In this post, we will review how many subscriptions are a big waste of money, but first, here is our disclosure.

Disclosure: This post may contain affiliate links, meaning we earn a commission on purchases made through those links at no extra cost to you. As an Amazon Associate, I earn from qualifying purchases.

Disclaimer: The content on this site is for informational and educational purposes only and does not constitute financial, investment, legal, tax, or any other professional advice and should not be used as a substitute for professional advice. For more details, read our full Disclaimer.

Variety is the spice of life, and overspending

Let’s face it. We have it pretty awesome these days. Getting what you want, when you want, from the comfort of our homes is incredible. But we would be wise to heed the words of Spiderman’s Uncle Ben, “With great power comes great responsibility.” What is good for Spiderman is good for us, too.

We have more choices than ever at our fingertips. With so many options comes great responsibility. The problem is with each new subscription comes another charge and another chance to overspend.

The world is dominated by subscription-based products and services. Movies, TV, and music are primarily consumed through streaming services. If gaming is your thing, there is a subscription for that, too. Most software and computer programs are now tied to subscriptions, and it does not stop there. There are subscription services for every area of your life.

There are now subscription services and boxes for beauty products, jewelry, clothing, flowers, and food. The list goes on and on. You can subscribe to a subscription box that sends you bacon every month. What if you prefer pickles instead? No problem. You can get a subscription box every month with your favorite pickles.

To make matters worse, It is easy to lose track of subscriptions. This can be a challenge with free trial offers requiring you to provide credit card details before signing up. Before you know it, the free trial ends, and you are paying for a service you do not use.

Small Monthly Pricing for Subscriptions Leads to Big Overspending

Subscriptions with low per-month fees are easy to sign up for and to forget about. It’s not uncommon for subscriptions that cost less than $20 per month to slip our minds. For instance, if your average credit card bill is $500 each month and a statement comes in at $520, you probably will not bat an eye at it. This is what happened to me with the Peacock streaming service.

I signed up for Peacock to watch The Office for $5.99/month. After finishing, I moved on to another series but soon forgot about it for over six months and paid over $50 for an unused subscription. That was $50 down the drain. $50 may not seem like much, but that was just one subscription I forgot about. Then there was Angie.

I subscribed to Angie when it was still called Angie’s List and barely used it. This one was difficult to catch because it costs a little over $40 per year and is only charged once a year. When I finally did notice the charge and cancel the service, I spent over $200.

The point is, I know how easy it is to overspend on subscriptions and to lose track of them. You are not alone. A recent survey revealed that many people had experienced the same thing.

The Subscriptions Survey Says . . .

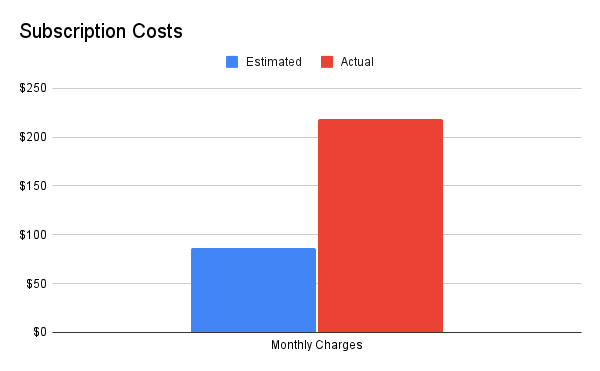

A survey by C+R Research in 2022 found that people way underestimate the amount of money they spend on subscription services. On average, those surveyed estimated to spend $86/month on subscriptions, but their actual spending was $219/month. The same survey revealed that 74% of individuals find it easy to overlook monthly subscription service charges. At the same time, 42% had forgotten about a subscription they were paying for but not using.

If you look at these numbers over an entire year, it becomes clear how much we overspend on subscription services. The C+R Research survey shows that people estimate spending just over $1,000/year on these services, but in reality, they spend over $2,600. That is a difference of almost $1,600. That is eye-opening.

As you can see, we are underestimating how much we spend on subscriptions, leading us to overspend. So, how can you rein in subscription services? Where do you start?

The best place to start is with your credit and debit card statements.

1. Review Your Statements

Most people will use a credit or debit card to pay for subscription services. Many quickly browse or ignore statements. If you are struggling with credit card debt and money, you may want to ignore the damage and pay the minimum instead. However, you will never be able to catch unused subscriptions if you do not review your spending in detail.

So, make it a habit to review your credit card and bank statements every month. If you rely on an app to track your spending, then make sure you review the transactions in detail. Do not just review your spending broadly across categories. Remember, many subscriptions have small monthly charges, so you may miss these transactions unless you drill down into the details.

2. Make a list of your subscriptions

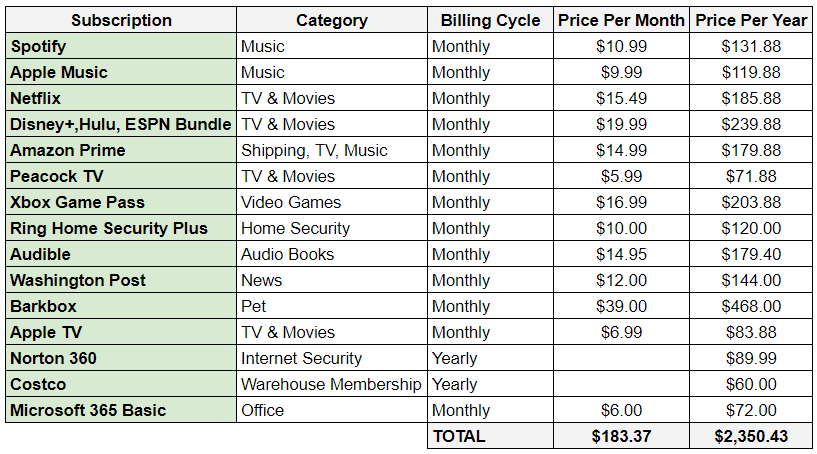

As you review your statements, list all your subscriptions with their costs. You can put it in Excel and Google Sheets or write it down on paper. It does not matter. The key is to list all your subscriptions, billing cycle, and cost per billing cycle and year. The list might look like the one below.

Creating this list is one of the most powerful steps you can take to reign in your subscriptions. It will put the full picture of your subscriptions and costs into view. By making this list, you are creating a mini budget focused on your subscriptions. From here, you can decide what to keep and to discard, leading us to our next step.

3. Review and Cancel Subscriptions

After reviewing your statements and listing your subscriptions, it’s time to decide which ones to cancel. Sometimes, you might decide to downgrade your subscription to a free version where available. You may also choose to keep them all. It is up to you and your budget to decide.

Using the list above, imagine you want to reduce your subscription cost by $1,000 a year. To achieve this, start by identifying subscriptions you no longer use from the list above. In this case, you will cut your paid subscription to Peacock TV. Like me, you only subscribed to Peacock to watch all the seasons of The Office. It helps that Peacock offers a free basic plan with a decent amount of content, making it easier to cut.

Next, check for any surprise subscriptions, such as the $12/month Washington Post one you forgot about after signing up for a $4/month promo a year ago. With so much free news content available, canceling the subscription is a no-brainer. Cancelling that one subscription is going to save you $144/year. Not bad.

The Tough Decisions on Subscriptions

Now, it is time to make tough decisions. Start by seeing if there are any redundant subscriptions. You still have three subscriptions remaining that are exclusively for TV/Movies. You can not do without Netflix and the Disney+ bundle, so you get rid of Apple TV instead. Besides, you only subscribed to Apple TV to watch Ted Lasso, and it ended.

Moving on to music, you are paying for three audio subscriptions. You are not listening to books as much anymore, so you cancel Audible. If you ever want to listen to a book, you can buy individual audiobooks on Spotify instead of paying a monthly fee. From there it is on to Spotify and Apple Music. Their offerings are almost identical. One needs to go. You choose Spotify because they offer a free version giving you more flexibility to downgrade if you decide to cut costs even more.

Now, It is time to identify your most expensive subscription. You love your dog, but at $39/month, Barkbox is draining a lot of money. $39 each month for a couple of dog toys and treats is hard to justify. It is much cheaper to buy those things at a pet store or a big box store as needed, not every month. This decision is painful since you love your dog, but Barkbox is no more.

The last step is to search for yearly subscriptions, as they may be harder to catch. You may be surprised to find that you’re being charged almost $90 for Norton 360, which you bought at a 50% discount on Amazon. You didn’t realize it was set to auto-renew at full price. So, you turn off auto-renewal in your Norton account and only pay for it at the discounted rate from now on.

Results

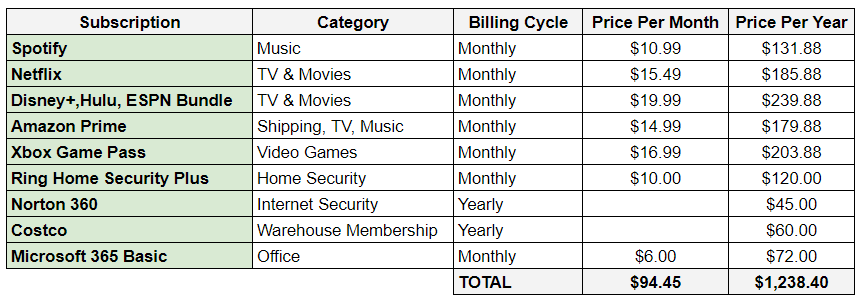

Let’s see how you made out after making these tough decisions. Below is the updated list.

You have cut your yearly subscriptions by over $1,200/year. Those are some excellent cost savings. Great job! You can use those savings to pay down debt or fund an emergency fund. The great part is you are not done yet. You can take more steps to gain greater control over your subscriptions and their costs.

4. Keep Track of Free Trials

Another great way to avoid overspending on subscriptions is to track your free trial deadlines. Put a reminder in your calendar, email account, smartphone, anywhere and everywhere. Get creative if you have to. You can put a sticking note on the inside of your front door so you see it every time you leave the house. You can also use a budgeting app to track and cancel your subscriptions.

I would suggest setting the reminders starting at least one week before the trial period ends, along with reminders leading up to the end date. It is hard to forget about a free trial if you constantly remind yourself about it. Doing this will help prevent paying for subscriptions you did not intend to keep.

I did this with Fubo TV. I do not subscribe to cable TV and wanted to watch a specific football game on the ACC Network. So, I started a free trial on Fubo TV and watched the football game. I made sure to keep track of that free trial and canceled it with a couple of weeks to spare.

5. Use It Then Lose It

You may be signing up for a new subscription for one or two pieces of content. Maybe you wanted to watch the final season of Ted Lasso on Apple TV or the latest season of The Lincoln Lawyer on Netflix. Whatever the reason, nothing is stopping you from canceling your subscription or starting it back up at any time.

You might want to watch the new season of The Mandalorian but have no other interest in the content on Disney+. No problem. Sign up for Disney+ for a month and cancel it before the next month. You will have plenty of time to watch the season and only spend around $11 doing it.

Remember to cancel the subscription, or you will find yourself paying for a service you are not using. I suggest immediately canceling your Disney+ subscription after watching The Mandalorian. Don’t wait. Don’t start checking out other content and forget about the subscription renewal. Cancel that subscription right away and sign back up for a month when the new season comes out.

Don’t Delay, Take Action Now

Follow the steps above to take charge and save money while still enjoying your subscriptions. There’s no need to cancel everything. These steps help you optimize your subscriptions to get the most out of them for less. You can enjoy the subscriptions that matter most to you while keeping more money in your pocket. You can use your savings to build an emergency fund, pay down debt, or invest.

Who doesn’t like that?

This might be the most fun you will have saving money.

So don’t delay. Take action now.

Bonus Section: The History of Subscriptions

When I was growing up, the primary subscriptions were to magazines and newspapers. If you wanted something else, you had to buy it at the store. This included movies, music, and software. Some companies offered subscription services for movies and music, but weren’t widely used. Why? They were a hassle and still required physical copies.

So, when your favorite recording artist came out with a new album, you needed to buy it at the store. You would have a physical copy of the album that you could touch and feel. You could pull out the album cover and spend hours learning every lyric on the CD. All for a one-time payment. There were no subscriptions. It was yours to keep forever. Believe it or not, the same was true for software.

If you wanted the latest iteration of Microsoft, you would buy a CD with the software and load it onto your computer. There was only one payment and no ongoing subscriptions. If you did not want to spend the money and update to the latest addition, you didn’t need to. You could keep your version of Microsoft Windows until it was no longer supported or became too outdated.

Along came Netflix, then the cloud, and everything changed

Netflix came along in the late 1990s and changed the subscription landscape forever. Netflix was finally able to do what other companies couldn’t: find an easy and affordable way to deliver movies directly to your home. It was the beginning of the end for Blockbuster.

Netflix made it so convenient. You could browse the selection of movies and TV shows from your computer and add them to your watchlist. In a few days, they would arrive at your home. When you finished the DVD, you would return it and get the next movie on your watch list. No more late fees and no more wasted trips to the video rental store only to find out they did not have the film you wanted. Then, in the early 2000s, the cloud became mainstream, and Netflix took it to the next level.

The cloud revolutionized how we acquired and consumed content and services. With the cloud, it became possible to access the same content instantly. There was no more mailing of DVDs. You can now access content when you want and from anywhere. Soon after, the iPhone would follow, and with it, the app store. The rest is history.