. It is extremely capital-intensive. It requires a substantial amount of money to acquire, renovate, and sell properties. Real estate companies often fund these activities through debt (leverage), and Opendoor is no exception.

The company holds over $2 billion in total debt based on Opendoor’s second-quarter 2025 financial results. This debt load can become a major burden, especially if their revenue does not increase, leading us to the next challenge Opendoor faces.

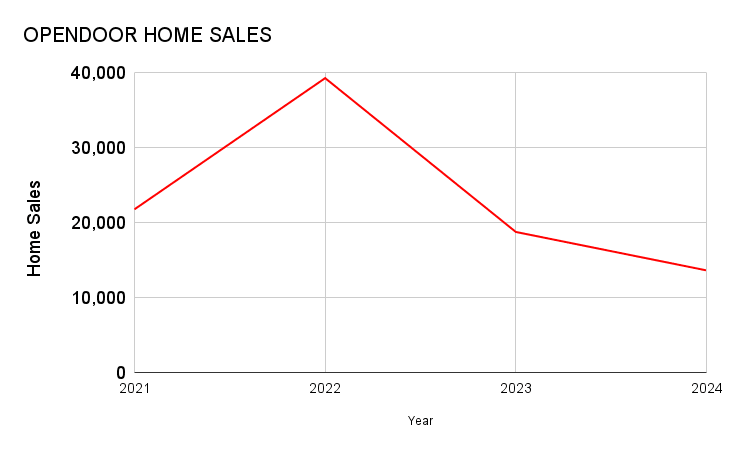

Declining Home Sales

Opendoor has experienced a significant decline in home sales since peaking in 2022, when it sold 39,183 homes. Between 2022 and 2024, the company saw a 65% drop in sales, resulting in only 13,593 homes being sold in 2024. This trend is concerning for a business focused on buying and selling homes. However, it’s important to note that Opendoor’s decline in home sales reflects the broader national trend, so it is not entirely indicative of flaws in its business model.

Shrinking Revenue

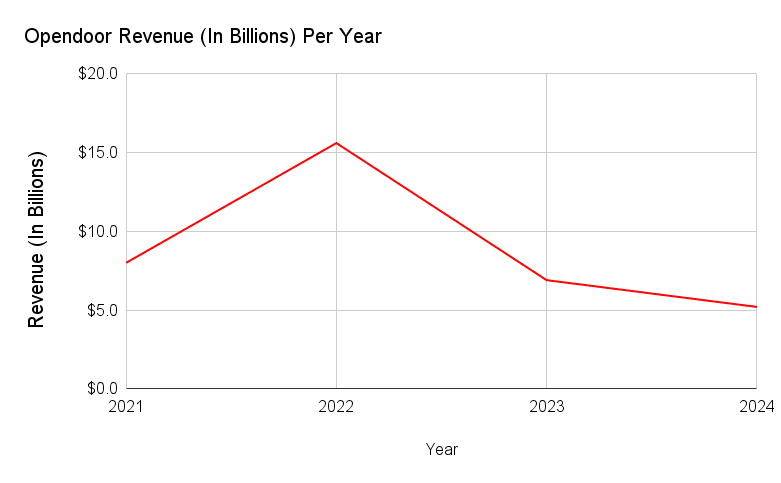

Not surprisingly, the chart below of Opendoor’s revenue looks almost identical to the chart of its home sales. In short, how its home sales go, its revenue goes.

Opendoor started strong after going public, generating $8 billion in revenue in 2021 and nearly doubling that figure to $15.6 billion in 2022. However, rising mortgage rates and the resulting slowdown in home sales took a toll on the company, causing its revenue to decline to $6.9 billion in 2023 and further down to $5.2 billion in 2024. The result is a 67% decline in revenue from 2022 to the end of 2024.

Looking ahead, 2025 doesn’t appear to be any better, as the revenue in the first two quarters of 2025 has been nearly identical to the revenue in the first two quarters of 2024.

Interest and Mortgage Rates

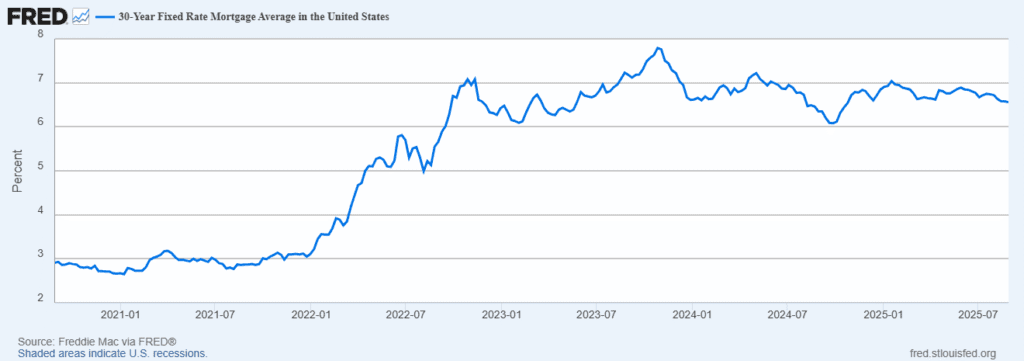

Probably the biggest obstacle for Opendoor is interest and mortgage rates. They have hammered the company’s home sales and revenue.

The chart below shows the average 30-year fixed-rate mortgage in the United States, as reported by the Federal Reserve Bank of St. Louis. It is almost the exact inverse of Opendoor’s charts of home sales and revenue. As mortgage rates increased, Opendoor’s revenue declined.

What Opendoor needs to hope for now is lower rates. Lower mortgage rates might lead to a pickup in home sales. At the same time, lower interest rates mean lower borrowing costs on Opendoor’s debt.

Lack of Profits

The chart below illustrates Opendoor’s earnings per share since 2020. The significant drop in late 2022 coincides with the sharp increase in interest and mortgage rates. Since then, Opendoor has been reducing its losses despite lower revenue and home sales, giving a glimmer of hope. The question now is whether the company can continue this trend and eventually turn a consistent profit.

Conclusion: Is Opendoor A Meme Stock Or A Cult Stock?

Whether someone views Opendoor as a meme stock or a cult stock largely depends on their perspective, and ultimately, only time will tell.

Those who view Opendoor’s artificial intelligence-driven iBuying as a disruptive and innovative technology are likely to see it as a cult stock. On the other hand, someone who considers it a failed business model may view the company as a meme stock.

Being innovative does not guarantee a company’s success. For Opendoor to thrive, it must tackle several challenges, beginning with its leadership. In the end, Opendoor needs to sell more homes and ensure that these homes are priced to generate profits rather than losses.

In the end, innovation must drive revenue growth and profits for a company to succeed. Without these, Opendoor risks becoming just another overhyped meme stock.