This post will examine MicroStrategy’s big bet on Bitcoin, but first, our disclosure:

Disclosure: This post may contain affiliate links, meaning we earn a commission on purchases made through those links at no extra cost to you. As an Amazon Associate, I earn from qualifying purchases.

Disclaimer: The content on this site is for informational and educational purposes only and does not constitute financial, investment, legal, tax, or any other professional advice and should not be used as a substitute for professional advice. For more details, read our full Disclaimer.

MicroStrategy Warning! Extreme Volatility Ahead

MicroStrategy is making headlines today due to its Bitcoin purchases, fueling speculation about its stock price. But, before we dive into MicroStrategy and its Bitcoin bet, be warned: Investing in MicroStrategy is not for the faint of heart.

MicroStrategy is a leveraged play on Bitcoin, meaning its stock price is highly sensitive to any change in Bitcoin’s price. It’s not unusual to see MicroStrategy’s stock price fluctuate by 10% or more on any given day. This volatility is a key characteristic of the company’s stock.

Investors in MicroStrategy tend to be attracted to its high volatility. They are willing to embrace the volatility for a chance at market-beating gains. While there is potential for significant gains if Bitcoin’s price rises, it’s important to be aware that there is also a potential for substantial losses if it falls. So, if you’re considering investing in MicroStrategy, research and ensure you have the risk tolerance to handle the volatility.

For full transparency, I currently own shares in MicroStrategy. However, this disclosure should not be considered investment advice or a recommendation to buy or sell MicroStrategy stock. I share this for informational purposes only so you know I have first-hand experience investing in MicroStrategy. I know what it’s like personally to own such a volatile stock.

Therefore, research is key before making any investment decision, and I hope this post proves educational. I’ll provide an overview of MicroStrategy, starting with its origin story. Then, we’ll delve into how it became the largest corporate holder of Bitcoin and its $42 billion Bitcoin investment plan. Along the way, I will provide links to additional resources. By the end, you will see why MicroStrategy is like no other company that came before it.

Are you ready to explore MicroStrategy’s Bitcoin bet?

Let the Journey begin!

MicroStrategy’s Origin Story

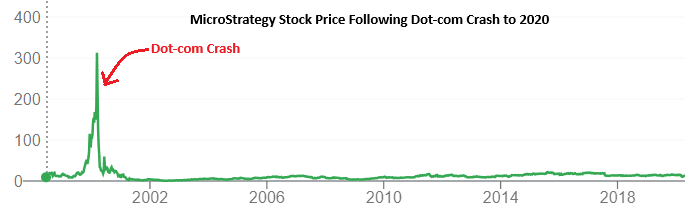

MicroStrategy was formed in 1989 by three MIT classmates: Michael Saylor, Sanju Bansai, and Thomas Spahr. The company’s mission was to develop data-driven business intelligence software, a niche gaining traction in the business world. In 1998, MicroStrategy went public, and its stock soared on the back of the dot-com bubble, and it seemed like MicroStrategy was on the path to success. However, its success did not last long.

Fun fact: There used to be an old NECCO candy factory located right down the road from the MIT campus on Mass Ave in Cambridge, MA. The factory would fill the air with the sweet scent of candy. I spent a lot of time working in that area, and whenever I think of MIT, I find myself craving NECCO Wafers. It’s like Pavlov’s dog. I am craving them right now as I write this!

In 2000, the dot-com bubble popped, sending MicroStrategy shares tumbling off a cliff. This forced MicroStrategy into a 1-for-10 reverse stock split to maintain its share price and inclusion in the Nasdaq.

During this same period, the Securities and Exchange Commission (SEC), a U.S. government agency responsible for regulating the securities industry, charged several MicroStrategy executives, including CEO Michael Saylor, with accounting fraud. They were accused of overstating their revenue and earnings. The executives would go on to settle with the SEC without admitting guilt but had to pay hefty fines.

MicroStrategy would find stability after the dot-com bubble and SEC settlement. However, it struggled to grow. Then came 2020 and Microstrategy’s pivot to the Bitcoin standard. This pivot would change everything for the company.

Learn More: What is a reverse stock split?

A reverse stock split occurs when a company consolidates its shares to increase its stock price. For example, let’s say you own 10 shares of a company trading at $1 per share, giving you a total investment of $10. If the company undergoes a 1-for-10 reverse stock split, you will now hold one share valued at $10 per share. In both scenarios, your total investment remains the same: $10 in the company.

The Pandemic and MicroStrategy’s Bitcoin Pivot

According to Michael Saylor, he tried everything to get MicroStrategy to grow in the ten years leading up to 2020. As CEO, Saylor attempted to buy the stock back, spent hundreds of millions of dollars on sales and marketing, and rebuilt the products several times. Despite these efforts, nothing worked. Then came the COVID-19 pandemic, making things much worse for MicroStrategy.

With people confined to their homes, the markets plummeted, and MicroStrategy’s stock value was halved. The company, once valued at $500 million, quickly dropped to $250 million almost overnight. Then, the Federal Reserve, under Jerome Powell’s leadership, lowered interest rates to zero, which resulted in MicroStrategy earning no returns on its cash. Faced with these challenges, Michael Saylor went looking for a solution, and that solution was Bitcoin.

In 2020, MicroStrategy Corporation decided to shift its treasury position from fiat currency to the Bitcoin Standard. Under the leadership of Michael Saylor, MicroStrategy made its first purchase of 21,454 bitcoins in the summer of 2020 and never looked back. Since then, the company has raised funds by issuing new shares and convertible bonds to finance billions of dollars in Bitcoin purchases.

From Bitcoin Skeptic to Bitcoin Bull

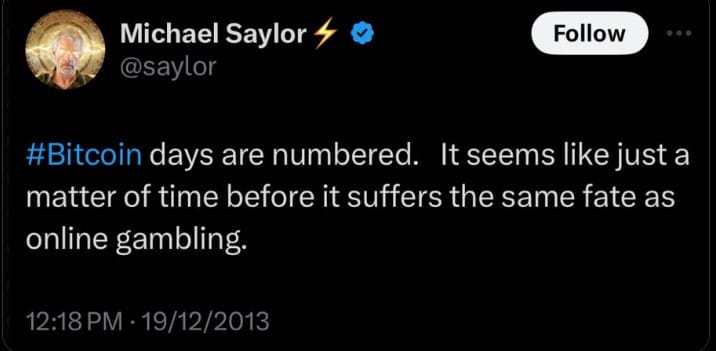

It may surprise some, but Michael Saylor was not always a supporter of Bitcoin. In 2013, he tweeted that the days of Bitcoin were numbered. However, the pandemic and 0% interest rates led Saylor to reevaluate a technology he had previously dismissed.

According to Saylor, he has yet to meet a critic of Bitcoin who has spent a hundred hours or more studying it. Saylor acknowledges that when he claimed that Bitcoin’s days were numbered, he had only invested a few hours researching it. In contrast, when he decided on MicroStrategy’s Bitcoin strategy, it was only after he devoted over a thousand hours to understanding the technology.

I've never met a well-informed #Bitcoin critic. pic.twitter.com/cfhmfDwhsr

— Michael Saylor⚡️ (@saylor) April 28, 2024

Learn More

If you want to learn more about Bitcoin, a great starting point is The Bitcoin Standard by Saifedean Ammous. Michael Saylor has stated, “The best compliment I can give this book is that I read it and decided to buy $425 million worth of bitcoin.”

From Software Company to Bitcoin Treasury

As we enter 2025, MicroStrategy holds nearly 450,000 bitcoins, valued at over $40 billion, making it the largest corporate holder of Bitcoin, bar none. This number is expected to grow even further. If you follow Michael Saylor on X (formerly Twitter), you know when he is preparing to buy more Bitcoin. He often shares his “Saylor Tracker” to express that there aren’t enough green dots, as shown in the post below.

Something about https://t.co/Bx3917zMqi is not quite right. pic.twitter.com/vRTAH2xTCX

— Michael Saylor⚡️ (@saylor) January 5, 2025

The end result is that under Michael Saylor, MicroStrategy transitioned from being a business analytics software company to becoming a Bitcoin Treasury that also offers software services. The impact of this transition cannot be overstated.

By July 2024, MicroStrategy’s stock was trading at over $1,300 per share, prompting the company to authorize a new stock split. This time, instead of consolidating shares, they implemented a 10-for-1 stock split. This means that investors would receive 10 shares for every share they owned.

Like a reverse stock split, the 10-for-1 stock split does not change the overall dollar value of an investment. Instead of owning one share of MicroStrategy at $1,300, an investor would now own 10 shares priced at $130 each. The total investment would remain the same at $1,300.

The main benefit of MicroStrategy’s stock split was that it reduced the stock price, making it more accessible for retail investors. It also indicated how closely MicroStrategy’s stock price is driven by its Bitcoin holdings. However, Bitcoin’s price is volatile and is known to fall as fast as it rises.

MicroStrategy’s Performance Lives and Dies By Bitcoin

MicroStrategy’s stock has experienced a remarkable increase of approximately 350% in 2023 and 2024. However, its ability to maintain this growth rate depends largely on the volatile price of Bitcoin. This volatility is further intensified by factors such as stock issuance and bond offerings, which we will explore in the next section.

The chart below shows the yearly returns, rounded to the nearest whole number, of MicroStrategy’s stock and Bitcoin from 2015 to 2024. I added the returns of the S&P 500 for context.

| Year | MicroStrategy | Bitcoin | S&P 500 |

|---|---|---|---|

| 2015 | 10% | 35% | -1% |

| 2016 | 10% | 124% | 10% |

| 2017 | -34% | 1,338% | 19% |

| 2018 | -3% | -73% | -6% |

| 2019 | 12% | 94% | 29% |

| 2020 | 172% | 302% | 16% |

| 2021 | 42% | 60% | 27% |

| 2022 | -74% | -64% | -19% |

| 2023 | 346% | 156% | 24% |

| 2024 | 359% | 121% | 23% |

In the five years leading up to 2020, MicroStrategy’s stock performance was mediocre, with its best year returning 12%. There was little correlation between its stock price and Bitcoin’s price. 2017 was the most extreme example, as Bitcoin surged by 1,338%, while MicroStrategy declined by 34%. However, everything changed in 2020 when MicroStrategy began adding Bitcoin to its balance sheet.

In 2020, it saw a stock price surge of 172% on the back of Bitcoin’s 302% advance. Since then, MicroStrategy has utilized stock and bond issuances to acquire more Bitcoins, effectively making MicroStrategy a leveraged investment in Bitcoin. This is reflected in its 2X and 3X returns on Bitcoin in 2023 and 2024. However, that leverage works in both directions.

What Comes Up Must Come Down

It can be easy to look at 2023 and 2024 and think MicroStrategy is a guaranteed path to riches. However, 2018 and 2022 highlight the risks of investing in volatile assets like Bitcoin and MicroStrategy.

Bitcoin is a young and speculative technology subject to wild price swings. It is known for its massive drawdowns throughout any given year. Oftentimes, Bitcoin will recover during that year, leading to positive returns. Other times, it doesn’t, leading to massive losses.

By 2022, MicroStrategy held over one hundred thousand bitcoins, and its stock price was directly tied to the price of Bitcoin. When Bitcoin crashed by 60% in 2022, MicroStrategy’s stock took a hit, too, falling 74%. To put this drop in perspective, if someone had invested $1,000 in MicroStrategy to start 2022, it would only be worth $260 by the end of the year.

Anyone considering investing in MicroStrategy or Bitcoin would be wise to assess if they have the emotional and financial risk tolerance to handle the volatility and the potential for substantial losses. It’s a lot like playing with fire. Get too close, and you might get burned.

MicroStrategy’s $42 Billion Bitcoin Plan

I want to emphasize an earlier point: MicroStrategy transformed itself into a Bitcoin Treasury that happens to operate a software business. Its software business has been stagnant, and revenue has declined throughout 2024. So when MicroStrategy acquires Bitcoin, it’s not using revenue from its software business. Instead, it’s funding it through equity and debt offerings.

In the third quarter of 2024, MicroStrategy announced a plan to raise $42 billion over the next 3 years to acquire Bitcoin. They call their plan the “21/21 Plan.” The “21/21” refers to the billions of dollars MicroStrategy will raise through different offerings. It plans to raise $21 billion through at-the-market (ATM) equity offerings and another $21 billion using fixed-income securities. Let’s look at each in more detail and see what they mean for the average retail investor.

At-The-Market (ATM) equity offerings

In a traditional equity stock offering, a company sells a specific number of shares at a fixed price that it sets. For example, let’s imagine a company is going public. For its upcoming initial public offering (IPO), it may offer 1,000,000 shares priced at $10 each when markets open on Monday, June 2nd, 2025.

After the IPO, there may come a time when a company wants to raise more money and decides to issue new shares. A company can use several equity offerings to accomplish this goal, including an At-The-Market (ATM) equity offering.

In an at-the-market (ATM) equity offering, a company issues new shares directly into the market on an as-needed basis and sells them at market prices. ATMs offer a company the flexibility to raise capital fast while minimizing costs. However, there are risks if a company performs an ATM equity offering.

The Risks and Rewards of MicroStrategy’s ATM Offerings

Selling new shares at market prices means a company may not get as much for the shares as hoped. That is because the prices of stocks on the open market are always fluctuating. But, the bigger issue with ATM offerings is stock dilution.

When a company issues more shares through an ATM offering, its value gets spread out over a larger number of shares. More shares lower the ownership percentage of existing shareholders and can potentially decrease the share price of a company. This decrease in share price may be short-lived but is a risk nonetheless.

The key difference between Microstrategy and other companies is that MicroStrategy uses the funds raised through its ATM offerings to buy more Bitcoin, $21 billion of it, to be exact. This strategy effectively increases the amount of Bitcoin each share represents. This distinction is important, as many investors who buy MicroStrategy shares do so for Bitcoin exposure. So, with every ATM offering, shareholders gain greater Bitcoin exposure per share.

Bitcoin exposure is what also drives investors to MicroStrategy’s convertible bonds.

Fixed-Income Securities: Convertible Bonds

As discussed earlier, MicroStrategy plans to raise $21 billion through fixed-income securities, and its offering of choice in this category is unsecured convertible bonds. MicroStrategy’s convertible bond offerings pay little to no interest but allow investors to convert their bonds to shares of the company’s stock at a later time and a predetermined price. I know it is confusing, so let’s look at this in more detail to get a better understanding of MicroStrategy’s convertible bonds.

In November 2024, MicroStrategy announced that it completed a $3 billion offering of convertible bonds that will mature in 2029. These bonds have a 0% coupon with a conversion price of $672.40. At the time of the offering, one share of MicroStrategy was trading at $434, so the conversion price of $672.40 reflects a 55% conversion premium. Specifically, MicroStrategy issued new unsecured 0% convertible bonds with a conversion rate of 1.4872 shares for every $1,000 principal.

At maturity, bondholders can choose either to be repaid the principal amount or to convert their bonds into shares. If they opt for conversion, they will receive 1.4872 shares for each $1,000 they hold in bonds. For example, if a bondholder has $100,000 in bonds and decides to convert them into shares, they will receive 148.772 shares.

I want to stress that this is a simple overview of how MicroStrategy’s 0% convertible bonds work. By no means am I an expert in bonds, and I have no direct experience with MicroStrategy’s convertible bonds. As with any investment, the details are in the fine print. Those details describe the rules for when and how MicroStrategy convertible bonds can be converted or bought back. Always read the fine print before investing in any security or company. It’s there to cover their butts, not yours!

Why Would Anyone Buy MicroStrategy’s Convertible Bonds?

You might be thinking: Why would anyone buy MicroStrategy’s convertible bonds? Think about it. MicroStrategy’s convertible bonds pay little to no interest and have a high conversion premium. It doesn’t look like much of a bargain!

The first thing to know is that it is not retail investors who are buying MicroStrategy convertible bonds. It’s institutions and qualified investors. One particular group of investors is bond fund managers.

Bond fund managers who want exposure to Bitcoin have few investment options. The objective of the bond funds they manage prevents them from adding Bitcoin directly to their funds. Instead, they are restricted to fixed-income securities. MicroStrategy’s convertible bonds offer bond fund managers exposure to Bitcoin while enabling them to meet their fund’s investment objectives.

Other institutional and qualified investors view MicroStrategy convertible bonds as a low-risk investment with the potential for substantial returns. These investors are happy to lend MicroStrategy money at or near zero percent interest rates to buy more Bitcoin. If Bitcoin’s price rises, MicroStrategy’s stock price will also increase, enabling these institutional investors to convert their bonds into MicroStrategy stock. Conversely, if Bitcoin’s price drops and MicroStrategy’s stock price declines, they still have the option to redeem the bond for its principal amount.

What Are the Risks of MicroStrategy’s Convertible Bonds?

If this all sounds too good to be true, it may be. There is no such thing as a free lunch in investing. Every investment, including MicroStrategy convertible bonds, carries risks.

MicroStrategy operates in a risky environment because its fate is closely tied to the extremely volatile price of Bitcoin. It is not uncommon for Bitcoin to experience drawdowns of 70% or even 80%. The biggest risk is that Bitcoin’s value collapses, leading to the downfall of MicroStrategy. If such a scenario occurs, MicroStrategy may struggle to raise the necessary funds to cover bond redemptions, which could have disastrous consequences for its investors.

On the other hand, if Bitcoin’s price were to soar, many holders of MicroStrategy’s convertible bonds might choose to convert their bonds into shares of MicroStrategy. This sudden influx of converted shares could increase the total number of shares outstanding, raising the risk of stock price dilution and potentially putting downward pressure on the stock price.

Will MicroStrategy’s Bitcoin Bet Pay Off?

In 2023 and 2024, MicroStrategy has been one of the top-performing stocks. Institutional investors are gobbling up its bonds like candy, and options traders can’t get enough of it. Based on these metrics, MicroStrategy’s investment in Bitcoin appears to be paying off. The question is, is it sustainable?

MicroStrategy has hitched its wagon to Bitcoin, and Bitcoin is one of the most volatile assets anyone can own. MicroStrategy then takes that volatility and amplifies it through ATM and convertible bond offerings. It is the ultimate volatility play, making MicroStrategy an ultra-risky speculative investment.

If you are considering investing in MicroStrategy, make sure you conduct thorough research and assess your financial situation and risk tolerance. Take a detailed look at your personal finances, taking into account your goals, investment portfolio, and time horizon. Consult a professional investment or financial advisor if needed. Above all else, don’t base your investment strategy on someone else’s opinion.