The SpaceX IPO is coming, and it is more than just rockets. In this post, we will look at what it means for investors, but first, our disclosure:

Disclosure: This post may contain affiliate links, meaning we earn a commission on purchases made through those links at no extra cost to you. As an Amazon Associate, I earn from qualifying purchases.

Disclaimer: The content on this site is for informational and educational purposes only and does not constitute financial, investment, legal, tax, or any other professional advice and should not be used as a substitute for professional advice. For more details, read our full Disclaimer.

SpaceX IPO: Musk, Rockets, xAI, and X – Oh My!

Putting politics and emotions aside, it’s hard to deny that Elon Musk is one of the greatest entrepreneurs and visionaries of our time.

Musk builds self-driving electric cars, reusable rockets, AI that rivals ChatGPT, brain-computer chips, and satellites that beam internet across the globe. He also owns a popular social media platform and a company that digs massive tunnels. Now, Musk plans to mass-produce humanoid robots and colonize Mars. At the center of all these ambitions are Tesla and SpaceX.

The big difference for investors: Tesla is a publicly traded company, SpaceX is not.

Until now, only private investors with deep pockets have had access to SpaceX, but that is about to change. With SpaceX’s IPO rumored for June 2026, retail investors will soon be able to get in on the action.

To say I am excited about SpaceX going public is a major understatement. SpaceX and its fast-growing subsidiary, Starlink, were already valued at around $1 trillion. Then, in early February, Musk gave SpaceX a monster Valentine’s Day gift: xAI, and with it the social media platform X. The acquisition of xAI pushes SpaceX’s valuation closer to $1.25 trillion or higher, making it one of the most valuable companies in the world.

To be clear, a lofty valuation does not guarantee success. If Tesla teaches us anything, it is that innovation can make for inflated valuations and extreme stock volatility. I expect SpaceX to be no different.

So, before getting swept up in the hype, let’s see all the good and the bad that may come with a SpaceX IPO.

Gear for Following the SpaceX IPO Like a Pro

If this IPO actually launches, you’re going to see rumors, hot takes, and X “experts” flying faster than a Falcon 9. If you are going to follow the chaos, you might as well do it properly.

What Is the SpaceX IPO?

IPO stands for Initial Public Offering. The primary purpose of an IPO is to raise capital to grow and expand a business. It is what most growing private companies do when they want to go public. When a company goes public, it lists its shares on a public exchange like the New York Stock Exchange (NYSE) or the NASDAQ.

SpaceX has costly goals, from colonizing Mars to putting AI data centers in space. A SpaceX IPO would help it raise substantial capital to fund those ambitions. Some estimates put the amount that a SpaceX IPO can raise at $50 billion, but that’s just scratching the surface.

Going public will give SpaceX greater access to credit. It will also allow them to issue bonds to the public and conduct secondary stock offerings to raise additional capital. In other words, going public gives SpaceX access to much more working capital beyond its IPO.

The bottom line is that if you want to put boots on Mars, you are going to need a lot of money. A SpaceX IPO is a giant first step toward providing that capital.

What Companies Come With A SpaceX IPO?

SpaceX is more than just rockets. With its acquisition of xAI, SpaceX has expanded into artificial intelligence and social media. Here are all of the businesses that fall under the SpaceX umbrella:

- SpaceX: Includes its reusable Falcon rockets, Dragon capsule, and its Starship spacecraft.

- Starlink: Satellite constellation with more than 9,000 satellites providing internet access to millions across the globe.

- Starshield: Classified satellite constellation used by the government and military for national security purposes

- xAI: Artificial Intelligence, including the Grok AI chatbot.

- X (formerly Twitter): Popular social media platform that came over with the xAI acquisition

That is quite the collection of companies. However, the million-dollar question (or more like trillion-dollar question) is, does SpaceX actually make money?

How Much Profit Does SpaceX Generate?

In 2025, SpaceX is reported to have generated around $15 billion dollars in revenue, of which $8 billion was profit. That equates to a 53% profit margin. That sounds great, but these numbers are from before SpaceX acquired xAI. The problem with xAI is that it burns cash like a SpaceX rocket burns fuel.

In 2025, it is estimated that xAI generated almost $4 billion dollars in revenue, mostly from subscriptions and advertising on X. That sounds promising until you realize that it spent roughly $12 billion on its AI buildout, resulting in an $8 billion loss. That’s the thing about AI. It has great potential, but that potential comes at a great cost. It’s not cheap to build out AI infrastructure.

Based on these numbers, if SpaceX had acquired xAI in 2025 rather than 2026, it would have generated $0 in profits in 2025. There is little doubt that the xAI acquisition will put pressure on SpaceX’s profits in the near term, if not longer.

With these numbers in mind, you might be asking, “How can a company that made $15 billion in revenue, which just acquired a losing company, be valued at over a $1 trillion?”

I have two words: rockets and Starlink.

How Many Rockets Does SpaceX Launch?

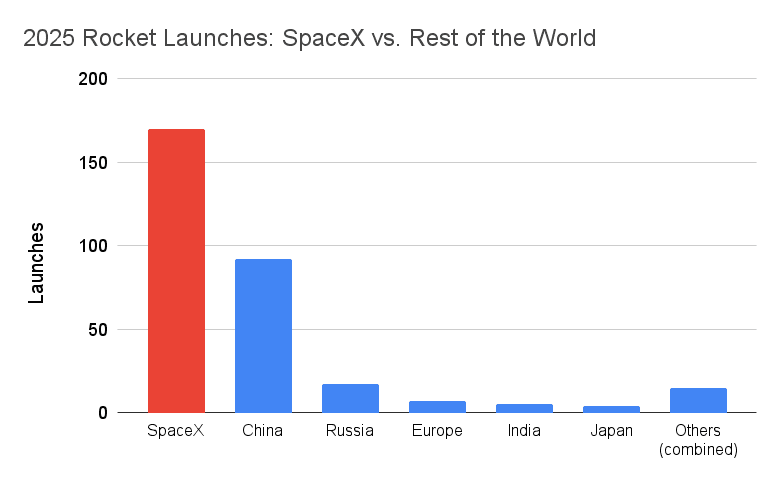

A SpaceX IPO puts its rocket dominance front and center. It is the undisputed rocket-launching champion in the world. It has held this title since 2020. No one comes close.

In 2025, an estimated 330 orbital rockets were launched globally, with SpaceX accounting for 160-170 of those launches. This means that SpaceX accounted for half of all orbital rockets launched worldwide in 2025. More impressively, it accounts for over 80% of orbital launches conducted in the United States. This trend is similar to the percentages seen in 2023 and 2024.

Orbital launches send payloads, like satellites, into orbit around Earth or supplies to the International Space Station. This differs from suborbital launches, which reach the lower levels of space and then quickly fall back to Earth. Katie Perry’s brief 11-minute round trip to space and back aboard Blue Origin’s New Shepard rocket is the perfect example of suborbital flight.

Speaking of Blue Origin, the race to space isn’t even close. Jeff Bezos’s Blue Origin conducted only 2 orbital launches in 2025, compared with SpaceX’s 160-170. If you compare Blue Origin’s 2 orbital launches to the 330 conducted worldwide in 2025, the comparison would be statistically meaningless, as in less than 1% (2 ÷ 330 = .006 or 0.6%). That is a far cry from SpaceX’s 50% global domination.

For SpaceX, this dominance translates into billions of dollars in government contracts. The United States uses SpaceX to launch astronauts and supplies to the International Space Station and for its top-secret spy satellite network, Starshield. Now that SpaceX is turning its sights to colonizing Mars and the moon, I expect the value of those contracts to grow.

As exciting as all of this seems to be, the real prize is Starlink.

Why Starlink Is the Prize Of A SpaceX IPO

Starlink is a constellation of satellites that beams down high-speed internet from space. Much like its rockets, Starlink has become a dominant player in the satellite industry.

How dominant?

It is estimated that more than 60% of all active satellites in space are Starlink satellites.

There are currently over 9,600 Starlink satellites circling the Earth, with plans to double and even quadruple that number in the coming years. All of those satellites translate into a big pile of money for SpaceX.

It can be difficult to pin down exact revenue numbers for a privately held company, but one thing is certain: Starlink has been growing rapidly.

In 2021, Starlink generated just over $200 million in revenue. By 2025, it soared to $10 billion, accounting for almost 70% of SpaceX’s total revenue that year ($10 billion out of SpaceX’s $15 billion). Forecasts for 2026 suggest that Starlink could double its revenue again, with some estimates projecting it might reach almost $20 billion. This revenue growth is driven by a rapid increase in Starlink subscribers.

Starlink’s subscriber base has grown from roughly 250,000 in 2021 to over 9 million by the end of 2025. It has essentially been doubling its subscriber base every year. During 2025 alone, Starlink’s subscriber base grew from 4.6 million to just over 9 million by year-end. Many expect Starlink to double its subscriber base yet again in 2026, reaching 18 million.

These numbers truly make Starlink the prize of a SpaceX IPO.

Starlink: The Cash Machine in Orbit

Most people just want reliable internet, and SpaceX is trying to deliver it to the planet through Starlink.

- Starlink provides reliable high-speed, low-latency, internet wherever you live

- Service plan required, activate STARLINK by selecting a service plan that is customized to meet your personal needs

- Select from plans suited for households or travel

How Does xAI Fit Into SpaceX’s Orbit?

If Starlink is the prize of a SpaceX IPO, then xAI is the question mark.

xAI was acquired by SpaceX to leverage its rocket and satellite technology to build AI data centers in space. The idea is that the sun can provide orbital AI Data Centers with unlimited solar power. It also eliminates cooling and land constraints and the “not in my backyard” resistance.

An orbital AI data center isn’t a giant warehouse floating in space. Instead, it’s a constellation of satellites that work together to provide massive amounts of computing power and AI inference. The satellite network is similar to Starlink but on a much larger scale. When Elon Musk discusses AI data centers in space, he envisions a massive network of a million orbiting AI-capable satellites transmitting data back to Earth.

Honestly, I cannot fathom how any of this is possible. It seems like a lot can go wrong, considering even a small piece of debris can wreak havoc in outer space.

For starters, it requires an almost absurd amount of satellites, each with large solar panels. SpaceX would need to ramp up rocket and satellite production and launch frequency to an unprecedented level to deploy all of these satellites. Then you have the challenge of coordinating all of those satellites while hoping the GPUs can withstand the harsh conditions of space. If a GPU breaks, there will be no way to replace it. Last but not least, SpaceX needs to receive that data back on Earth and distribute it to end users.

It’s a good thing there are people with far bigger brains than the one that currently occupies my head working on these problems.

What Would A SpaceX IPO Be Priced At?

Now that we have a better understanding of what’s included with a SpaceX IPO, it’s time to answer the question on everyone’s mind: What would a SpaceX IPO be priced at?

The ultimate goal of a SpaceX IPO is to raise $30 billion to $50 billion, making it the largest IPO ever. Based on these projections, analysts estimate the range for a SpaceX IPO to be $400 to $800 per share, with some estimates exceeding $1,000.

A share price in this range would put its P/E (price-to-earnings) at almost 200, which is extremely high. However, high P/E ratios are not unusual for fast-growing companies, as future growth (and speculation) is factored into the price. Hopefully, as revenue grows, the P/E will decline.

Regardless, SpaceX stock will not be cheap. At $400 to $800 per share, many retail investors will struggle to afford a single share of the company. I know I am one of those investors just hoping to own one single share. For many investors, the best way to gain exposure to SpaceX is to own the index it is listed on or ETFs tracking it.

What Are The Risks Of A SpaceX IPO?

While I am excited about a SpaceX IPO, I am not delusional. Investing always involves risk, and investing in SpaceX will be no exception. SpaceX may be a mature company, having been founded in 2002, but it will have its challenges. We already covered many of the risks in this post; here are a few of the major ones:

Space and AI Are Capital Intensive

The Space and AI industries require significant capital to succeed, and SpaceX is involved in both. Building rockets, spaceships, satellites, and AI data centers is very expensive. It is this very need for capital that is driving SpaceX’s IPO. In short, SpaceX needs a lot of money to make money.

xAI Weighing On SpaceX Profits

SpaceX made about $8 billion in profits in 2025, but that was before it acquired xAI. Now, the impact of xAI will be felt on SpaceX’s profits going forward. Currently, xAI operates at a loss, and those losses will dig into SpaceX’s profits and potentially put pressure on its stock price.

Any future investor in SpaceX has to hope that Musk’s plan of orbital data centers can transform xAI from a loser to a winner. If it does, then SpaceX’s stock might soar. Otherwise, let’s hope Elon has another trick up his sleeve with xAI.

Public Earnings Equals Public Scrutiny

Once SpaceX goes public, everything will be out in the open: The good, the bad, and the ugly. Analysts will dissect its quarterly earnings and every word uttered by SpaceX’s leadership team and Elon Musk. Being under such a microscope can lead to wild price swings with every miss and beat, and every time Elon has something important to say.

Speaking of wild price swings, that brings us to the next risk of a SpaceX IPO.

Innovation + Valution + Speculation = Volatility

With a valuation of over $1 trillion dollars and a P/E closing in on 200, a SpaceX IPO is ripe for speculation. Innovation and speculation will drive investors, traders, and gamblers alike to its IPO, with many looking to 10X their money. When that happens, you get volatility and lots of it. In other words, volatility equals risk, and speculation only amplifies volatility.

Where there is volatility, you can see wild price swings, and with them, a chance at big gains or major losses. I expect investing in SpaceX to be a rollercoaster ride.

Missed Timelines And Delays

Timelines will be crucial once SpaceX goes public. Investors and analysts will be looking through them with a fine-toothed comb. If a timeline is delayed, the stock price may suffer. Just ask Tesla about the impact of announcements or production delays on its stock price.

To be fair, these declines are often temporary and may not matter much for long-term shareholders, so long that they ultimately deliver on their promises. However, if the delays become permanent and products are scrapped, there could be much larger problems at hand.

Tools for Not Getting Wrecked By Hype

Before betting on what could be the biggest IPO in history, it helps to remember that markets have been humbling investors for over a century.

Crash Test Money survival kit:

SpaceX IPO: Putting It All Together

If the SpaceX IPO happens, it could become the biggest in history. potentially raising $50 billion. The promise of boots on Mars, orbital AI data centers, and rapidly growing Starlink subscribers has driven SpaceX’s valuation to over $1 trillion.

But this is Crash Test Money, not fan fiction.

SpaceX may dominate launches today, but that dominance comes at a price. It is expensive to build and launch rockets. Timelines slip. AI burns cash. Moonshots have a tendency to become duds. Investors chasing history could end up stress-testing their own portfolios instead.

So yes, a SpaceX IPO could be legendary, but it could also be hype colliding with reality.

If you’re thinking about buying in, don’t just ask how high it could go.

Ask what happens if it crashes back down to earth.