In the post, we look at the second quarter of 2023 earnings for the Dogs of the Dow, but first, here is our disclosure.

Disclosure: This post may contain affiliate links, meaning we earn a commission on purchases made through those links at no extra cost to you. As an Amazon Associate, I earn from qualifying purchases.

Disclaimer: The content on this site is for informational and educational purposes only and does not constitute financial, investment, legal, tax, or any other professional advice and should not be used as a substitute for professional advice. For more details, read our full Disclaimer.

Quick Overview of Dogs of the Dow

The Dogs of the Dow investment strategy attempts to invest in undervalued blue-chip companies with dividend yield as the only metric. On the last trading day of the year, you identify the ten companies with the highest dividend yields in the Dow Jones and invest equal amounts into each at the start of the new year. You repeat this process every year, swapping out stocks as needed.

After researching the Dogs of the Dow investment strategy, I decided to give it a try. Crash Test Money aims to offer reliable money-related content based on personal experience. Therefore, at the beginning of January, I invested in the 2023 Dogs of the Dow, consisting of Verizon, Dow, Intel, Walgreens, 3M, IBM, Amgen, Cisco Systems, Chevron, and JP Morgan.

Unfortunately, it has been all downhill since my initial investments.

Bad Dogs of the Dow Q2 2023

2023 is shaping up to be a horrible year for the Dogs of the Dow investment strategy. The Dogs of the Dow got off to a terrible start during the first quarter of 2023 and have continued their downward trajectory in the second quarter. The only way to describe it is to call it a train wreck. Needless to say, I am very disappointed with the Dogs of the Dow’s 2023 performance.

I was hopeful the second quarter would be better than the first. It didn’t do much to ease my worries. The only silver lining is that the number of stocks with positive returns for the year has increased. Nevertheless, among the ten stocks that comprise the Dogs of the Dow, only three improved their returns from Q1 to Q2. That is not good.

As of the second quarter’s end, the Dogs of the Dow 2023 have experienced a decrease of over 7% for the year, compared to a 5% loss in the first quarter. When accounting for the average dividend of approximately 4.5%, their overall decline is about 2.5% for the year. This is in stark contrast to the S&P 500, which has grown by over 16% by the end of the second quarter, not including its yield of 1.5%.

As a result, only one stock among the Dogs of the Dow 2023 posted better returns than the S&P 500. That stock is Intel. Outside of Intel, no other dogs come close to the S&P 500 returns. This has been a bad year to try the Dogs of the Dow strategy. Unfortunately for me, predicting the future is not one of my specialties.

A Picture Says a Thousand Words

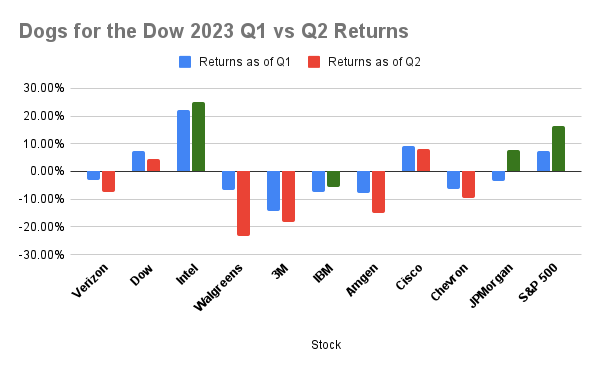

It’s difficult to truly convey the poor performance of the Dogs of the Dow in 2023 through words alone. To better illustrate their returns thus far, I’ve included a chart for reference.

The green bars in the chart represent the stocks that performed better quarter-over-quarter. I have also included the S&P 500 for comparison.

Intel has continued to perform well. However, the standout winner in the second quarter was JP Morgan. Unfortunately, with the exception of JP Morgan, Intel, and IBM, all other stocks saw a decrease in their returns from the previous quarter. The one piece of good news in the second quarter is there are now four stocks in positive territory for the year instead of three.

Let’s dive deeper into the returns, starting with the positives. I prefer getting the good news first as it helps to soften the blow of the bad news. With that being said, here are the winners.

The Winning Dogs of the Dow

JP Morgan, The Q2 Dogs of the Dow Winner

Despite experiencing negative returns earlier in the year, JP Morgan has managed to move into positive territory, with a yearly return of over 7.6%. The second quarter proved successful for the bank, with a significant 10% swing in returns from the first quarter to the second.

JP Morgan’s active quarter included acquiring the struggling First Republic Bank. This acquisition might signal the end of the brief banking crisis initiated by Silicon Valley Bank. I am optimistic that the worse is behind the banking industry and that JP Morgan can continue to perform well in the second half of the year.

Among the Dogs of the Dow 2023, I consider JP Morgan a long-term investment. Being the biggest bank in the United States, it will likely provide some stability among bank stocks. Regardless, I will hold JP Morgan until the end of the year, no matter what, so I hope it continues its upward trajectory.

Intel

I have to admit I was wrong about Intel’s performance. I had predicted it would be one of the weakest performers in the Dogs of the Dow 2023, but I was far off the mark. Intel keeps chugging along and has met and exceeded my expectations by adding to its returns in Q2.

Intel is outpacing all other stocks in the Dogs of the Dow 2023. It is also outgaining the S&P 500 by a wide margin. With another strong quarter, Intel’s yearly returns have now exceeded an impressive 25%. I must confess that I am puzzled by these returns, especially since Intel declared its largest quarterly loss ever in Q1 of 2023.

I am unsure how it does it, but Intel is defying gravity. Now, all I can do is wait and see if these gains can be maintained until the end of the year. I am crossing my fingers and toes that they can.

IBM

How can a stock that finished the second quarter in negative territory be a winner?

The reason is IBM showed improvement in the second quarter as its losses decreased from over 7% to less than 5.5%.

This performance was enough to make it the third and final stock in the Dogs of the Dow 2023 to improve returns quarter-over-quarter. When accounting for its almost 5% dividend, IBM is close to breaking even for the year. While this is not great, it is better than nothing, considering how poorly the Dogs of the Dow have been performing in 2023.

It’s possible that IBM will see a positive turnaround by the end of the year. However, given the performance of the Dogs of the Dow this year, I am not holding my breath.

Honorable Mentions

Cisco Systems and Dow Inc maintained a positive standing despite their subpar performance in the quarter. Their yearly returns decreased while the S&P 500 grew during the same period. Therefore, it was not the best quarter for these two companies.

Cisco Systems has returns of around 8% for the year, whereas Dow’s returns have slightly decreased to just over 4%. However, it’s worth noting that Cisco offers a 3% dividend, while Dow’s is over 5%. This means that if their performance remains unchanged for the rest of the year, I could receive returns of approximately 11% and 9%, respectively.

Although it may not be outstanding compared to the S&P 500’s performance, the return is still reasonable. However, there is also the possibility that Cisco Systems and Dow Inc will continue to decline. If that happens, things will have gone from bad to worse for the Dogs of the Dow 2023.

The Losing Dogs of the Dow

Walgreens

Walgreens is a classic example of things going from bad to worse. Their stock was down nearly 7% towards the end of the first quarter and plummeted over 23% by the end of the second quarter. It does not get much worse than that. This is a clear indication of the challenges they are facing, even after posting decent earnings.

Honestly, I never had much enthusiasm for owning this particular stock. If you look at the stock chart for Walgreens over the past five years, it resembles a beginner’s ski slope. I understand that past returns do not guarantee future returns, but I cannot find any indications that it will improve its performance anytime soon.

All I can do now is hope for a miracle, but hope is not and should never be an investment strategy.

Amgen

It’s hard to believe that Amgen’s stock dropped by over 15% in the first half of the year. If someone had told me this at the beginning of the year, I would not have believed them. Unfortunately, this is the reality we face. Amgen has had a rough quarter, mainly due to the increasing number of lawsuits against its acquisition of Horizon Therapeutics. The current situation makes it uncertain whether Amgen can recover some losses before the year ends.

3M

3M dropped another 4% on the year, leading it down over 18% by the close of the second quarter 2023. The good news, if there is any, is that 3M stock has seemed to find a floor around $100 per share. 3M also reached a $10.3 billion settlement over water contamination due to PFAS, also known as the “forever chemical.” Following the settlement announcement, 3M stock experienced a brief rally that fizzled out.

The pressing question remains: will 3M be able to stage a significant rally during the latter half of the year? I am not convinced it can, but anything can happen. Just look at Intel.

I am almost certain that if 3M fails to rally, it will become a part of the Dogs of the Dow in 2024, as its current dividend yield is over 6%. That dividend yield should keep 3M among the 10 highest dividend stocks in the Dow Jones. That is the only thing I feel confident about when it comes to 3M.

Chevron

As mentioned in my post on the first quarter results of the Dogs of the Dow, it seems inevitable Chevron would eventually come down to earth. Chevron was coming off of a massive 2022, gaining over 50% on higher energy prices. Energy prices have since come down, and Chevron’s stock has followed. Chevron is now down over 9% on the year.

It seems like the energy sector is always going through boom and bust cycles. That is because earnings are so dependent on the price of oil and energy. Despite this, Chevron stands out as a significant player in this sector, which might make it a favorable stock to hold onto for the long term.

Verizon

Verizon’s performance hasn’t been great, being down by over 7% for the year at the end of Q2 2023. On the other hand, it now offers a dividend of around 7%, which helps to offset the losses. Investing-wise, it’s disappointing to break even when the S&P 500 is up over 16%. However, for me, it’s currently about preserving capital, especially with the underperformance of the Dogs of the Dow in 2023.

I will take it if I can break even with Verizon by the end of the year. Winning is great, but a tie is better than a loss if you cannot win. That is what I am hoping for out of Verizon at this point.

Closing Thoughts

I’m beginning to doubt the effectiveness of the Dogs of the Dow investment strategy. Its simple approach of owning the ten stocks with the highest dividend yield in the Dow Jones might be its greatest downfall. Ultimately, this strategy limits the stocks you can own. It also does not take a buy-and-hold approach since you trade out stocks each year.

As a result, I am considering lowering my investments in the Dogs of the Dow. Investing is a long-term endeavor, and timing the market is unwise. Normally, I wouldn’t contemplate altering my portfolio after only six months. However, when it comes to investing in stocks, it is so hard to beat the simple but powerful strategy of owning an S&P 500 index fund or ETF. If I sell some of my Dogs of the Dow shares, I plan to reinvest the proceeds into my S&P 500 index fund.

Ultimately, this is what Crash Test Money is all about. There is so much noise and advice on investing and personal finance. But do the people advocating for these different strategies practice what they preach? And do these strategies work?

At Crash Test Money, we believe in putting words into action. We aim to offer you a real look at a particular money strategy based on our personal experiences, whether positive or negative. We are not financial professionals and do not recommend buying or selling any financial security or following a specific strategy. Rather, our goal is to educate and inform you through our firsthand experiences.

As such, I have decided to stick with the Dogs of the Dow strategy until the end of the year, come what may. I might even consider testing this method again in the coming year to understand its effectiveness better. Keep an eye out for updates!