In this post, we will look at the amazing power of compounding, but first, here is our disclosure.

Disclosure: This post may contain affiliate links, meaning we earn a commission on purchases made through those links at no extra cost to you. As an Amazon Associate, I earn from qualifying purchases.

Disclaimer: The content on this site is for informational and educational purposes only and does not constitute financial, investment, legal, tax, or any other professional advice and should not be used as a substitute for professional advice. For more details, read our full Disclaimer.

What is Compounding?

Compounding is when you earn money on your principal balance and reinvest those earnings back into the investment, where those earnings generate earnings. Simply put: your money makes money. Compounding only works if you stay invested and reinvest your earnings, allowing it to work its magic. The longer the time you can let your money work, the greater potential for larger gains.

Compounding is so powerful that it can take even the smallest investments and turn them into big gains. This is especially true If you combine the principle of compounding with the principle of dollar cost averaging. But remember, as with all things related to investing, compounding only works if you invest in high-quality securities or place your money in accounts that offer higher rates of return. You will not be able to reap the benefits of compounding if you place your money in savings accounts with an interest rate near zero or a speculative stock that goes bust.

The Power of Compounding in Action

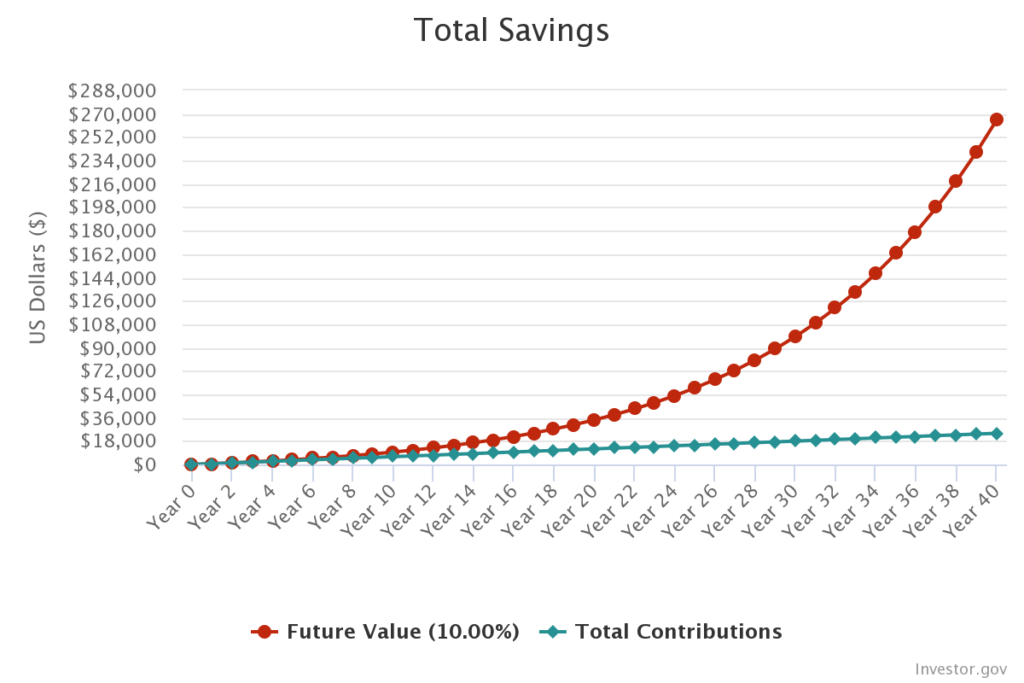

In my post on dollar cost averaging, I highlight how dollar cost averaging allows you to fit investing into your budget, regardless of how much you can invest. You do not need vast sums of money to invest, you need time and the amazing power of compounding. Don’t let the fact that you can only budget $25 or $50 a month for investing stop you from putting that money to work. With the power of compounding, you can potentially turn that $25 or $50 into six figures over 40 years by investing in an S&P 500 index fund.

In the examples that follow, we will use a yearly rate of return of 10%. This is in line with the historical average of the S&P 500. Investing in low-cost index funds or ETFs that track the broader market, like an S&P 500 index fund, is a great way to invest. Remember, past returns do not guarantee future returns, so there is no guarantee that the S&P 500 will continue to return an average of 10% yearly. Also, this is an average, and there are years when the S&P 500 will gain well over 10% and others where it earns far less.

The calculations and graphs used in this post are from the US Securities and Exchange Commission website. They have one of the best compounding calculators and several other calculators for savings and college goals.

I hope the ensuing examples inspire you to take action no matter how much money you have available for investing.

$50, and The Six Figure Return

What if I said you could have over $265,000 for the low price of only $50 per month? Sound too good to be true? It’s not. It is possible when you take advantage of the power of compounding. Let’s look at an example to see how this is possible.

Jane is in her early twenties and just starting off on her own. This is the first time she has had to pay for food, rent, and a car to get to and from work. Jane only has $50 at the end of each month to put toward investing but decides it is still worth it. So, she opens an account at a low-cost brokerage company and invests $50 per month for the next 40 years in an S&P 500 index fund returning an average of 10% per year.

Forty years later, Jane’s $50 monthly contribution would have yielded over $265,000. Jane’s total contributions over those 40 years would have only been $24,000. Jane could have easily given up, as the total returns were small during the first 15 years. But after those first 15 years, things start taking off, and the power of compounding goes to work. The result is Jane spent $24,000 and got $265,000 in return. That is amazing, and the power of compounding!

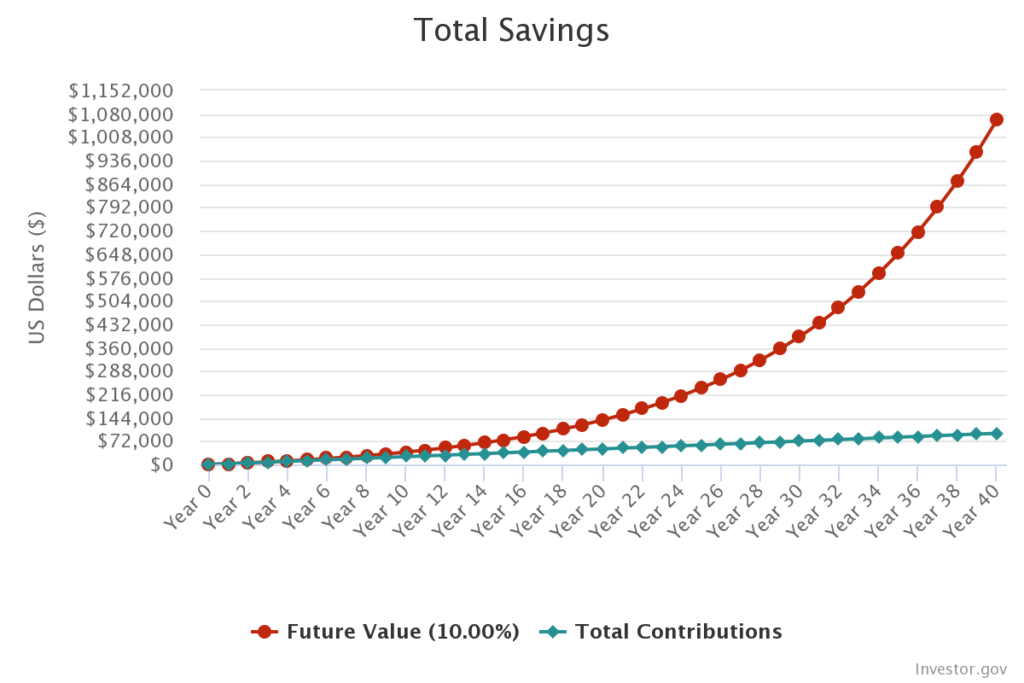

$200, and The Seven Figure Return

Jane is doing great in her new job, and her boss is taking notice. All her hard work and effort pay off, and Jane receives a big raise after her first full year on the job. Instead of investing $50 monthly in an S$P 500 index fund, she can now invest $200 monthly. What are the results now that Jane can invest $200 per month for 40 years into the same S&P 500 index fund that earns 10% per year? The results are mind-blowing.

Thanks to the power of compounding, Jane would be a millionaire at the time of her retirement. Her total contributions would have only been $96,000 or $2,400 annually over those 40 years. Put another way: Janes’s 5-figure total investment would result in a 7-figure return over 40 years. That is the incredible power of compounding.

The Power of Compounding and Savings accounts

I am not a big fan of big banks and their savings accounts. They offer their customers next to nothing on their savings and make them jump through hoops to avoid fees. There is nothing like the power of compounding to put this all in perspective, as compounding is only as good as the interest rate you earn on your money. Let’s take a look at an example.

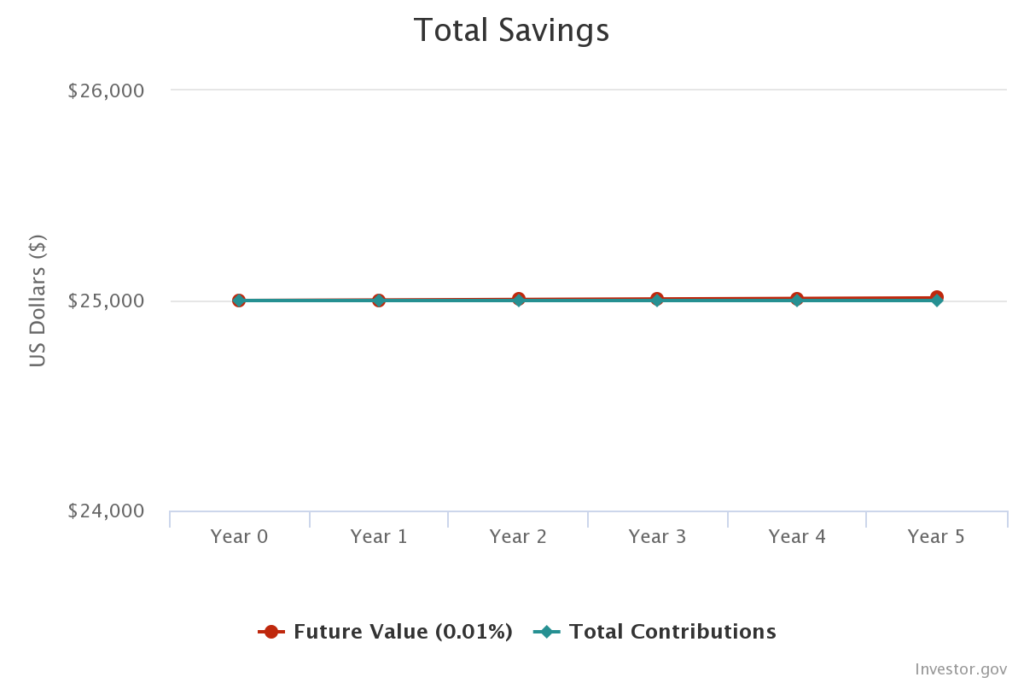

A meager .01% Interest Rate

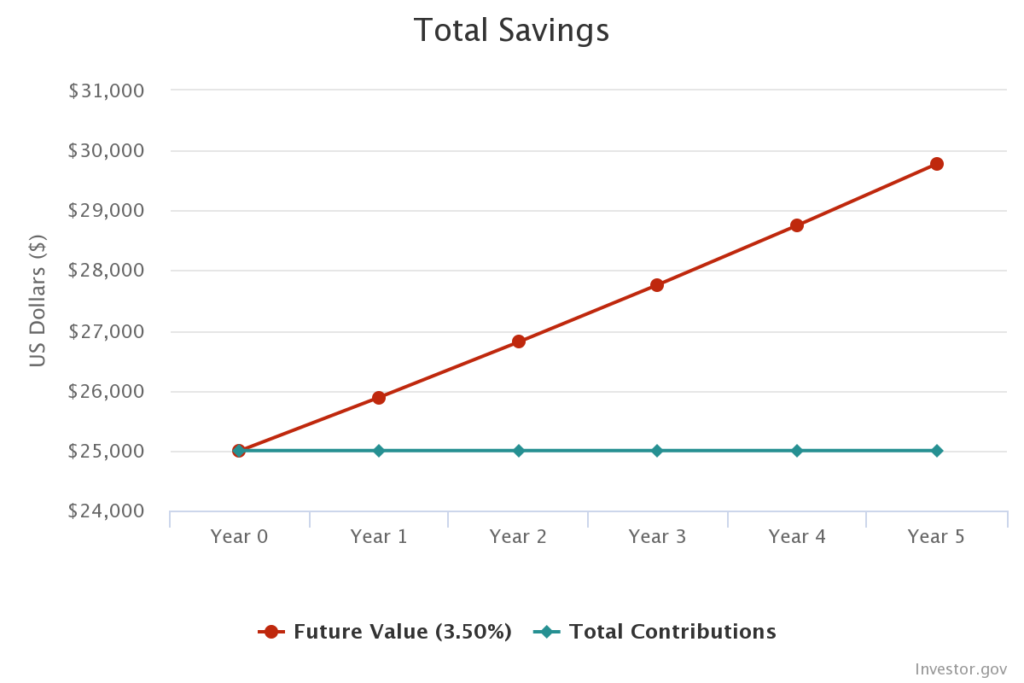

John is in his mid-forties and keeps his $25,000 emergency fund in a savings account at one of the big national banks. This savings account only earns him 0.01% APY even after the meteoric rise in inflation. John has held this $25,000 in this account for the past five years. Recently, he has been eyeing an FDIC-insured online bank offering 3.5% on savings accounts with no minimum requirements. He is trying to decide if he should switch banks. John goes to investor.gov to crunch the numbers and is shocked by the results.

John almost fell out of his chair after seeing the results. The chart below demonstrates how pathetic the return is when earning 0.01%. It is as flat as a kitchen table. The $25,000 emergency fund would grow to $25,012.50. That is a whopping total of $12.50 in interest over five years. The power of compounding had no chance with such a low-interest rate.

3.5% Sticks the Landing

After seeing the horrible returns he receives from the big national bank, John runs the numbers on the online savings account offering 3.5%. The results are like night and day. After five years, that $25,000 would grow to almost $30,000. Compounding had a chance to work its magic when the interest rate was higher. After seeing the difference, John transfers his emergency fund to the FDIC-insured online savings account, offering 3.5% interest.

The Keys to Compounding

Yield

Yield is an important factor when it comes to compounding. We saw this in the example with John and the savings accounts. Compounding works best when you are maximizing your rate of return. The power of compounding is minimized when you earn 0.01%. The same is true with investing. If Jane had placed all her money in a bond fund averaging 4% yearly, her returns would have been much different.

At 4%, Jane’s $50 monthly contribution would have returned $57,000 over 40 years instead of the $265,000 she earned investing in an S&P 500 index fund that averages a 10% yearly return. Jane’s $200 monthly contribution earning a yearly average of 4%, would have turned into $228,000 over 40 years, not $1 million.

This does not mean you should chase the highest yield possible when choosing investments, as it comes with greater risk. Instead, be aware of the impacts of yield on compounding. Ultimately, it is best to balance your risk tolerance and investment goals.

Fees and their Impact On the Power of Compounding

Fees impact compounding in the same way as yield. Let’s imagine a scenario where Jane tries to choose between two different funds. Both funds track the S&P 500 and have averaged a 10% yearly return. One is an index fund with an expense ratio of 0.015%, and the other is an actively managed mutual fund with an expense ratio of 1%. That one percent difference may not seem like a big deal, but let’s see what happens after 40 years.

We saw that Jane could become a millionaire by investing $200 monthly over 40 years in a fund that tracked the S&P 500. If Jane decided to go with the index fund with a 0.015% expense ratio, she would still have over a millionaire dollars after 40 years of investing. Her returns would have been minimally impacted. What would have happened if Jane had chosen the actively managed mutual fund instead?

If Jane had decided to invest in the actively managed mutual fund, she would have fallen short of the million-dollar mark. Instead of a million dollars, Jane would have had around $800,000 after 40 years. That is a $200,000 difference over 40 years. How can a roughly 1% difference in fees have such an impact? It all comes down to the power of compounding. That 1% difference over 40 years adds up. It is 1% not being compounded year after year, so be mindful of fees when investing.

Time, The Fuel Behind the Power of Compounding

I have left the best for last. The most important factor when it comes to compounding is time. If Jane had delayed investing until her thirties, she would have had a dramatic difference in her returns. That $200 per month contribution would have turned into $400,000 after 30 years, not the $1 million we saw after 40 years. By delaying investing until her thirties, Jane would have to invest over $500 per month to get the same returns she earned by investing $200 per month starting in her twenties.

So, don’t let how much you can invest stop you from investing. The sooner you start, the bigger the returns. Maybe you can only invest $25 per month to start. Or perhaps you can only contribute 3% of your pay to an employer-sponsored retirement account. Who cares? Just start! You can always increase your monthly contributions as your career advances and your salary increases. The power of compounding will go to work,

Key Takeaway: Don’t let perfection be the enemy of good. Invest in high-quality securities like a low-cost S&P 500 index fund or ETF. Do what you can, no matter how large or small the amount, and let time and the amazing power of compounding do the rest.