This post will explore the simple yet powerful money rule known as the Rule of 72. But first, our disclaimer:

Disclosure: This post may contain affiliate links, meaning we earn a commission on purchases made through those links at no extra cost to you. As an Amazon Associate, I earn from qualifying purchases.

Disclaimer: The content on this site is for informational and educational purposes only and does not constitute financial, investment, legal, tax, or any other professional advice and should not be used as a substitute for professional advice. For more details, read our full Disclaimer.

What is the Rule of 72?

The Rule of 72 is a simple formula for estimating how long it takes for an investment to double in value at a specific interest rate. It allows you to see the impact of compounding on your investments in the easiest way possible.

To apply the Rule of 72, divide 72 by the annual rate of return to estimate the number of years required for an investment to double. There is no complex math involved, just basic division.

For all you math lovers out there, the Rule of 72 formula looks like this:

72 ÷ Rate of return = Number of years it takes for investment to double

For example, if you have an investment averaging 8% returns each year, your investment will double in 9 years. Here is what the calculation looks like:

72 ÷ 8 = 9 years

You can also work the formula in reverse to calculate the interest rate needed to double your money within a specific time frame. Here is the formula:

72 ÷ Number of years until investment doubles = Rate of return

For instance, imagine you are trying to determine the rate of return that will ensure that you invest in an investment that doubles every ten years or less. Using the Rule of 72, you calculate that you need an annual rate of return of 7.2% or more to accomplish this goal.

72 ÷ 10 Years = 7.2

Easy peasy, right? Who doesn’t love simple math?!

Benefits of the Rule Of 72

The biggest benefit of the Rule of 72 is that it allows you to deduce the complexity of compounding into a simple-to-use formula. With it, you can easily compare potential returns between different investments at different interest rates. You do it on the fly using your head or the calculator on your phone.

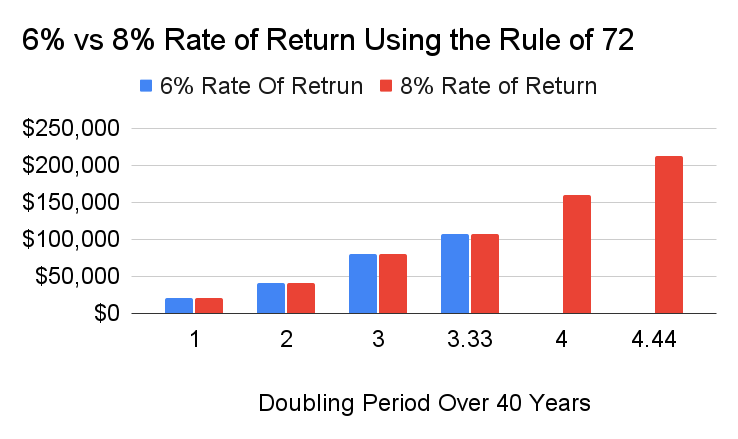

Suppose you’re 27 years old and have $10,000 to invest for retirement in 40 years. You’re choosing between two investments. One option averages an 8% annual return but is volatile, so there is no guarantee it will continue to do so. While the other gives a more stable 6% return. You can use the Rule of 72 to quickly estimate how often each will double and determine if taking on more risk for a potentially higher reward is worth it.

Even though you can do the math in your head, you don’t want to take chances. Instead, you whip out your smartphone calculator and come up with the following results:

Rule of 72 for 8% investment:

72 ÷ 8 = 9 years

Rule of 72 for 6% investment:

72 ÷ 6 = 12 years

The 8% investment will double 3 years sooner than the 6% investment. However, that is if it continues to average 8% returns. Over 40 years, the 8% investment has the chance to double over 4 times (40 ÷ 9 = 4.44), while the 6% investment will double over 3 times (40 ÷ 12 = 3.33). That may not seem like a huge difference, but it is.

While the difference may not seem significant at first, it adds up to around $100,000 more over 40 years, as shown in the chart below. Is the risk of the 8% investment and the potential for an additional $100,000 worth the risk? The decision is yours!

Rule of 72 Limitations

The beauty of the Rule of 72 is that it provides a simple calculation for the complex concept of compounding. However, this simplicity has its limitations. Here are a few to be aware of.

1. It Is An Estimate

The Rule of 72 provides an estimate rather than an exact number. It is a simple rule used to estimate the complex concept of compounding. In other words, the Rule of 72 gives you a rough idea, not a precise figure.

Stanford University provides more details on the Rule of 72 and its accuracy by stating the following:

The rule of 72 is only an approximation that is accurate for a range of interest rate (from 6% to 10%). Outside that range the error will vary from 2.4% to 14.0%. It turns out that for every three percentage points away from 8% the value 72 could be adjusted by 1.*

* Stanford University, EE204, Business Management for Electrical Engineers and Computer Scientists, The Rule of 72

Example Scenarios Using the Stanford University Method

Knowing Stanford University’s findings is good, but I suggest not overcomplicating things. The Rule of 72 will get you close enough. Adding or subtracting by 1 for every 3 percentage points away from 8% may not be worth the effort.

For instance, if you have an investment earning 2%, you can use 70 instead of 72 to get a more precise estimate of the number of years it will take to double. Using 70 will yield 35 years (70 ÷ 2 =35 years), whereas sticking with 72 will result in 36 years (72 ÷ 2 = 36 years). The difference is negligible. At that point, once your doubling time is over 30 years, who cares whether it’s 35 or 36 years? The same applies in the opposite direction.

Imagine you are a superstar investor earning 14% annually. In that case, you can decide to use 74 instead of 72. Using 74 will result in 5.3 years (74 ÷ 14 = 5.3 years) versus 5.1 years if you stay with the Rule of 72 (72 ÷ 14 = 5.1 years). Once again, who cares if it is 5.3 or 5.1 years? Regardless of which one you choose, it will take around 5 years for an investment to double at a 14% annual rate of return.

If you need more precise calculations, I recommend using a compound interest calculator. Several options are available online, but I prefer the compound interest calculator at investor.gov.

If you are really into math, you can take it to the next level by using the Time Value of Money (TVM) or running a Monte Carlo simulation. However, I have one word of advice: maybe don’t mention this on a first date if you’re hoping for a second one!

2. Rates Of Returns Can Fluctuate

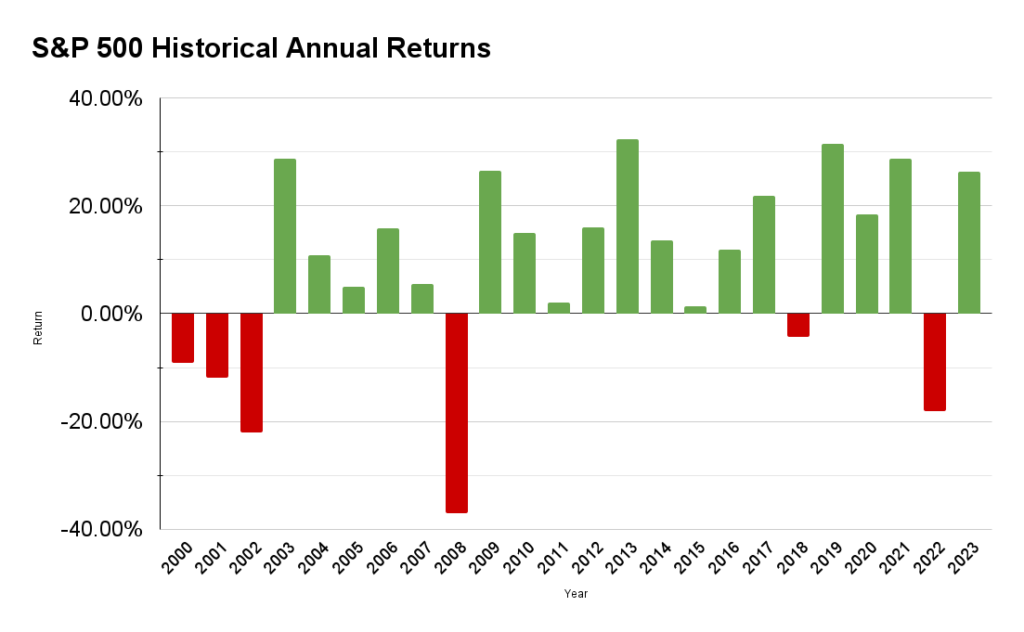

Your rate of return can fluctuate depending on the investment. This limitation applies to everything from the interest rate you earn on your savings account to the yearly returns you earn from a mutual fund. Dealing with investments that have fluctuating returns adds a level of uncertainty to the Rule of 72 calculation. The S&P 500 is a perfect example.

The historical annual average return of the S&P 500 is 10% but can fluctuate widely in any given year. The chart below shows the yearly return of the S&P 500 from 2000 to 2023. As you can see from the chart, there are many years where the S&P 500 returns well over 10% and many years where it has negative returns reaching greater than 30%.

Investing in the market involves experiencing extreme fluctuations in returns. These fluctuations make it challenging to estimate when your investment will double using the Rule of 72. The same applies to money in a savings account to a much lesser extent; the interest rate earned today can change based on factors like inflation.

The point is that the future is unpredictable, and past returns do not guarantee future returns. Although the S&P 500 has averaged 10% annual returns over the long haul, there is no guarantee it will continue to do so. Therefore, no calculation can predict future market returns, be it the Rule of 72 or otherwise.

A Word On Inflation

I have read several articles on the Rule of 72, and many list inflation as a limitation of the Rule of 72. This association drives me bonkers. The Rule of 72 is a formula for calculating the number of years it takes for an investment to double at a given interest rate. That’s all it is. It is meant to be simple and is not designed to account for other variables that may impact returns, like inflation.

Inflation impacts all investments and savings. Inflation is the reason so many of us invest in the market in the first place. We take on added risk in the hopes that our investment returns will outpace the rate of inflation. In fact, the Rule of 72 can help you better understand the impact of inflation on your investments. Here’s how it works:

72 ÷ Rate of inflation = Number of years purchasing power will be cut in half

Let’s see how the Rule of 72 works if inflation is running at 3%.

72 ÷ 3 = 24 years

The results from the example above show that with an inflation rate of 3%, your purchasing power will be halved every 24 years. Put simply, $100 today will be worth $50 in 24 years. Another way to look at it is that $100 in 24 years will be able to buy what $50 can buy today. Therefore, it is not so much that inflation is a limitation of the Rule of 72 but rather a force working against it.

Putting It All Together: Why Use The Rule Of 72

The Rule of 72 is a simple and helpful formula for estimating the number of years it will take for an investment to double in value. To use the rule, divide 72 by the annual rate of return of an investment. For example, if an investment has an annual rate of return of 8%, using the Rule of 72 would show that it will take roughly 9 years for the investment to double in value (72 divided by 8 equals 9). Although this rule offers investors a quick and easy method to assess their investments’ potential growth, it has limitations.

The Rule of 72 works best when applied to an investment that offers close to a guaranteed rate of return. When applying it to market investments, like stocks and mutual funds, its accuracy diminishes with each swing in the market. However, that is true of any calculation you use to project the growth of market investments, as future returns are not guaranteed.

The key takeaway is that the Rule of 72 is a great tool to have on hand. It allows you to calculate the power of compounding through simple division. You can use it anywhere and at any time to quickly assess the impact of a given interest rate on your investments. Let the Rule of 72 motivate you to save and invest more. Your future self will thank you!

Frequently Asked Questions (FAQs)

The Rule of 72 is a simple formula for estimating the time it takes for an investment to double in value at a specific interest rate.

The Rule of 72 is calculated using the following formula:

72 ÷ Rate of return = Number of years it takes for investment to double

For Example, if an investment has an annual rate of return of 9%, using the Rule of 72 would show that it will take roughly 8 years for the investment to double in value.

72 ÷ 9 = 8 years

Yes and no. There is nothing stopping someone from using the Rule of 72 on any investment, but it works best for investments with a guaranteed rate of return. When used for market investments like stocks and mutual funds, its accuracy depends on averages and the changing markets. So, be cautious because no one or nothing can predict future returns. Past returns do not guarantee future returns.